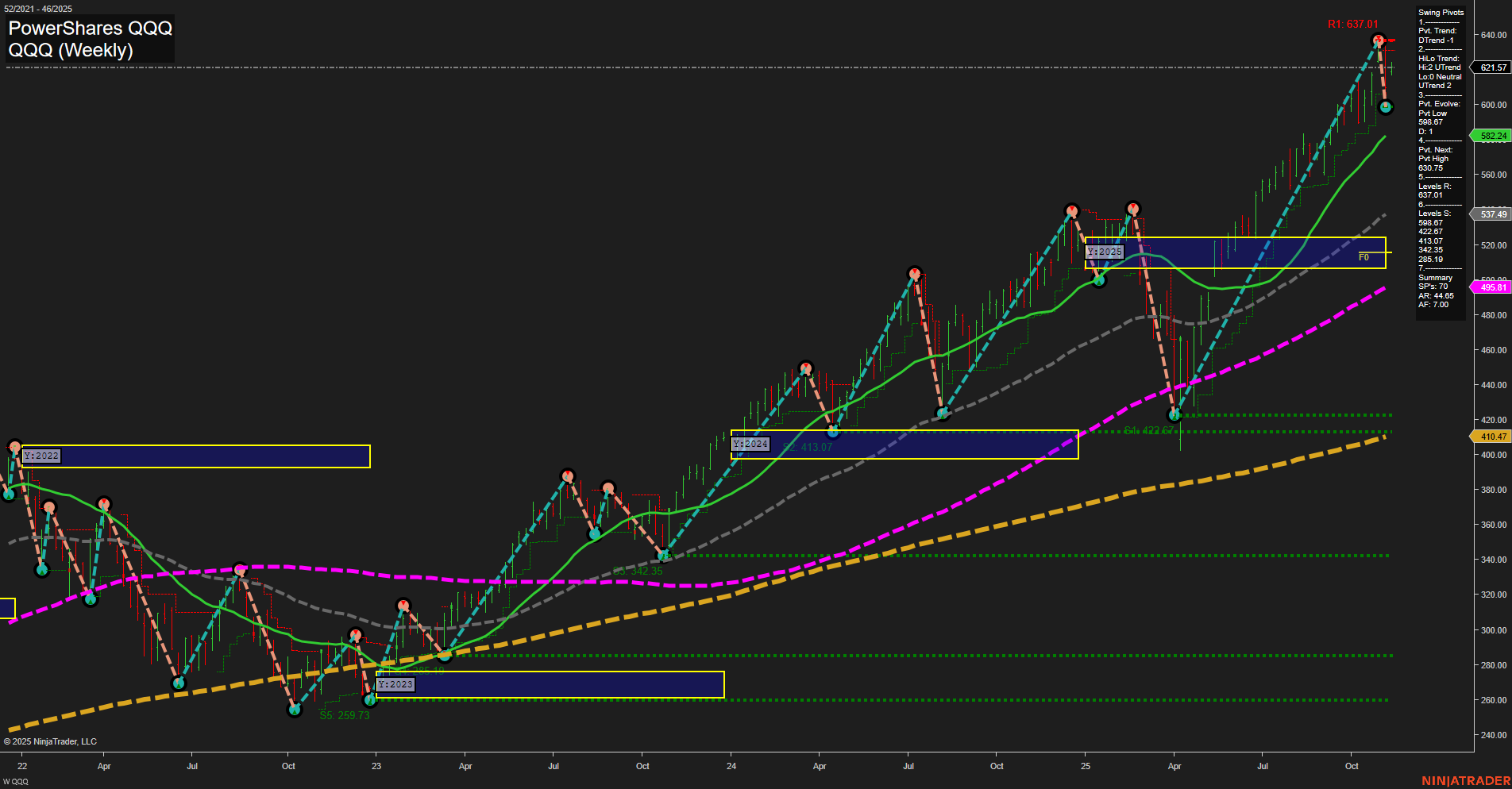

The QQQ weekly chart shows a strong long-term uptrend, with all major moving averages (from 5-week to 200-week) trending higher and well below the current price, confirming robust bullish momentum over the longer horizon. However, the most recent price action has produced a large, fast-moving bar to the downside, triggering a short-term downtrend in the swing pivot structure. The short-term (WSFG) and intermediate-term (MSFG) session fib grids are neutral, indicating a pause or consolidation phase rather than a clear directional bias. The most recent swing high at 637.01 now acts as resistance, while the nearest support is at 495.81, with additional support levels much lower. The intermediate-term HiLo trend remains up, suggesting that the broader trend is intact despite the current pullback. This setup is characteristic of a market experiencing a sharp retracement or correction within a larger bullish cycle, often seen after extended rallies. Volatility is elevated, and the market is testing key support levels, with the potential for either a continuation of the correction or a resumption of the uptrend depending on how price reacts around these pivots and moving averages.