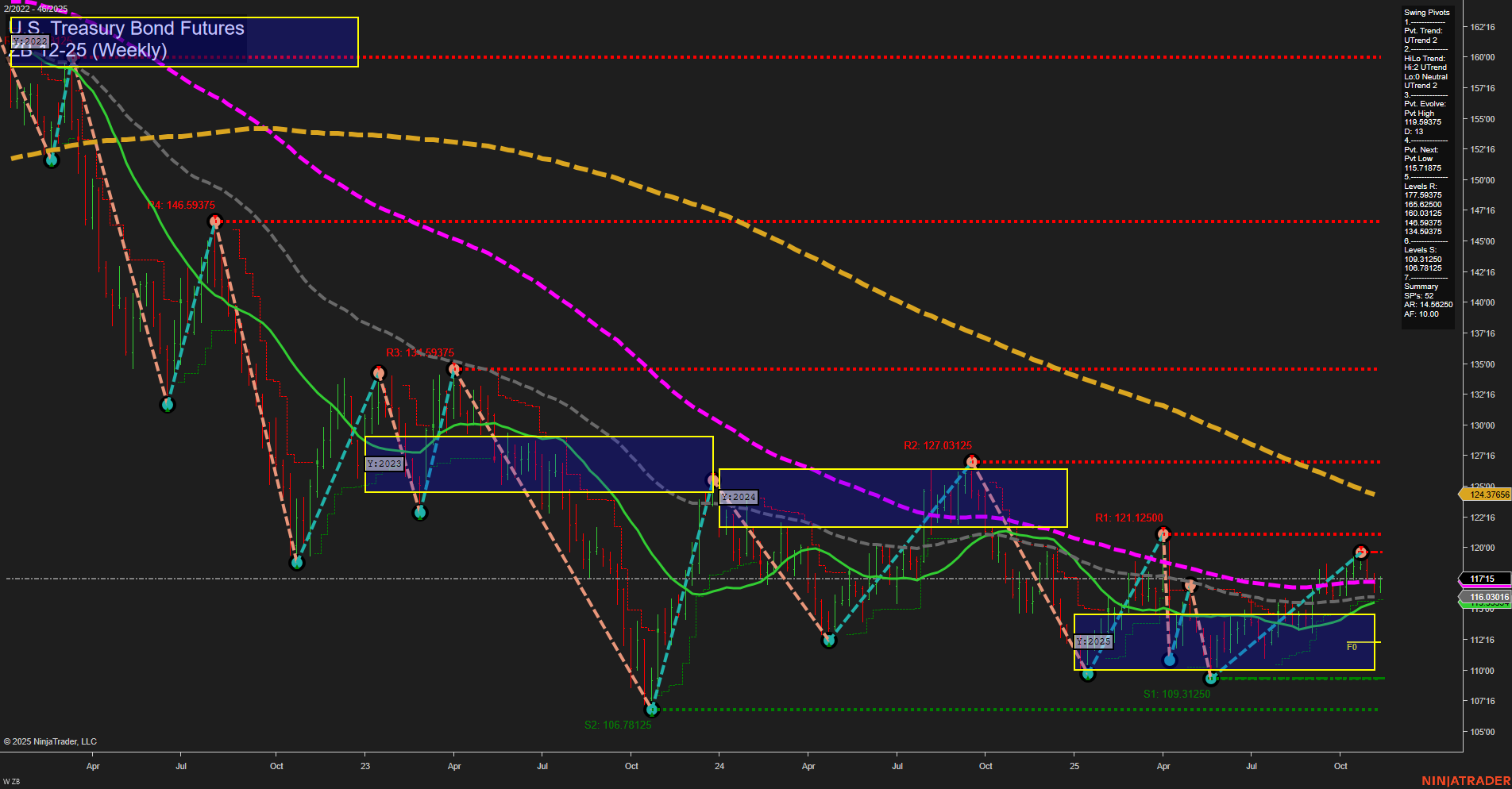

The ZB U.S. Treasury Bond Futures weekly chart shows a market in transition. Price action has shifted to an average momentum phase, with medium-sized bars reflecting a move away from the prior volatility extremes. Both short-term and intermediate-term swing pivot trends are up, supported by the 5, 10, and 20-week moving averages all trending higher, indicating a constructive environment for swing traders on these timeframes. However, the long-term picture remains bearish, as the 55, 100, and 200-week moving averages are still in downtrends, and price is trading below these key resistance levels. The chart is currently consolidating within the yearly NTZ (neutral zone), with price action oscillating between well-defined support (109.31, 106.78) and resistance (127.03, 134.59, 146.59) levels. This suggests a potential for further range-bound movement or a base-building phase, with the possibility of a trend reversal if price can sustain above intermediate resistance. The overall structure reflects a market that is attempting to recover from a prolonged downtrend, but has not yet confirmed a long-term bullish reversal. Swing traders may find opportunities in the prevailing short- and intermediate-term uptrends, while remaining mindful of the significant overhead resistance and the broader bearish context.