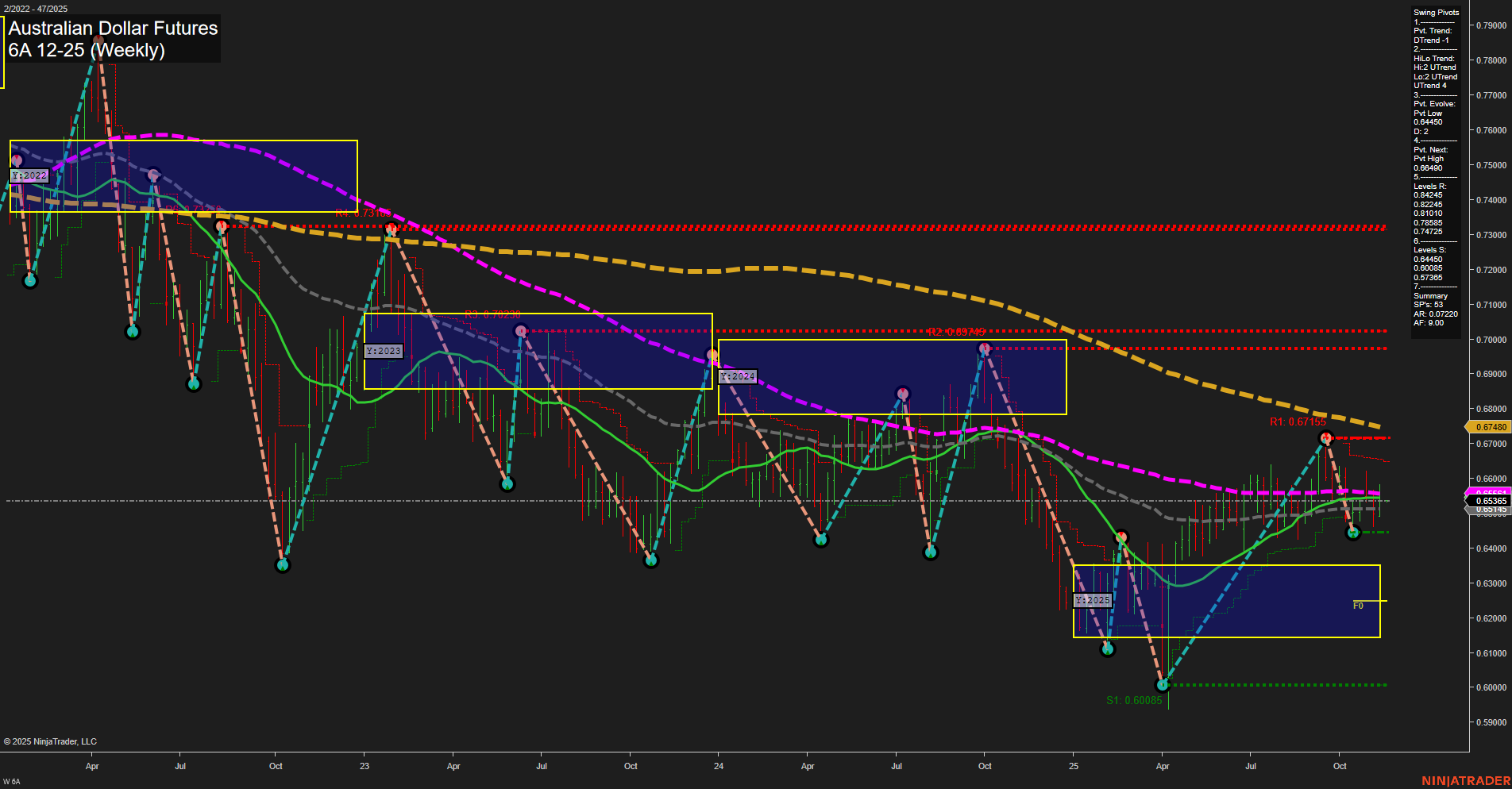

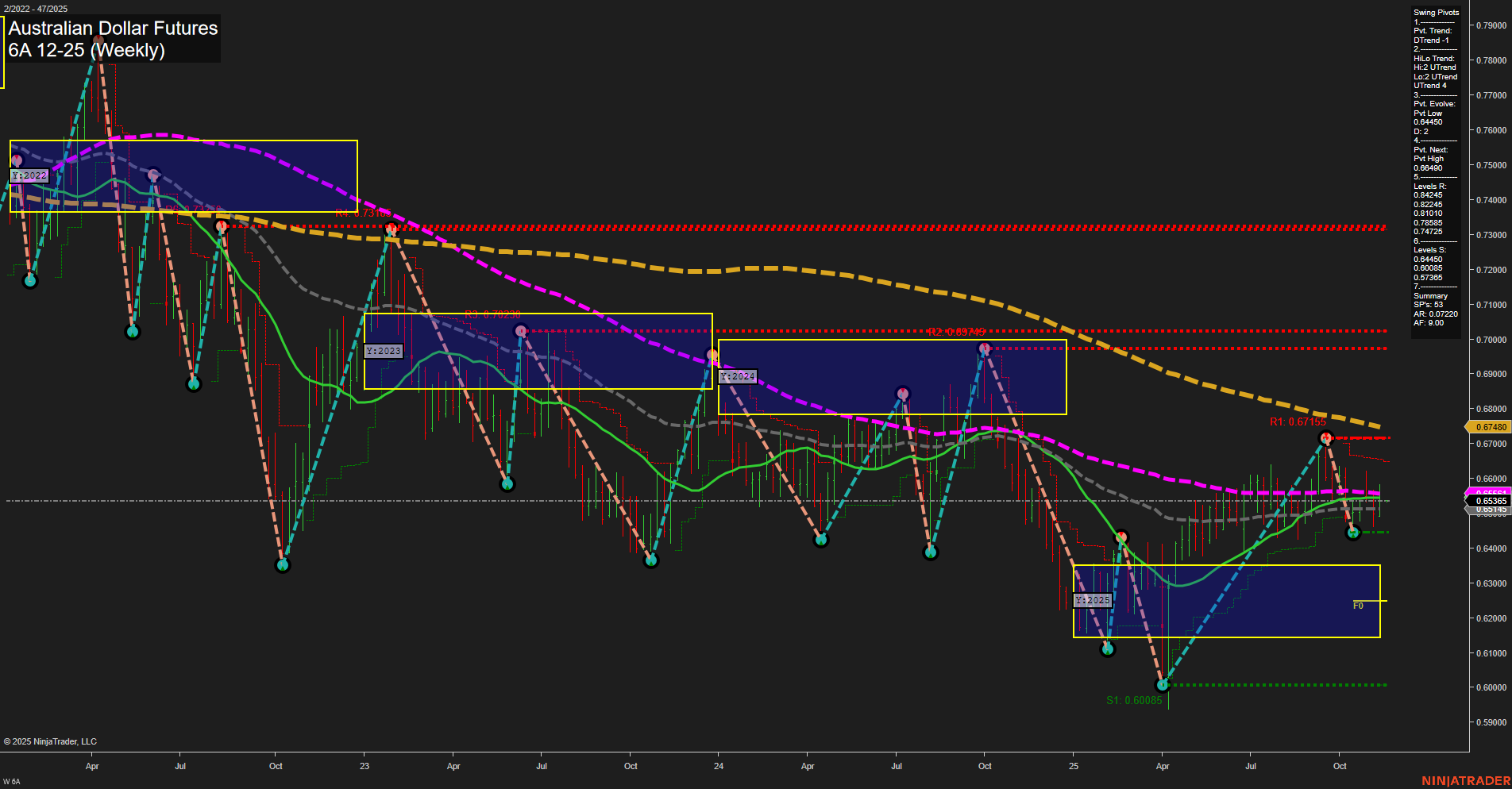

6A Australian Dollar Futures Weekly Chart Analysis: 2025-Nov-16 18:00 CT

Price Action

- Last: 0.65365,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt Low 0.64549,

- 4. Pvt. Next: Pvt High 0.66940,

- 5. Levels R: 0.67155, 0.66940, 0.64816, 0.64205,

- 6. Levels S: 0.63085, 0.60085, 0.57365.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.65325 Down Trend,

- (Intermediate-Term) 10 Week: 0.65485 Down Trend,

- (Long-Term) 20 Week: 0.65595 Up Trend,

- (Long-Term) 55 Week: 0.66245 Down Trend,

- (Long-Term) 100 Week: 0.67480 Down Trend,

- (Long-Term) 200 Week: 0.70730 Down Trend.

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The Australian Dollar Futures (6A) weekly chart shows a market in transition, with price currently at 0.65365 and momentum slowing after a recent swing high. The short-term swing pivot trend has turned down, while the intermediate-term HiLo trend remains up, indicating a possible retracement within a broader recovery. Price is consolidating near the 20-week moving average, which is the only benchmark in an uptrend, while all other key moving averages (5, 10, 55, 100, 200 week) are trending down, reinforcing a bearish long-term structure. Resistance is clustered near 0.66940–0.67155, with support at 0.63085 and lower. The neutral stance of the session fib grids (WSFG, MSFG, YSFG) suggests indecision, with no clear directional bias from the grid frameworks. Overall, the chart reflects a market pausing after a rally, with short-term weakness, intermediate-term neutrality, and persistent long-term bearishness. This environment may favor range-bound or mean-reversion strategies until a decisive breakout or breakdown occurs.

Chart Analysis ATS AI Generated: 2025-11-16 18:00 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.