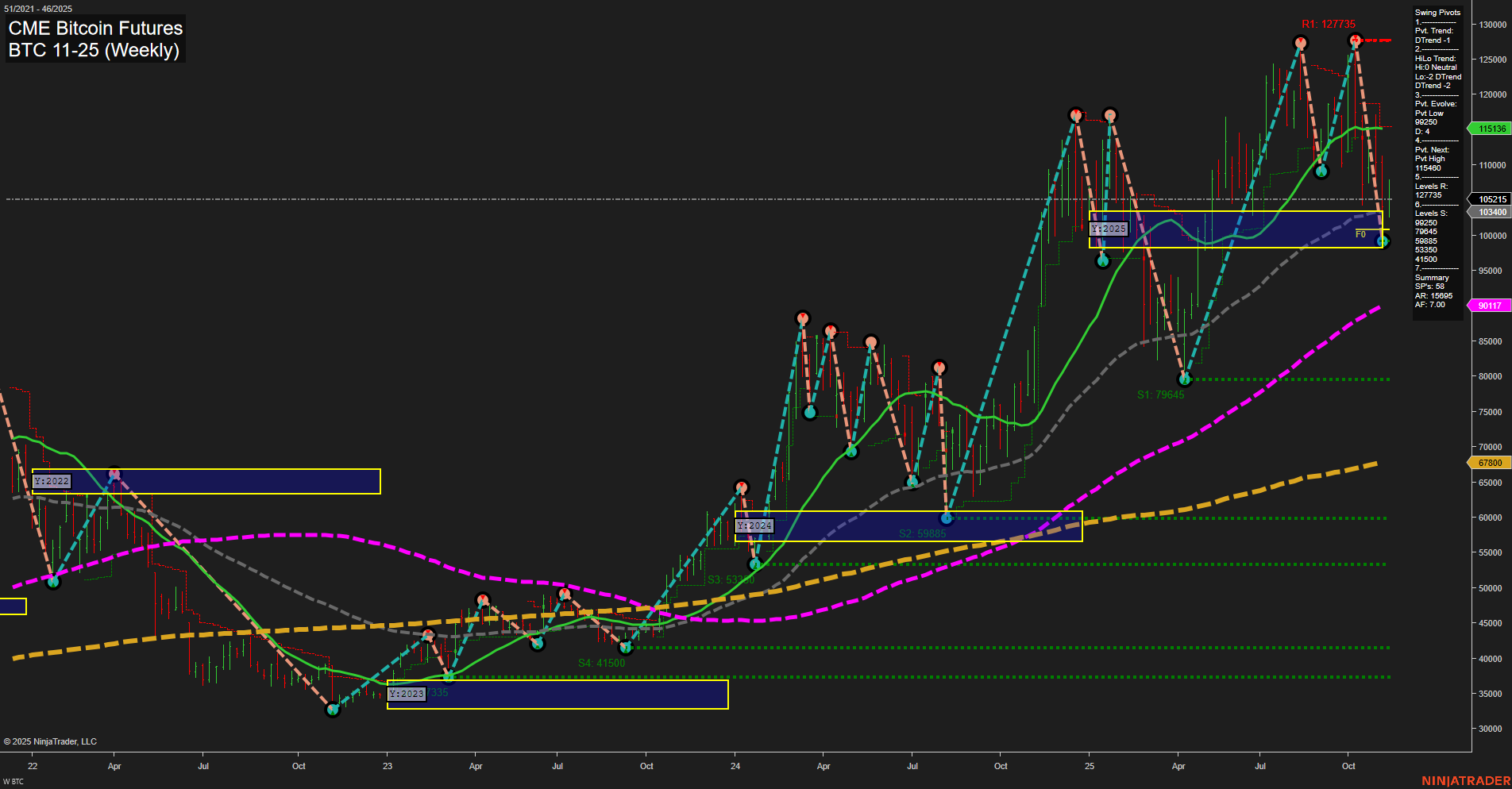

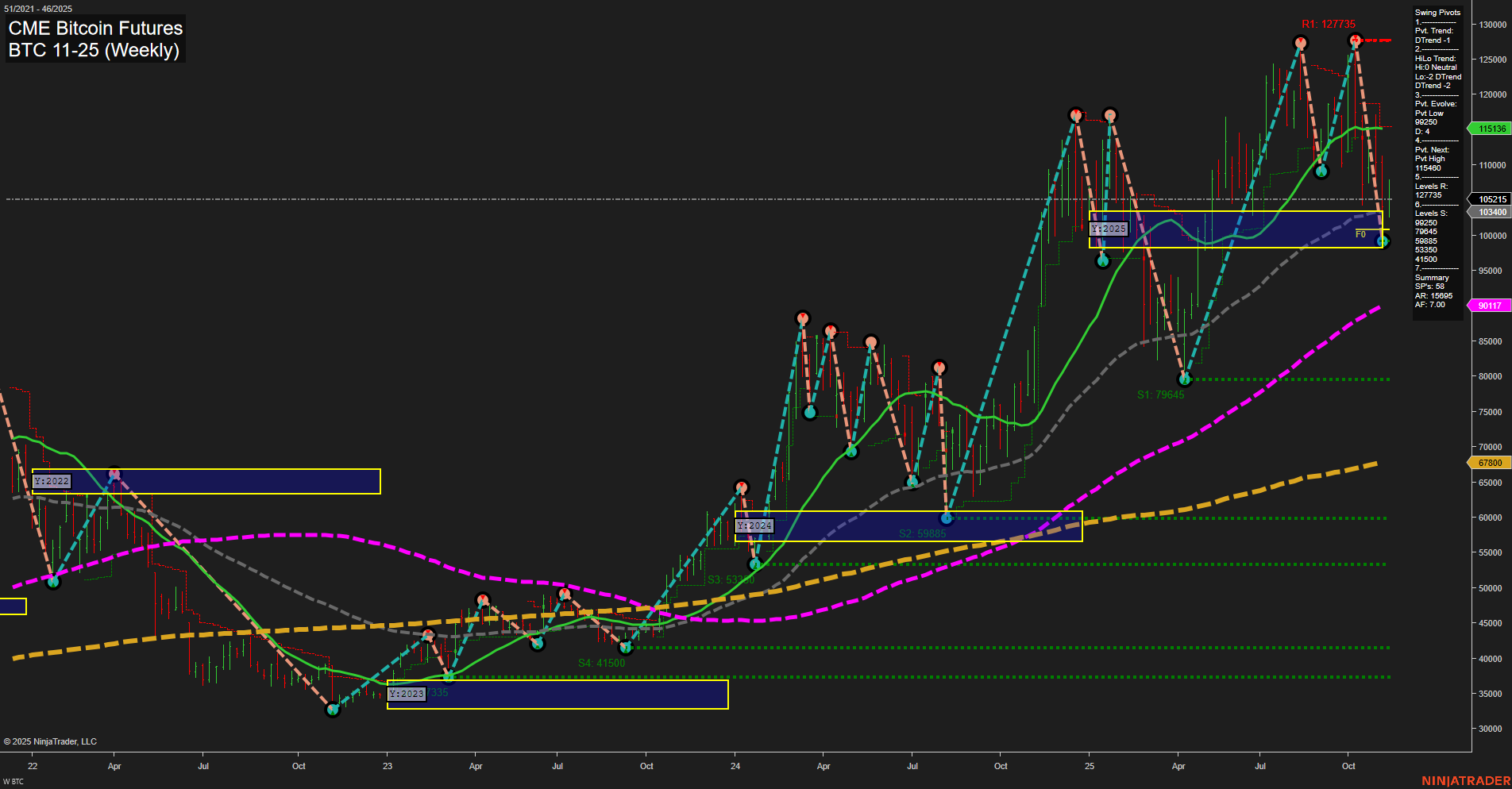

BTC CME Bitcoin Futures Weekly Chart Analysis: 2025-Nov-12 07:04 CT

Price Action

- Last: 103040,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 11%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: -85%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 17%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 92540,

- 4. Pvt. Next: Pvt high 115160,

- 5. Levels R: 127735, 115160,

- 6. Levels S: 92540, 79645, 59885, 53305, 41500.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 115316 Down Trend,

- (Intermediate-Term) 10 Week: 115316 Down Trend,

- (Long-Term) 20 Week: 105215 Down Trend,

- (Long-Term) 55 Week: 99117 Up Trend,

- (Long-Term) 100 Week: 90117 Up Trend,

- (Long-Term) 200 Week: 67800 Up Trend.

Recent Trade Signals

- 11 Nov 2025: Short BTC 11-25 @ 103030 Signals.USAR-WSFG

- 11 Nov 2025: Short BTC 11-25 @ 103030 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The current weekly chart for CME Bitcoin Futures shows a strong recent selloff, with large bars and fast momentum driving price down to the 103040 level. Short-term and intermediate-term trends have shifted bearish, as confirmed by both swing pivot trends and recent short trade signals. Price is currently above the yearly and weekly session fib grid centers, indicating that the long-term structure remains intact and bullish, but the monthly grid is decisively negative, reflecting a significant retracement or correction phase. Key resistance sits overhead at 115160 and 127735, while support is layered below at 92540 and 79645. The 20-week moving average has turned down, reinforcing the intermediate-term weakness, but the 55, 100, and 200-week moving averages remain in uptrends, supporting the broader bullish cycle. The market is in a corrective phase within a larger uptrend, with volatility elevated and a potential for further downside tests before any sustained recovery. The overall structure suggests a pullback within a long-term bull market, with the next major pivot levels and moving averages providing key reference points for swing traders.

Chart Analysis ATS AI Generated: 2025-11-12 07:05 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.