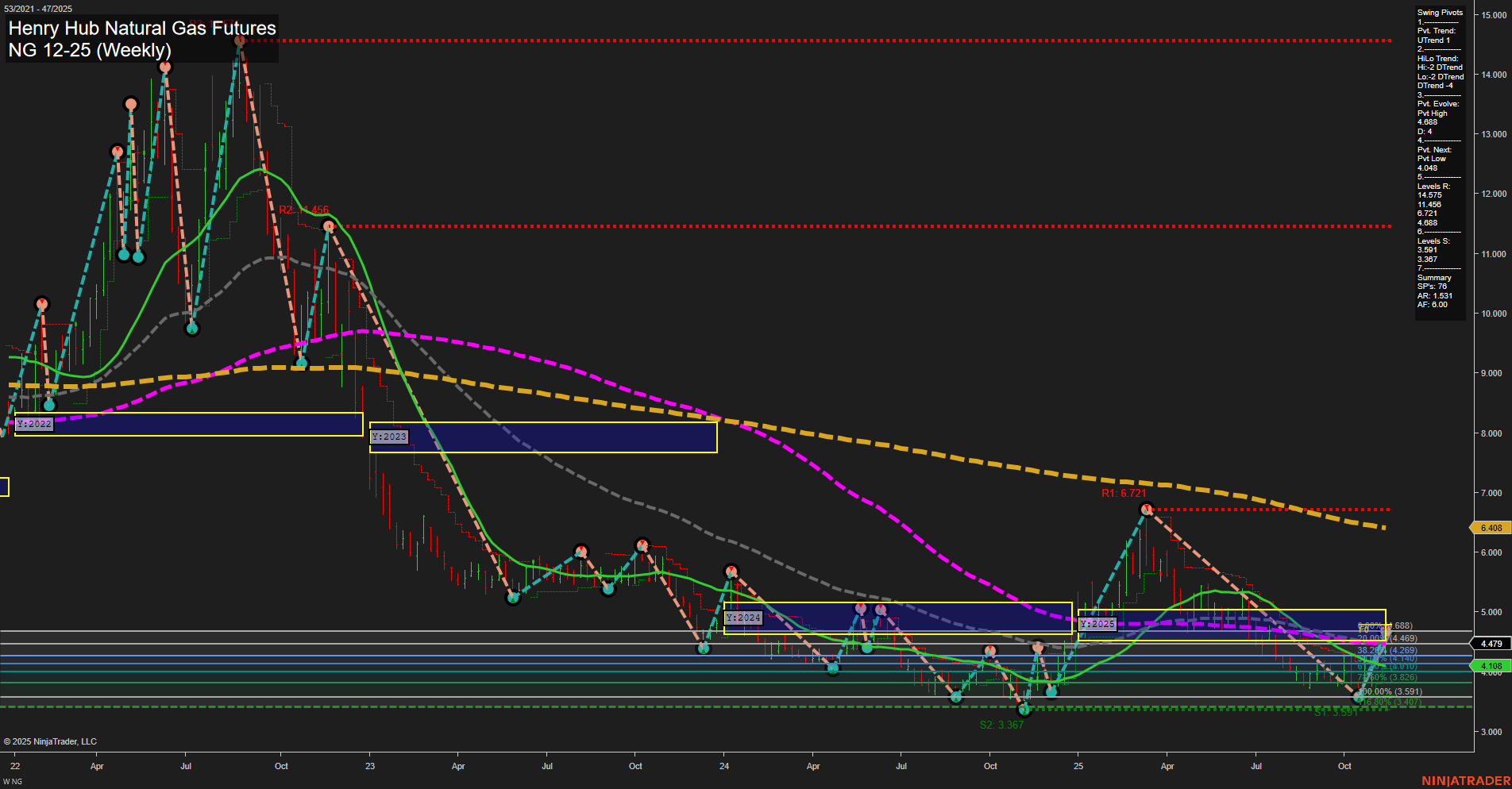

The weekly chart for NG Henry Hub Natural Gas Futures shows a persistent bearish structure across all timeframes. Price action is subdued with medium-sized bars and slow momentum, indicating a lack of strong directional conviction. The short-term Weekly Session Fib Grid (WSFG) and long-term Yearly Session Fib Grid (YSFG) both show price below their respective NTZ (neutral trading zones) and are trending down, reinforcing the dominant downward bias. The intermediate-term Monthly Session Fib Grid (MSFG) is an outlier, showing an uptrend, but this is not supported by the swing pivot structure or moving averages. Swing pivots confirm the downtrend, with both short-term and intermediate-term trends pointing lower and the next key pivot low at 4.048. Resistance levels are stacked well above current price, while support is clustered in the 3.2–3.6 range, suggesting limited downside before a potential test of these lower levels. All major long-term moving averages (20, 55, 100, 200 week) are above price and trending down, further confirming the bearish environment. A recent short signal (14 Nov 2025) aligns with the prevailing trend. The overall technical landscape suggests the market remains in a corrective or continuation phase of a broader downtrend, with no clear signs of reversal. The environment is characterized by persistent lower highs and lower lows, and any rallies have so far failed to break above key resistance or moving averages. Volatility appears contained, with no evidence of a breakout or V-shaped recovery. The market is likely in a phase of consolidation within a broader bearish cycle, with traders watching for a test of support or a potential breakdown to new lows.