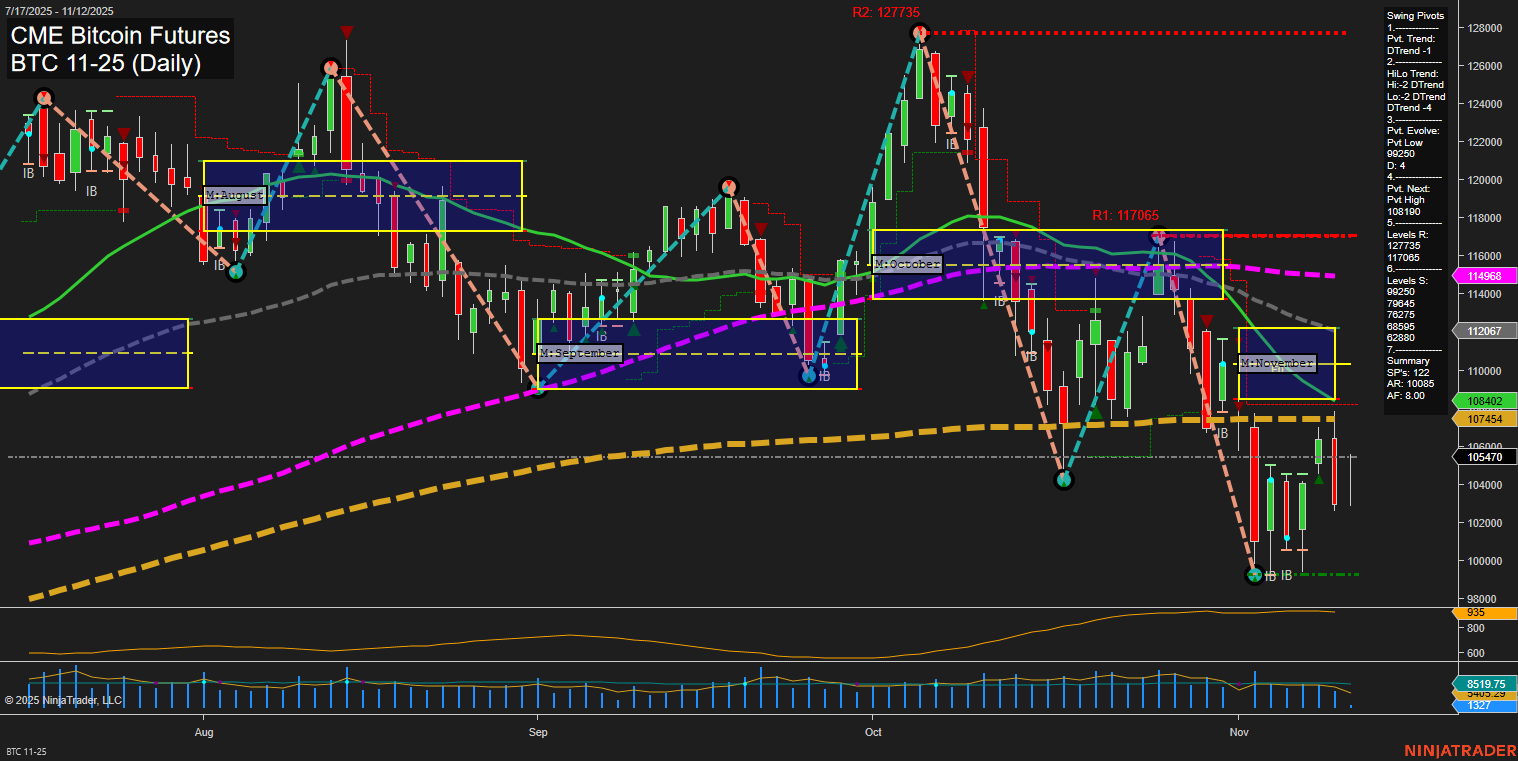

The current BTC CME futures daily chart reflects a market in the midst of a corrective phase, with both short-term and intermediate-term trends pointing downward. Price action is characterized by medium-sized bars and slow momentum, indicating a lack of strong directional conviction after a recent sell-off. The weekly session fib grid (WSFG) shows a minor upward bias, but this is overshadowed by the monthly session fib grid (MSFG) which is firmly in a downtrend, with price trading below the monthly NTZ and F0% levels. Swing pivot analysis confirms a dominant downtrend, with the most recent pivot low at 98,250 and the next potential reversal at 108,180, suggesting the market is testing support levels after a sharp decline. Resistance remains overhead at 114,968, 117,065, and 127,735, while support is layered below at 99,250 and further down. All key daily moving averages (5, 10, 20, 55, 100) are trending down, reinforcing the bearish structure, though the 200-day MA remains in an uptrend, hinting at longer-term structural support. Volatility (ATR) is elevated, and volume metrics are robust, reflecting active participation during this corrective move. Recent trade signals have triggered short entries, aligning with the prevailing trend. Overall, the market is in a bearish swing phase with potential for further downside or consolidation unless a significant reversal develops at key support levels.