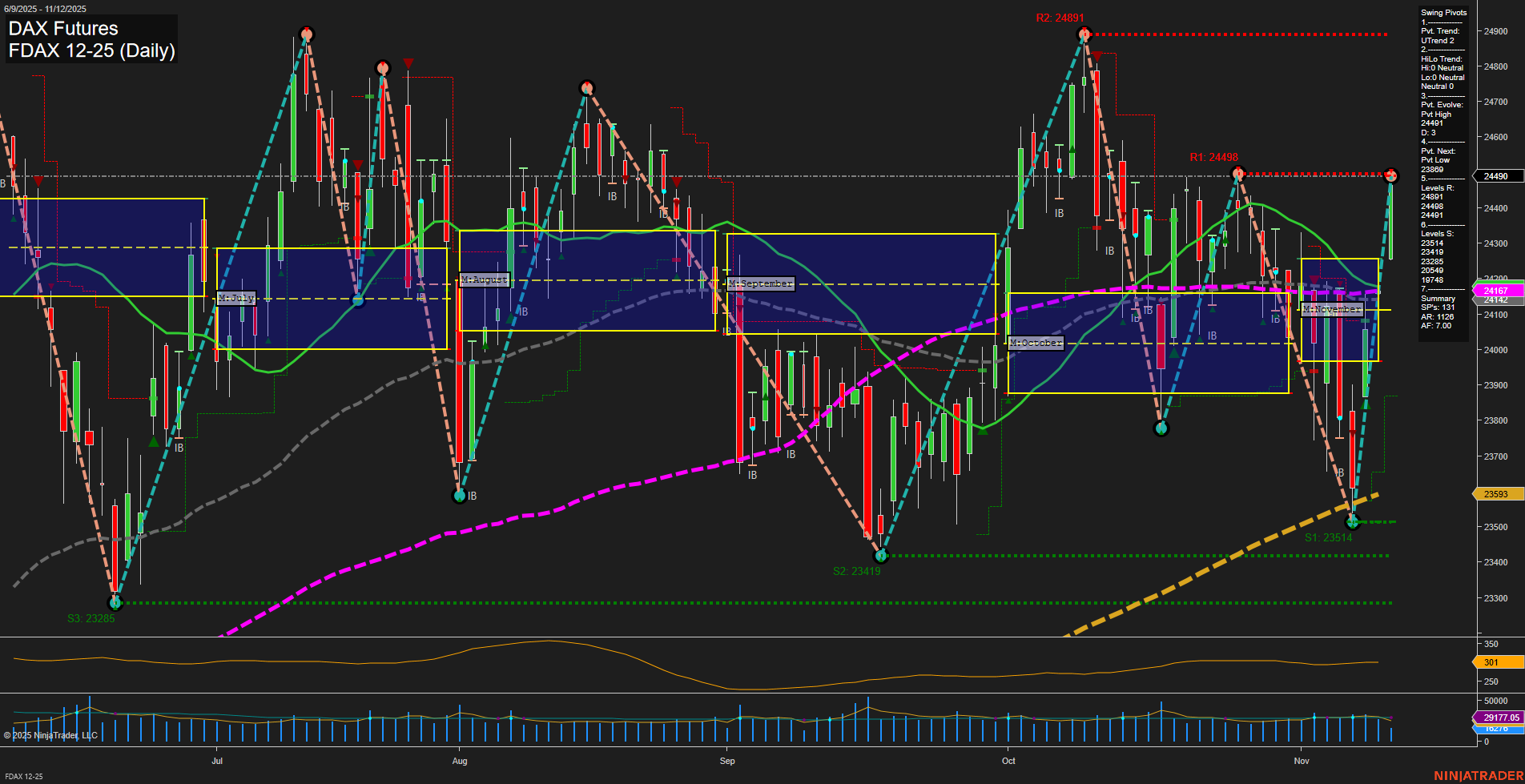

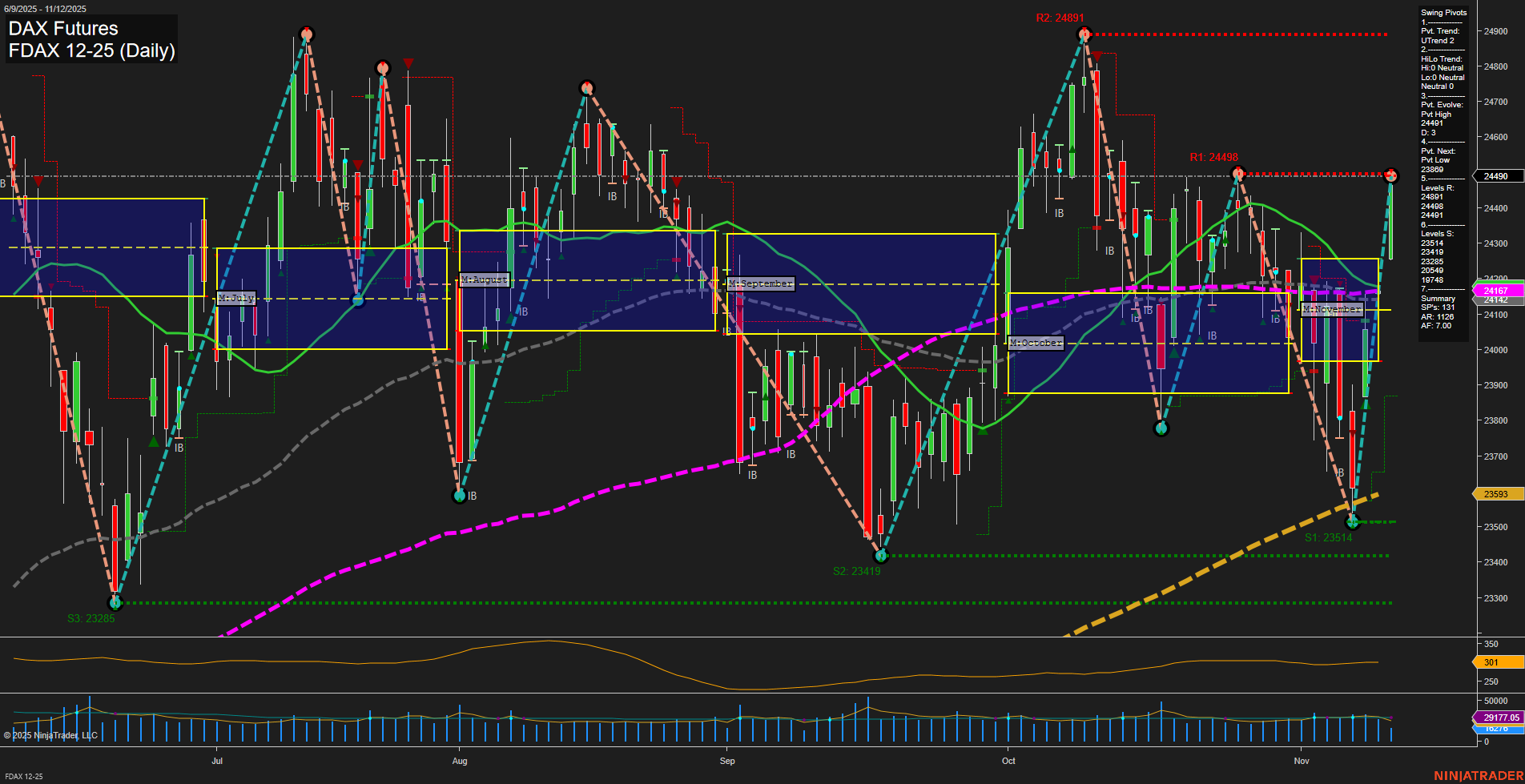

FDAX DAX Futures Daily Chart Analysis: 2025-Nov-12 07:09 CT

Price Action

- Last: 24490,

- Bars: Large,

- Mom: Fast.

WSFG Weekly

- Short-Term

- WSFG Current: 98%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 48%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 122%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt High 24491,

- 4. Pvt. Next: Pvt Low 23514,

- 5. Levels R: 24891, 24498,

- 6. Levels S: 24101, 23918, 23419, 23285, 23514.

Daily Benchmarks

- (Short-Term) 5 Day: 24167 Up Trend,

- (Short-Term) 10 Day: 24102 Up Trend,

- (Intermediate-Term) 20 Day: 24167 Up Trend,

- (Intermediate-Term) 55 Day: 24102 Up Trend,

- (Long-Term) 100 Day: 24167 Up Trend,

- (Long-Term) 200 Day: 23593 Up Trend.

Additional Metrics

Recent Trade Signals

- 11 Nov 2025: Long FDAX 12-25 @ 24129 Signals.USAR-MSFG

- 06 Nov 2025: Short FDAX 12-25 @ 23763 Signals.USAR.TR120

- 06 Nov 2025: Long FDAX 12-25 @ 24132 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The FDAX is exhibiting strong bullish momentum across all timeframes, with price action characterized by large, fast-moving bars and a decisive move above key session fib grid levels. The short-term swing pivot trend is up, supported by a recent pivot high, while the intermediate-term trend is neutral, suggesting some consolidation or digestion of recent gains. All benchmark moving averages are aligned in uptrends, reinforcing the underlying strength. Resistance is noted at 24498 and 24891, with support clustered around 24101 and 23918, providing clear reference points for potential retracements or continuation moves. Recent trade signals have favored the long side, in line with the prevailing trend. Volatility remains elevated, as indicated by the ATR and volume metrics, suggesting active participation and potential for further directional moves. Overall, the technical landscape favors a bullish outlook, with the market in a strong recovery phase following a prior pullback, and poised for possible tests of higher resistance levels if momentum persists.

Chart Analysis ATS AI Generated: 2025-11-12 07:09 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.