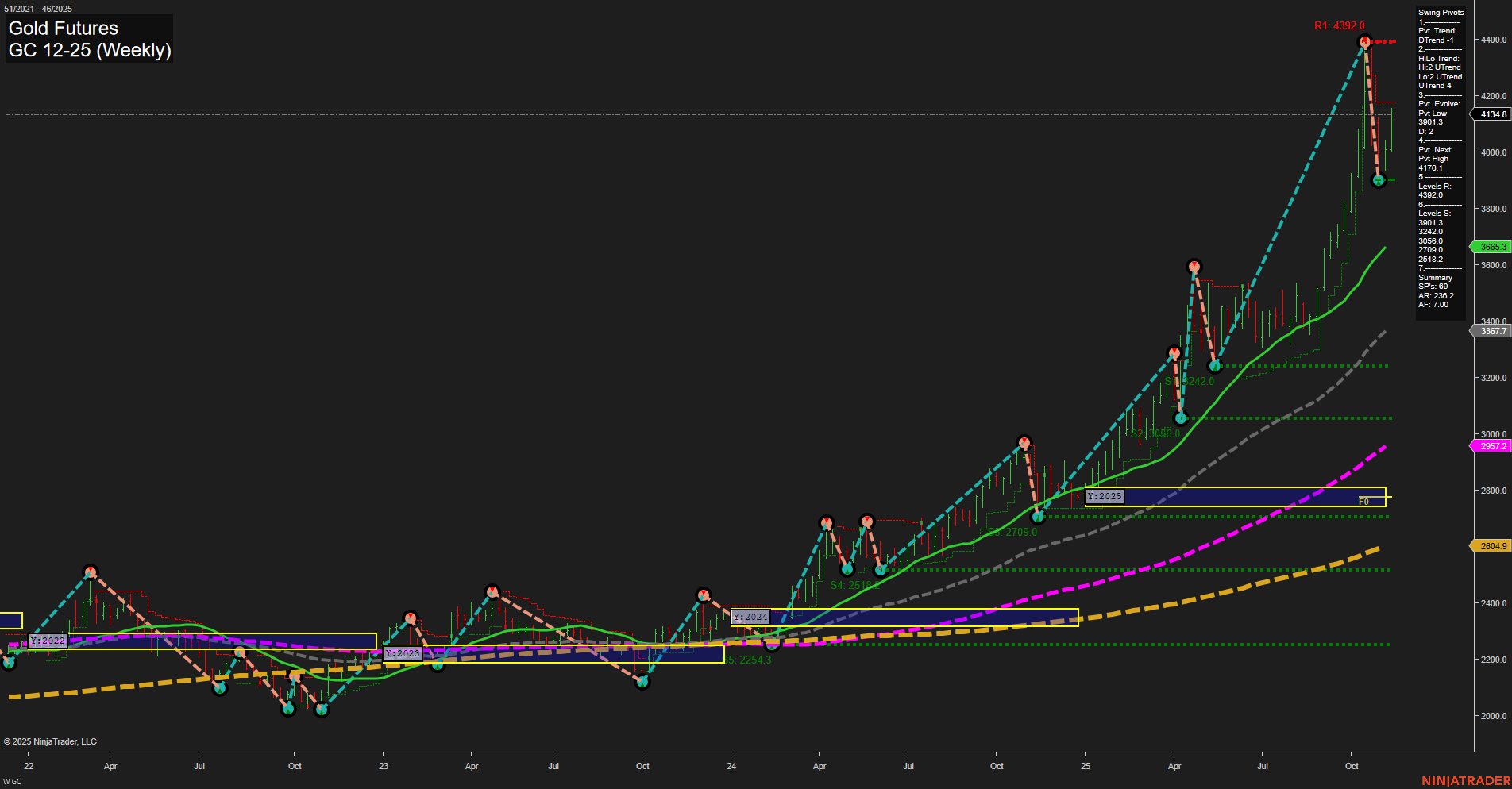

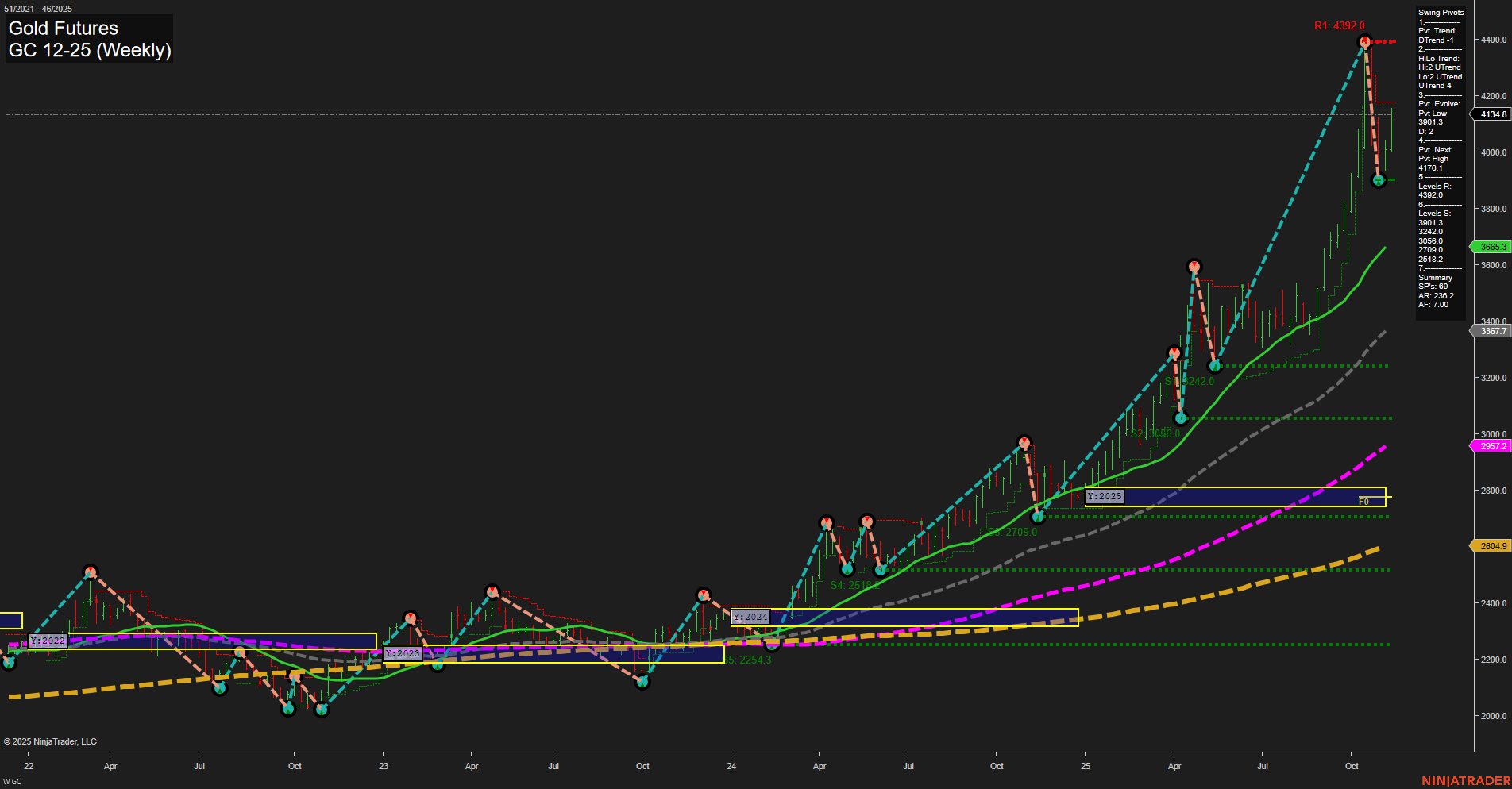

GC Gold Futures Weekly Chart Analysis: 2025-Nov-12 07:11 CT

Price Action

- Last: 4134.6,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 50%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 95%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 391%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 3901.3,

- 4. Pvt. Next: Pvt high 4392.0,

- 5. Levels R: 4392.0,

- 6. Levels S: 3901.3, 3242.0, 3056.0, 2709.0, 2516.0.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 3965.3 Up Trend,

- (Intermediate-Term) 10 Week: 3665.9 Up Trend,

- (Long-Term) 20 Week: 3367.7 Up Trend,

- (Long-Term) 55 Week: 2957.2 Up Trend,

- (Long-Term) 100 Week: 2604.9 Up Trend,

- (Long-Term) 200 Week: 2362.8 Up Trend.

Recent Trade Signals

- 10 Nov 2025: Long GC 12-25 @ 4052.8 Signals.USAR-WSFG

- 06 Nov 2025: Long GC 12-25 @ 4017.6 Signals.USAR.TR120

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

Gold futures have experienced a strong rally, with price action showing large, fast-moving bars and momentum at elevated levels. The short-term swing pivot has shifted to a downtrend, indicating a possible pullback or consolidation after a significant run-up, while the intermediate and long-term trends remain firmly up. All major moving averages are trending higher, confirming the underlying strength of the market. The most recent swing low at 3901.3 serves as a key support, with resistance at the recent high of 4392.0. Recent trade signals have triggered new long entries, reflecting continued bullish sentiment in the broader trend. The overall structure suggests the market is in a strong uptrend with potential for short-term retracement or consolidation before any further advance. The technical landscape remains supportive for the bulls on intermediate and long-term horizons, while short-term traders may observe increased volatility and possible mean reversion as the market digests recent gains.

Chart Analysis ATS AI Generated: 2025-11-12 07:12 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.