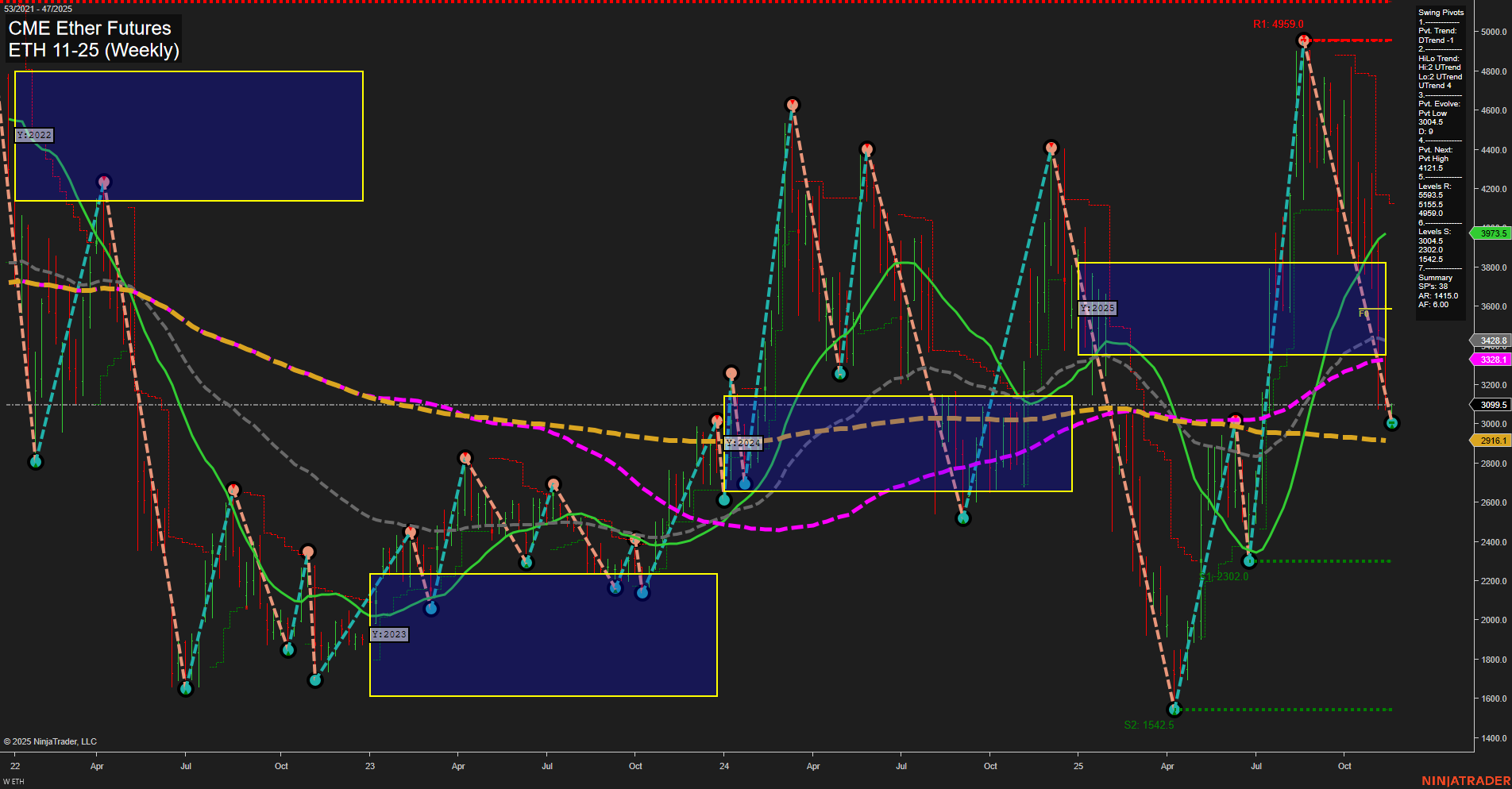

The ETH CME Ether Futures weekly chart is showing pronounced downside momentum, with large bars and fast momentum confirming a strong move lower. All major session fib grid trends (weekly, monthly, yearly) are aligned to the downside, with price trading below their respective NTZ/F0% levels, reinforcing a bearish bias across all timeframes. Swing pivot analysis highlights a dominant downtrend in both short- and intermediate-term trends, with the most recent pivot evolving at a low of 3095.5 and the next significant resistance at the previous high of 4959.0. Key resistance levels are stacked well above current price, while support is much lower, suggesting a wide range for potential volatility. Weekly benchmark moving averages are predominantly trending down, with only the longest-term averages (100 and 200 week) showing a slight uptrend, but these are being tested as price trades below most key averages. Recent trade signals have triggered short entries, further confirming the prevailing bearish sentiment. Overall, the chart structure points to a market in a corrective or trending down phase, with little evidence of a reversal or stabilization at this stage. The environment is characterized by strong selling pressure, lower highs, and a lack of bullish catalysts, indicating that the path of least resistance remains to the downside for now.