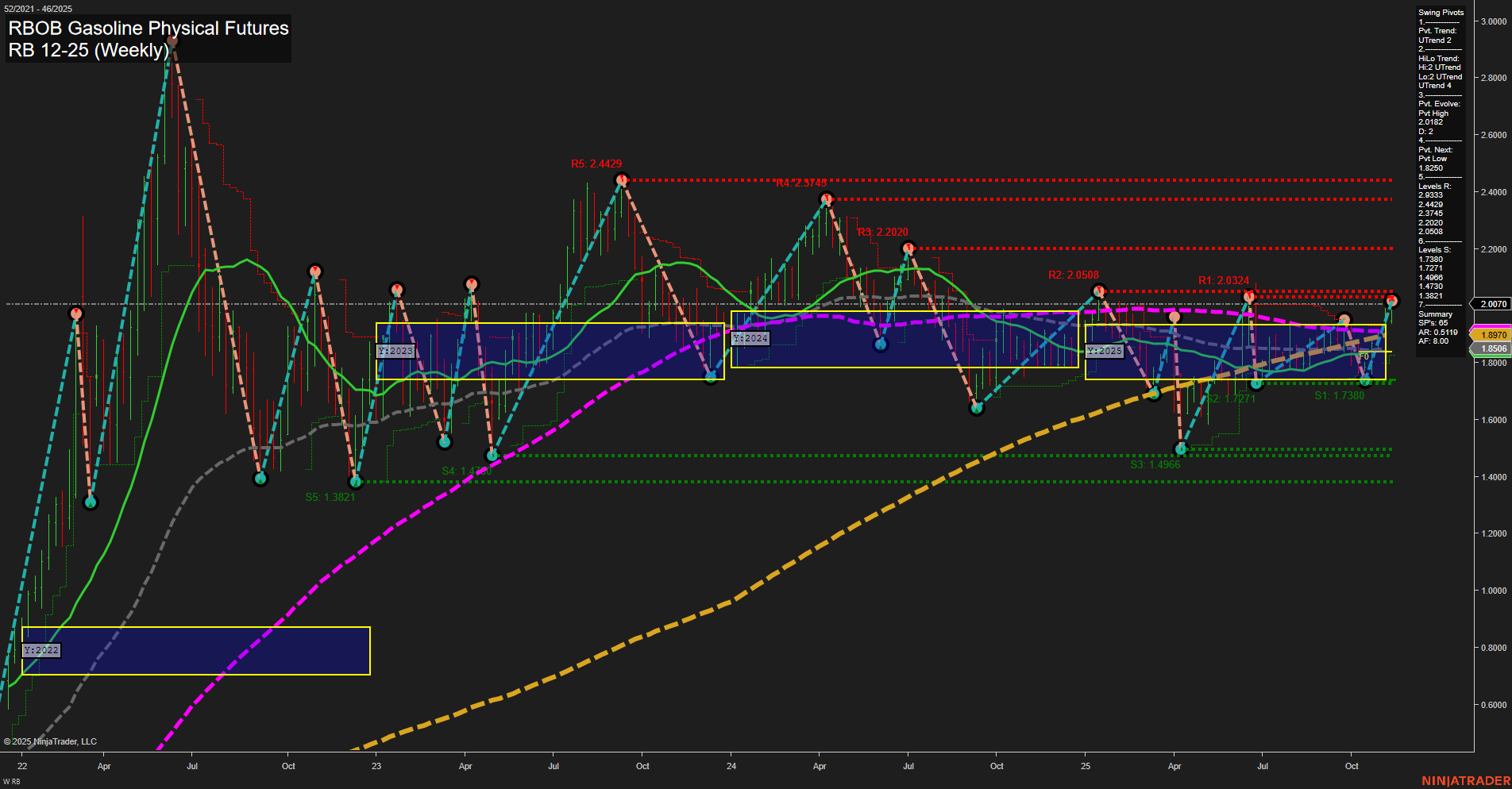

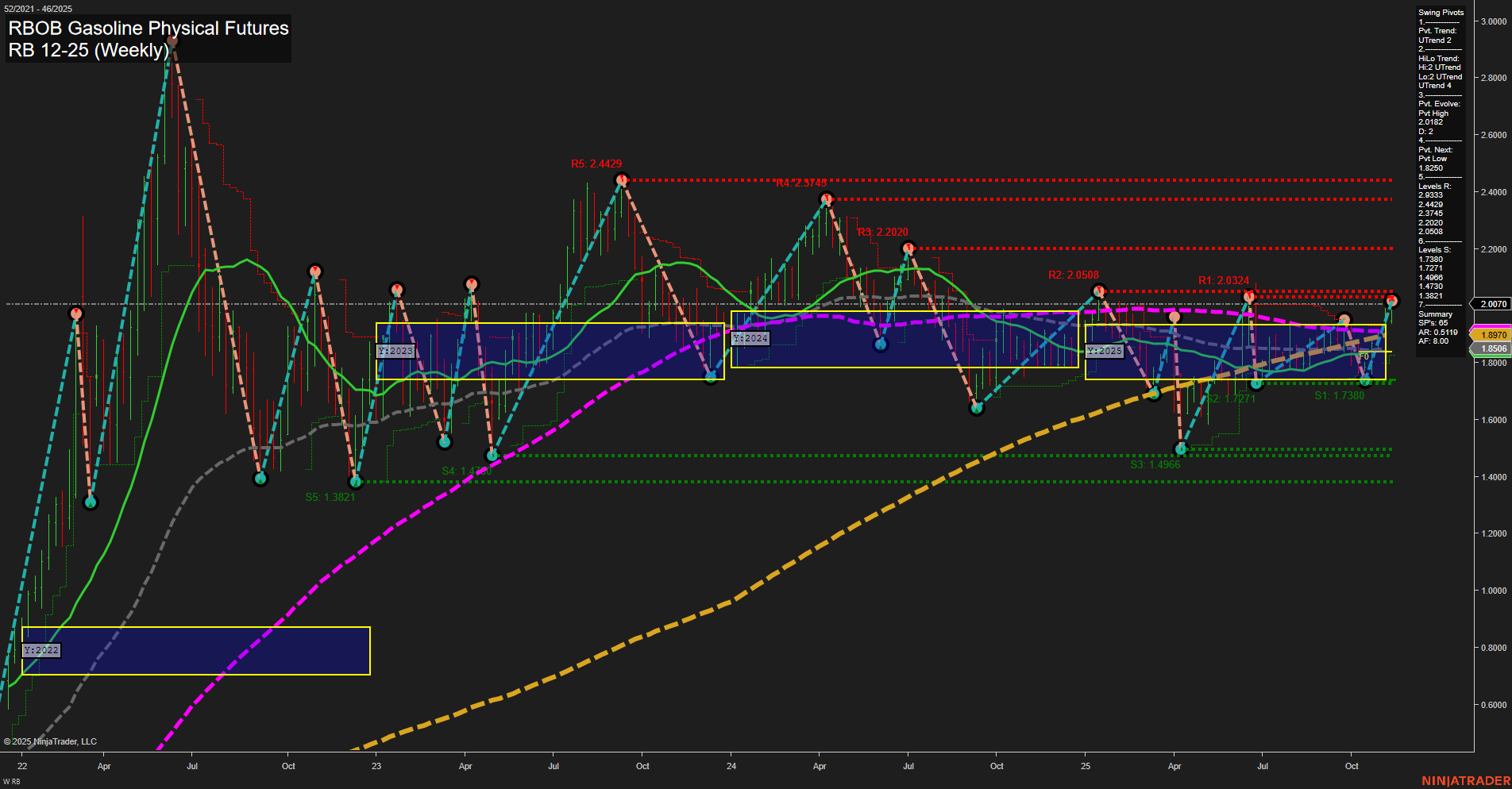

RB RBOB Gasoline Physical Futures Weekly Chart Analysis: 2025-Nov-12 07:16 CT

Price Action

- Last: 2.0070,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 66%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 107%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 17%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 2.0324,

- 4. Pvt. Next: Pvt low 1.8560,

- 5. Levels R: 2.4429, 2.3749, 2.2020, 2.0508, 2.0324,

- 6. Levels S: 1.7380, 1.4971, 1.4278, 1.3821.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.8897 Up Trend,

- (Intermediate-Term) 10 Week: 1.8560 Up Trend,

- (Long-Term) 20 Week: 1.9079 Up Trend,

- (Long-Term) 55 Week: 1.8221 Up Trend,

- (Long-Term) 100 Week: 1.6211 Up Trend,

- (Long-Term) 200 Week: 1.4019 Up Trend.

Recent Trade Signals

- 11 Nov 2025: Long RB 12-25 @ 1.9825 Signals.USAR.TR120

- 11 Nov 2025: Long RB 12-25 @ 1.9603 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The weekly chart for RB RBOB Gasoline Physical Futures as of mid-November 2025 shows a clear bullish structure across all timeframes. Price is trading above the NTZ center and all major moving averages, with the 5, 10, 20, 55, 100, and 200-week benchmarks all trending upward, confirming broad-based strength. The swing pivot structure highlights a recent pivot high at 2.0324 and a next support pivot low at 1.8560, with resistance levels stacked above at 2.0508, 2.2020, and higher. The current momentum is average, and price bars are medium, suggesting steady but not explosive movement. Recent trade signals have triggered new long entries, aligning with the prevailing uptrend. The market has shown resilience, bouncing from support and making higher lows, with the NTZ grid bias and session fibs all confirming upward momentum. The technical landscape suggests a trend continuation environment, with the potential for further tests of resistance levels if the current structure holds. No signs of major reversal or exhaustion are present, and the overall setup favors trend-following strategies in the current cycle.

Chart Analysis ATS AI Generated: 2025-11-12 07:17 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.