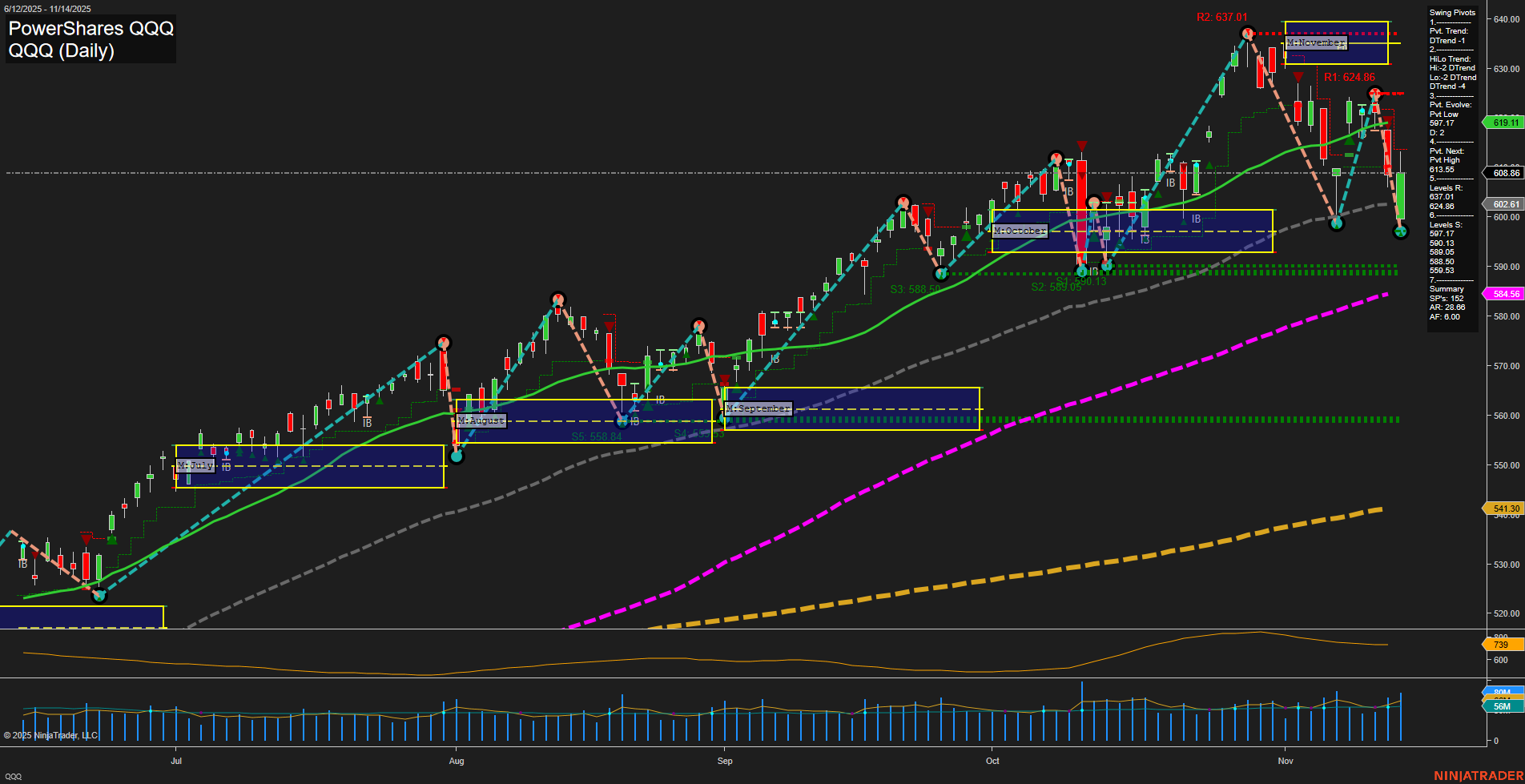

The QQQ daily chart currently reflects a notable shift in momentum, with large bars and fast momentum indicating heightened volatility and active price swings. Both the short-term and intermediate-term trends have turned bearish, as confirmed by the swing pivot trend (DTrend) and the downward direction of the 5, 10, and 20-day moving averages. The most recent swing pivot has established a new low at 602.61, with resistance levels overhead at 624.86 and 637.01, suggesting the market is in a corrective phase after a strong prior uptrend. However, the longer-term structure remains bullish, supported by the 55, 100, and 200-day moving averages trending upward, indicating that the broader uptrend is still intact. The ATR is elevated, and volume remains robust, pointing to increased participation and potential for continued volatility. The market appears to be in a pullback or retracement phase within a larger bullish cycle, with key support levels to watch for potential stabilization or reversal. No clear breakout or breakdown from the monthly or yearly session fib grids, and the overall environment is neutral to corrective in the short and intermediate term, but constructive in the long term.