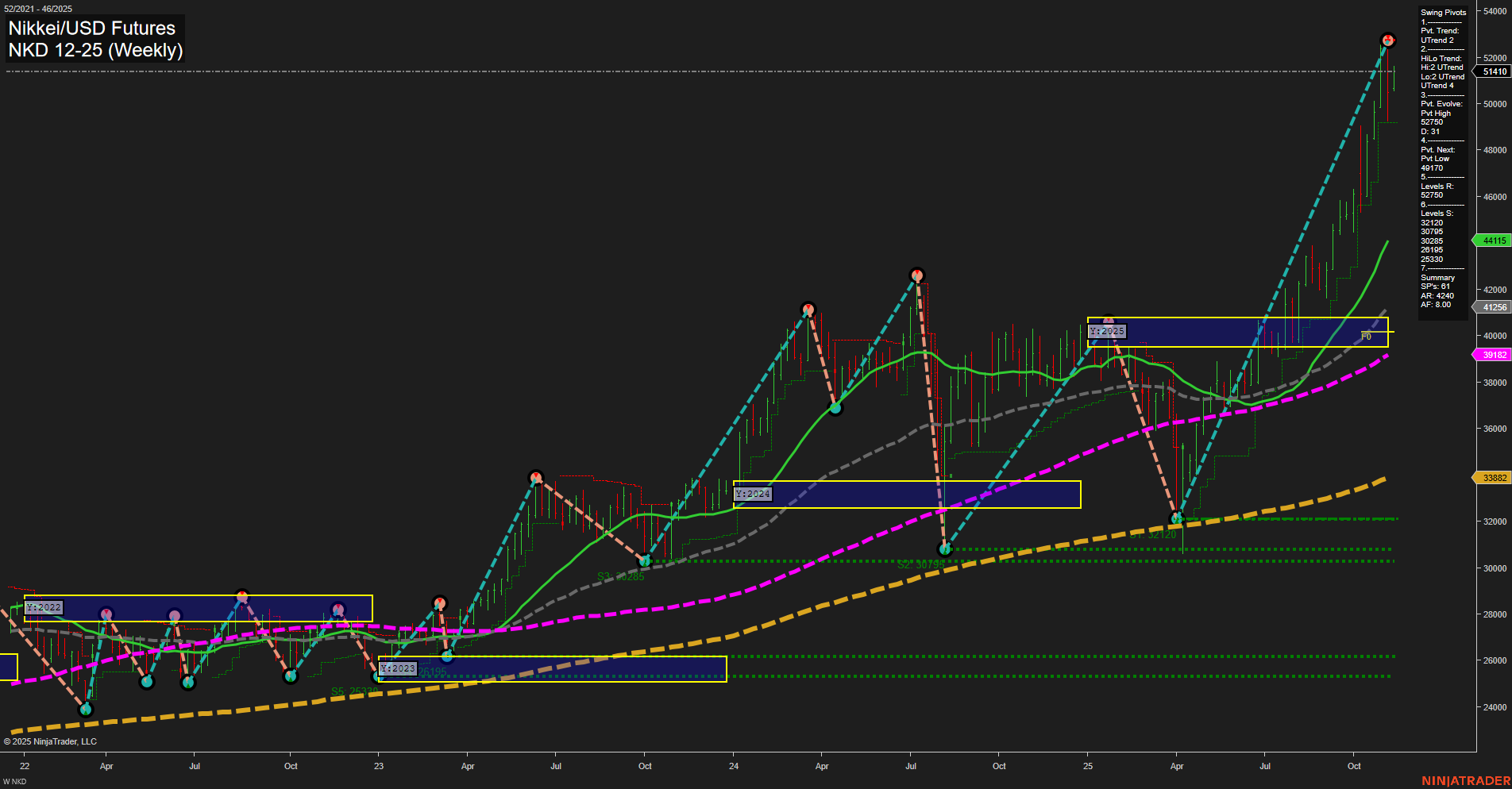

The NKD Nikkei/USD Futures weekly chart is displaying a strong bullish structure across all timeframes. Price action is characterized by large bars and fast momentum, indicating aggressive buying and a possible breakout environment. The price is well above all key Fibonacci grid levels (weekly, monthly, yearly), with each session grid showing an upward trend and the price positioned above the NTZ center, reinforcing the bullish bias. Swing pivot analysis confirms the uptrend, with the most recent pivot high at 51410 and the next potential pivot low at 49710, suggesting the market is in an extended rally phase. All major support levels are significantly below the current price, highlighting the strength of the move and the absence of nearby resistance other than the recent high. Benchmark moving averages from short to long term are all trending upward, with the price trading well above these averages, further supporting the prevailing bullish momentum. Recent trade signals show a mix of short and long entries, but the most recent signal is a long, aligning with the dominant trend. Overall, the chart reflects a robust uptrend with strong momentum, higher highs, and higher lows, typical of a sustained rally phase. The market is in a clear trend continuation mode, with no immediate signs of reversal or significant pullback, and volatility appears elevated as evidenced by the large weekly bars.