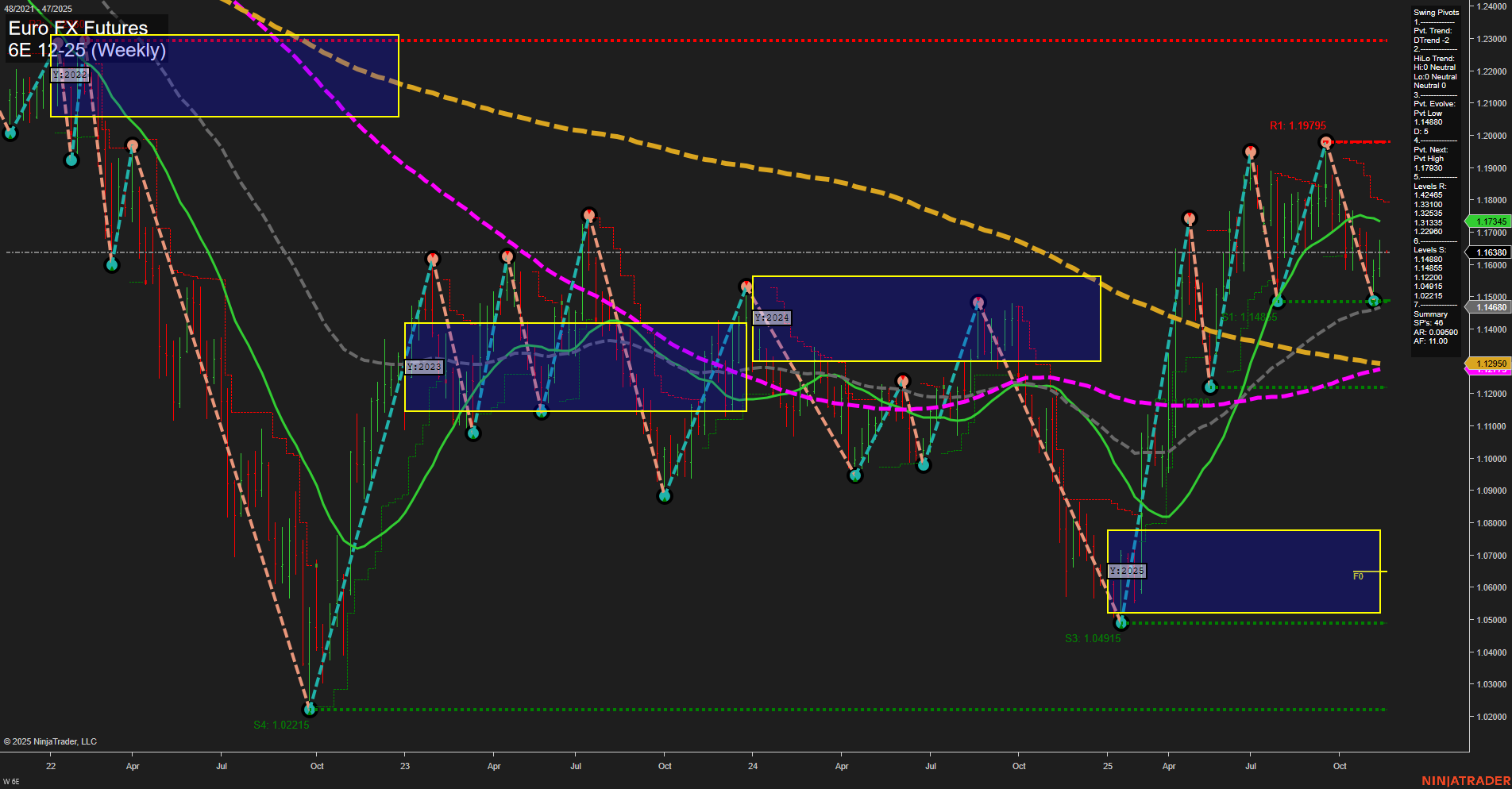

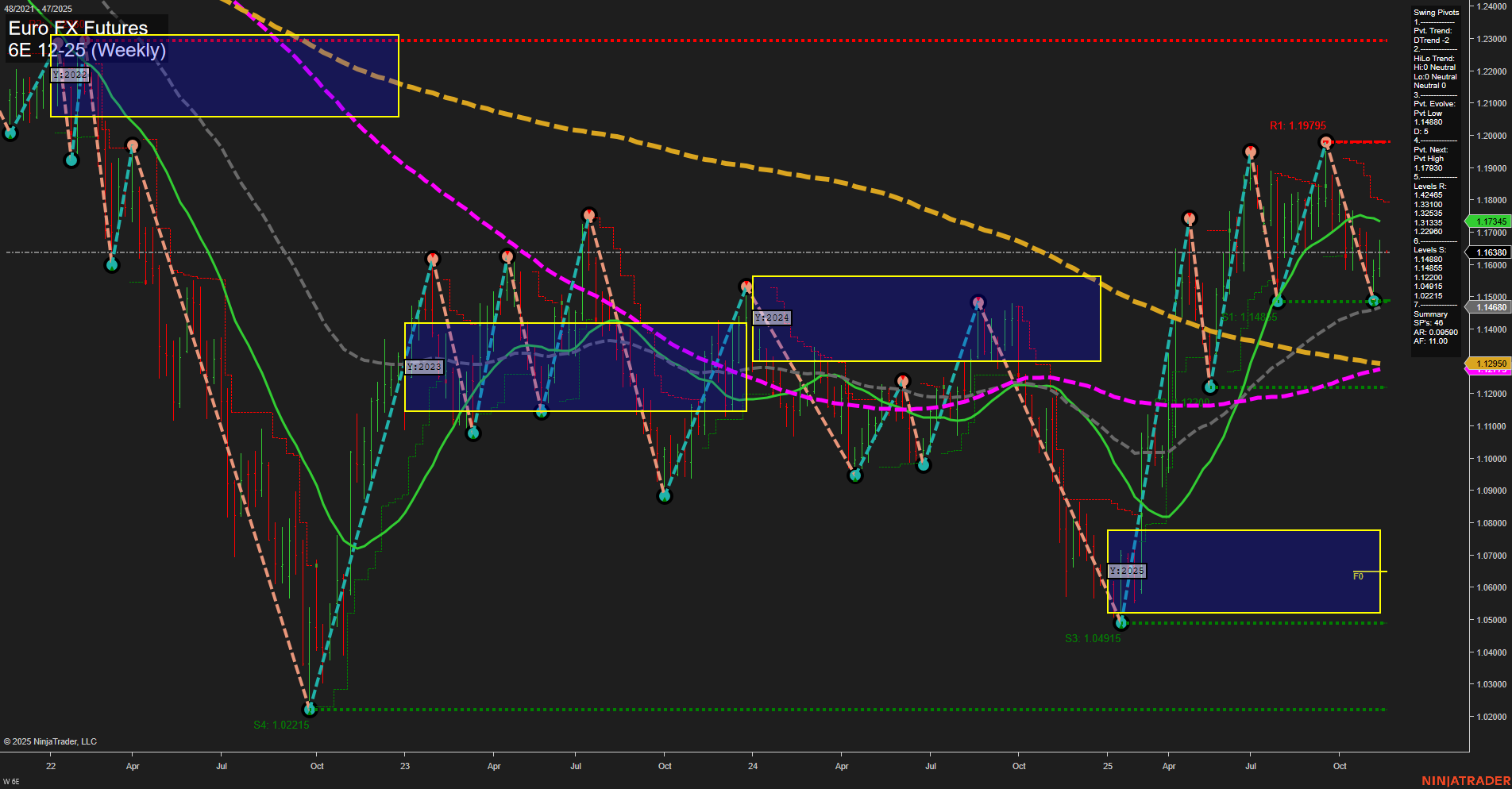

6E Euro FX Futures Weekly Chart Analysis: 2025-Nov-16 18:02 CT

Price Action

- Last: 1.16380,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -5%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: -45%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 79%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt Low 1.14680,

- 4. Pvt. Next: Pvt High 1.17935,

- 5. Levels R: 1.19795, 1.17935, 1.13310, 1.12335,

- 6. Levels S: 1.14680, 1.12950, 1.04915, 1.02215.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.17435 Down Trend,

- (Intermediate-Term) 10 Week: 1.16830 Down Trend,

- (Long-Term) 20 Week: 1.14685 Up Trend,

- (Long-Term) 55 Week: 1.12950 Up Trend,

- (Long-Term) 100 Week: 1.12500 Up Trend,

- (Long-Term) 200 Week: 1.12950 Down Trend.

Recent Trade Signals

- 13 Nov 2025: Long 6E 12-25 @ 1.1668 Signals.USAR.TR720

- 13 Nov 2025: Long 6E 12-25 @ 1.16045 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The 6E Euro FX Futures weekly chart shows a market in transition. Short-term and intermediate-term trends are bearish, with price action below both the weekly and monthly session fib grid centers and momentum at an average pace. The most recent swing pivot trend is down, and the 5- and 10-week moving averages are both trending lower, confirming short-term weakness. However, the long-term outlook remains bullish, as the yearly session fib grid trend is up and price is above the yearly NTZ center, with the 20-, 55-, and 100-week moving averages all in uptrends. Key resistance levels are clustered above at 1.17935 and 1.19795, while support is found at 1.14680 and further below at 1.12950. Recent long trade signals suggest some attempts at a reversal, but the prevailing short-term and intermediate-term structure remains under pressure. The market is currently in a corrective phase within a broader long-term uptrend, with potential for further consolidation or a test of lower support before any sustained move higher.

Chart Analysis ATS AI Generated: 2025-11-16 18:02 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.