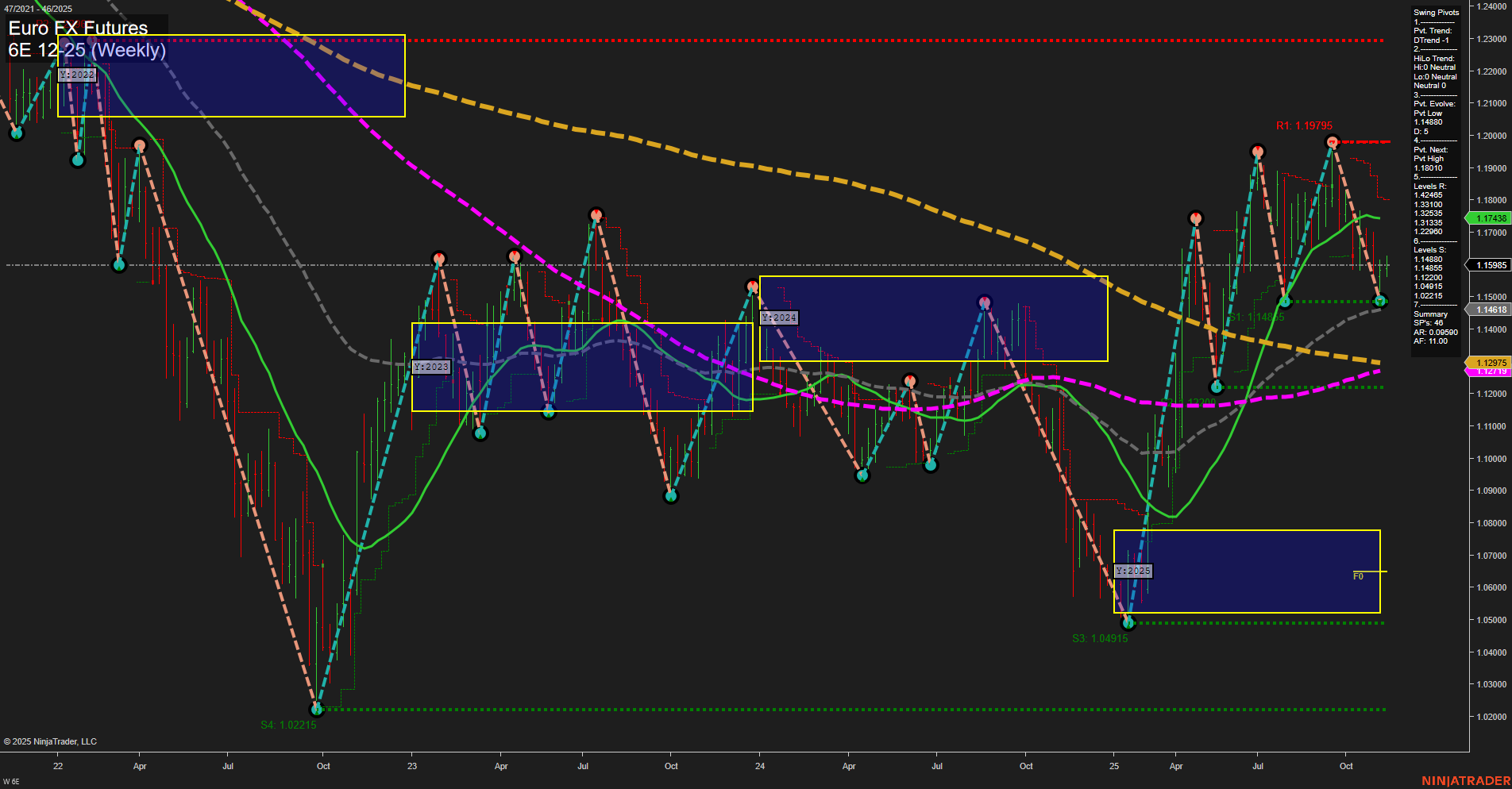

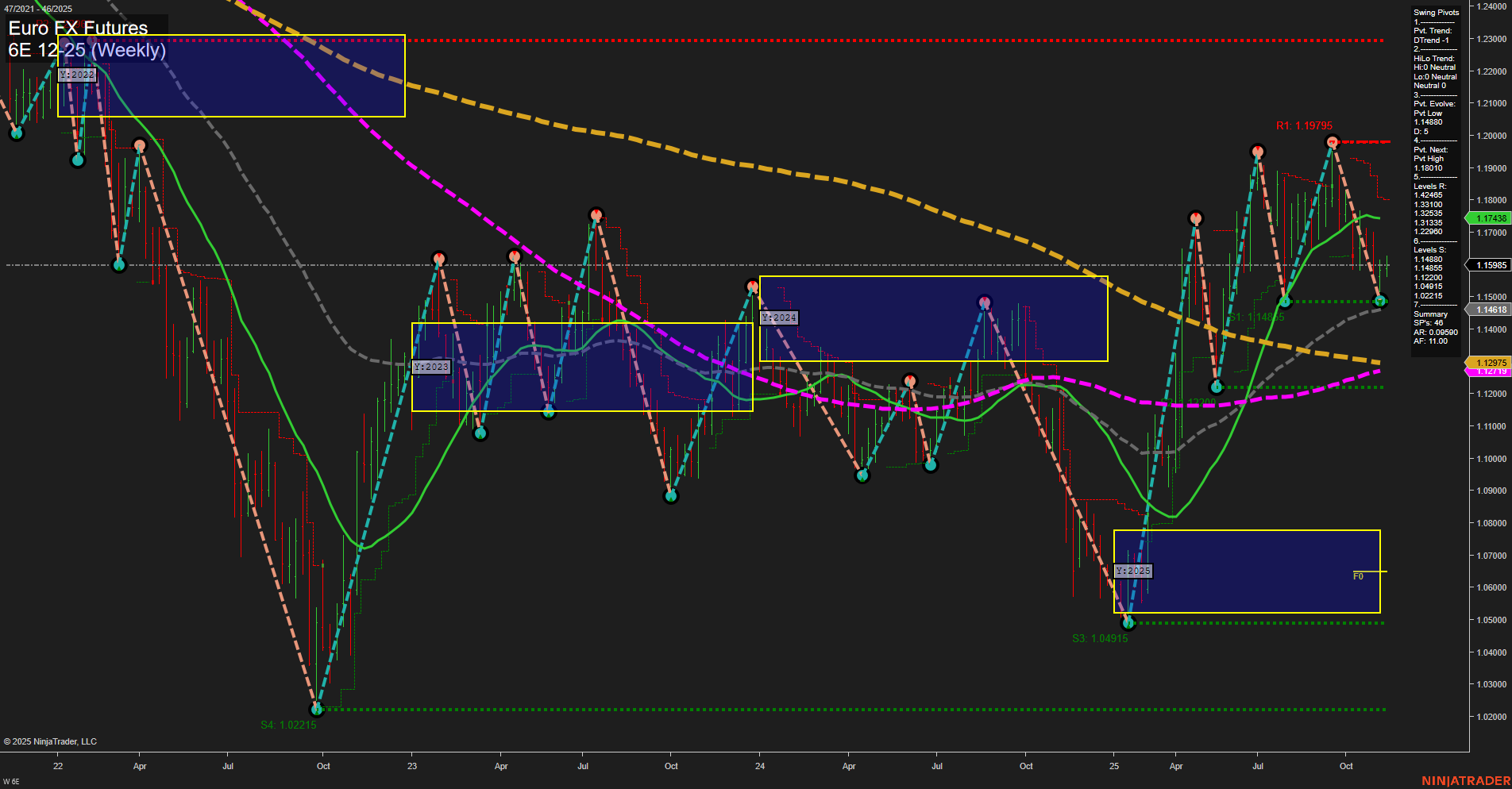

6E Euro FX Futures Weekly Chart Analysis: 2025-Nov-12 07:02 CT

Price Action

- Last: 1.17438,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 8%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: -55%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 76%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 1.14618,

- 4. Pvt. Next: Pvt high 1.19795,

- 5. Levels R: 1.19795, 1.18305, 1.17925, 1.17205,

- 6. Levels S: 1.14618, 1.12975, 1.10491, 1.02215.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.15985 Up Trend,

- (Intermediate-Term) 10 Week: 1.14618 Up Trend,

- (Long-Term) 20 Week: 1.17438 Up Trend,

- (Long-Term) 55 Week: 1.12401 Up Trend,

- (Long-Term) 100 Week: 1.12975 Up Trend,

- (Long-Term) 200 Week: 1.12401 Down Trend.

Recent Trade Signals

- 12 Nov 2025: Long 6E 12-25 @ 1.16035 Signals.USAR-WSFG

- 06 Nov 2025: Long 6E 12-25 @ 1.15545 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The 6E Euro FX Futures weekly chart shows a market in transition, with a clear divergence between short/long-term bullishness and intermediate-term bearishness. Price action is currently above the key NTZ F0% levels on both the weekly and yearly session fib grids, supporting a bullish bias in those timeframes. The most recent swing pivot is a low at 1.14618, with the next significant resistance at the swing high of 1.19795. All benchmark moving averages except the 200-week are trending up, reinforcing the underlying strength, while the 200-week MA remains a lagging resistance. Recent trade signals have triggered new long entries, aligning with the short-term uptrend. However, the intermediate-term (monthly) fib grid and swing pivot HiLo trend remain down, suggesting ongoing corrective or consolidative action within a broader uptrend. The market is likely in a pullback or retracement phase within a larger bullish structure, with volatility and choppy price action as it tests resistance levels. Watch for potential continuation if price can break above the 1.17925–1.19795 resistance zone, while support at 1.14618 and below remains critical for the bullish case.

Chart Analysis ATS AI Generated: 2025-11-12 07:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.