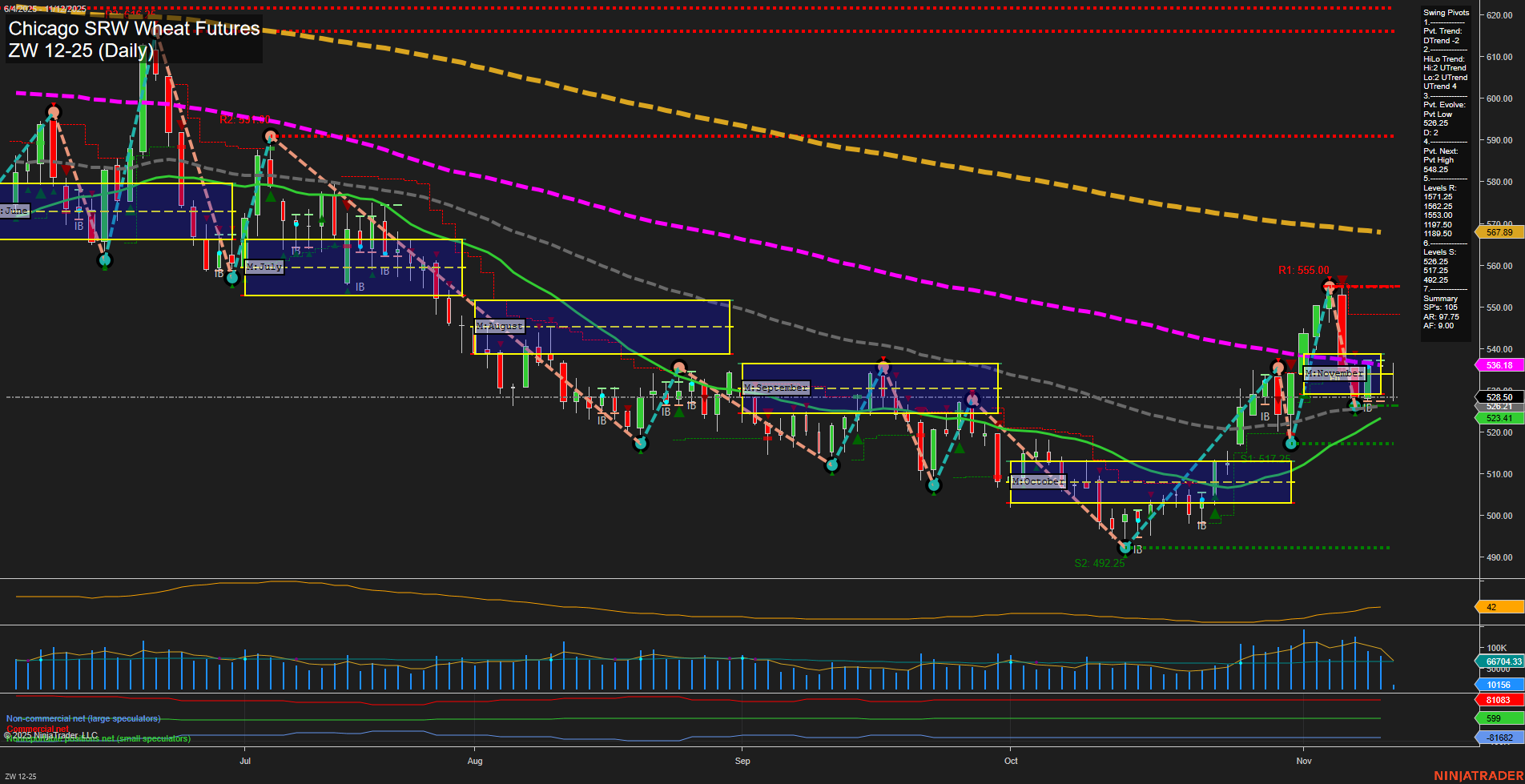

The ZW Chicago SRW Wheat Futures daily chart shows a recent surge in price action, with large bars and fast momentum indicating heightened volatility and strong participation. The short-term WSFG and intermediate-term MSFG both show price above their respective NTZ/F0% levels, supporting an upward bias and confirming an uptrend in these timeframes. However, the long-term YSFG remains negative, with price below the yearly NTZ and a persistent downtrend, highlighting a broader bearish backdrop. Swing pivot analysis reveals a short-term downtrend (DTrend) following a recent pivot high at 548.25, but the intermediate-term trend remains up (UTrend), with the most recent pivot low at 502.25 acting as a key support. Resistance levels are clustered above, with 555.00 and 548.25 as significant hurdles, while support is found at 502.25 and 492.25. Benchmark moving averages show short- and intermediate-term MAs trending up, but the 100-day and 200-day MAs are still in downtrends, reinforcing the mixed outlook across timeframes. The ATR at 51 and elevated VOLMA at 77,996 reflect ongoing volatility and active trading conditions. A recent long signal was triggered on Nov 11 at 536.5, aligning with the short- and intermediate-term bullish structure, though the short-term trend has turned neutral as price consolidates after a sharp rally and pullback. The market is currently in a transition phase, with potential for further upside if resistance levels are cleared, but the long-term trend remains a headwind. Watch for continued volatility, possible retests of support, and reactions at key resistance to gauge the next directional move.