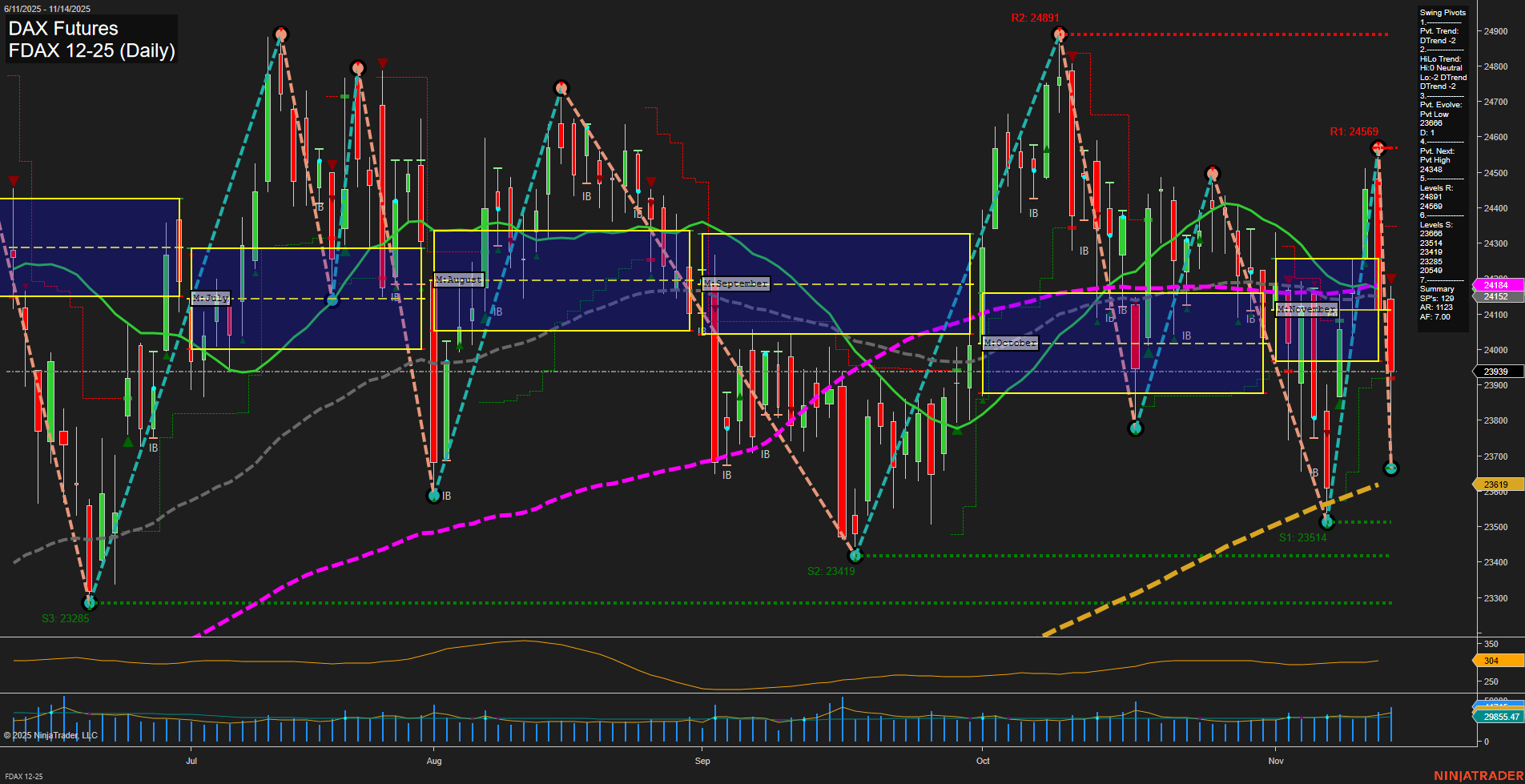

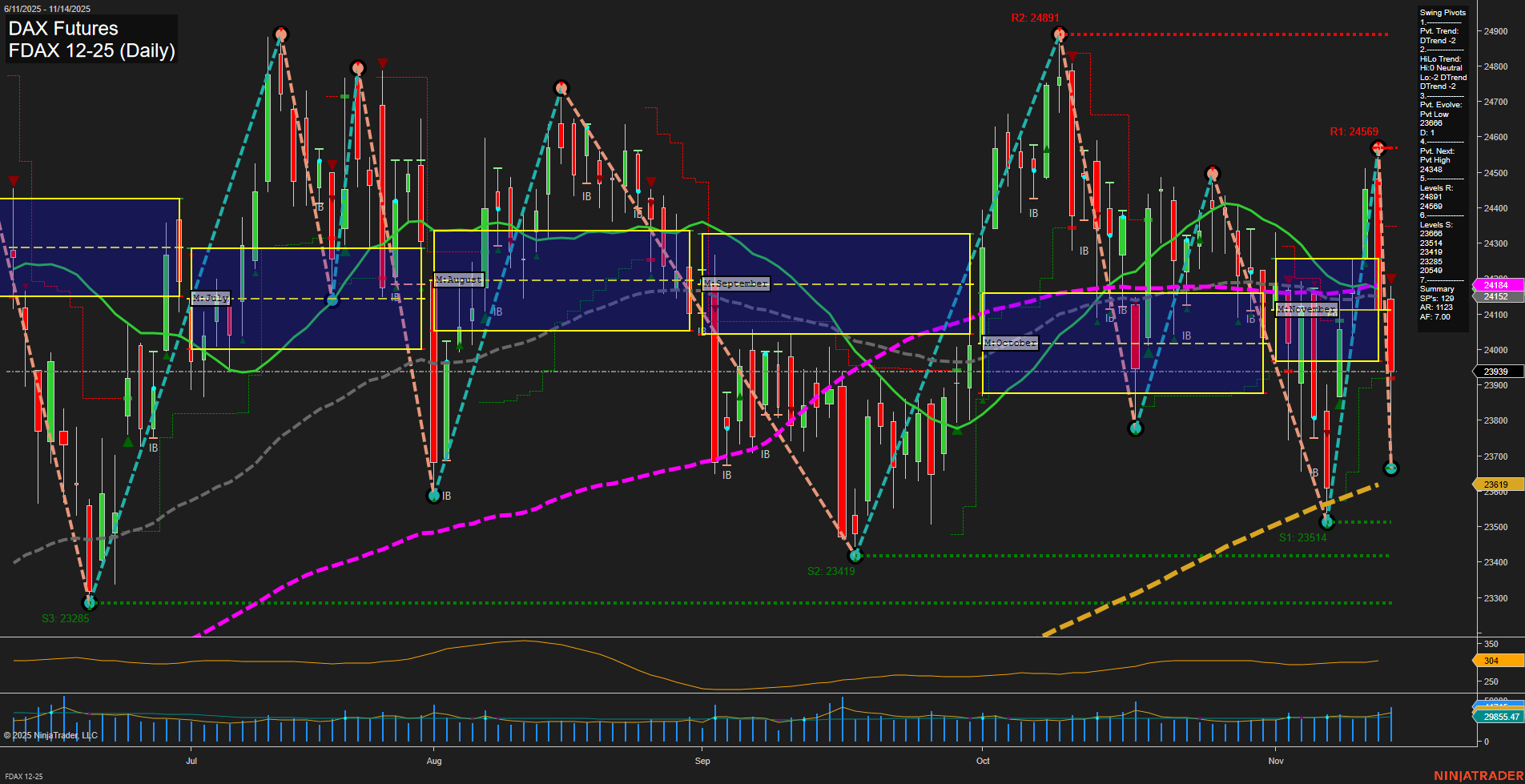

FDAX DAX Futures Daily Chart Analysis: 2025-Nov-16 18:08 CT

Price Action

- Last: 23619,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 8%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: -16%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 104%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 23514,

- 4. Pvt. Next: Pvt high 24348,

- 5. Levels R: 24891, 24569, 24348,

- 6. Levels S: 23514, 23419, 23286.

Daily Benchmarks

- (Short-Term) 5 Day: 24168 Down Trend,

- (Short-Term) 10 Day: 24152 Down Trend,

- (Intermediate-Term) 20 Day: 23939 Down Trend,

- (Intermediate-Term) 55 Day: 24152 Down Trend,

- (Long-Term) 100 Day: 23955 Down Trend,

- (Long-Term) 200 Day: 23619 Up Trend.

Additional Metrics

Recent Trade Signals

- 14 Nov 2025: Short FDAX 12-25 @ 23728 Signals.USAR-WSFG

- 14 Nov 2025: Short FDAX 12-25 @ 23934 Signals.USAR-MSFG

- 13 Nov 2025: Short FDAX 12-25 @ 24314 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The FDAX daily chart is currently exhibiting strong short-term and intermediate-term bearish momentum, as evidenced by the fast, large downward price bars and a clear DTrend in both the short-term pivot and HiLo trends. Price is trading below the monthly session fib grid (MSFG) NTZ, confirming intermediate-term downside pressure, while the weekly session fib grid (WSFG) remains positive, suggesting some underlying support on a shorter time frame. All key moving averages except the 200-day are trending down, reinforcing the prevailing bearish sentiment. The 200-day MA, however, is still in an uptrend, indicating that the long-term structure remains intact and bullish. Recent trade signals have all triggered short entries, aligning with the current downward swing. Volatility is elevated (high ATR and VOLMA), and price is testing key support levels near 23514, with further support at 23419 and 23286. Resistance is stacked above at 24348, 24569, and 24891. The market is in a corrective phase within a broader uptrend, with potential for further downside in the near term unless a reversal at support is confirmed. The environment is characterized by high volatility, sharp swings, and a possible transition zone as the market tests the resilience of long-term support.

Chart Analysis ATS AI Generated: 2025-11-16 18:08 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.