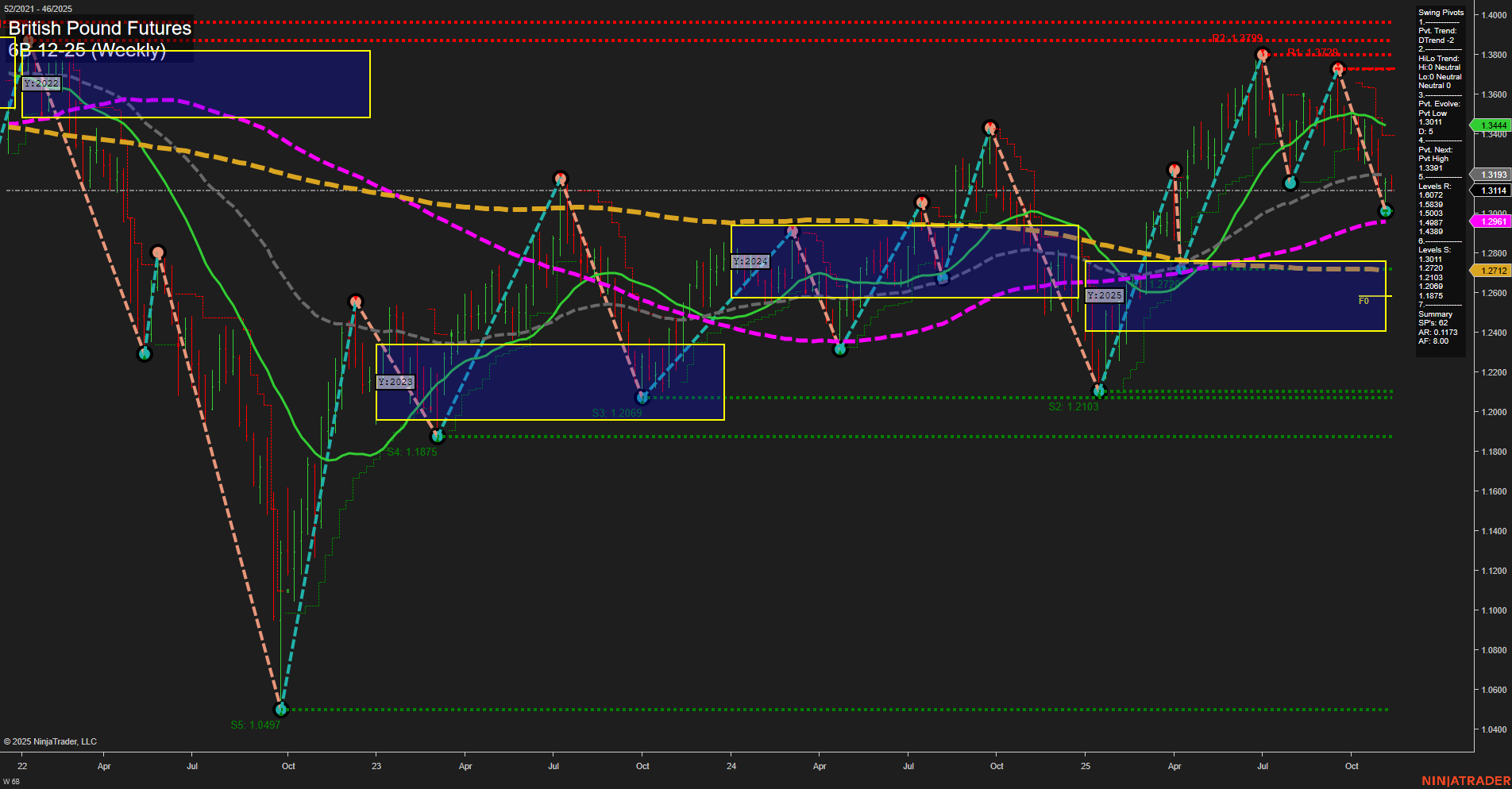

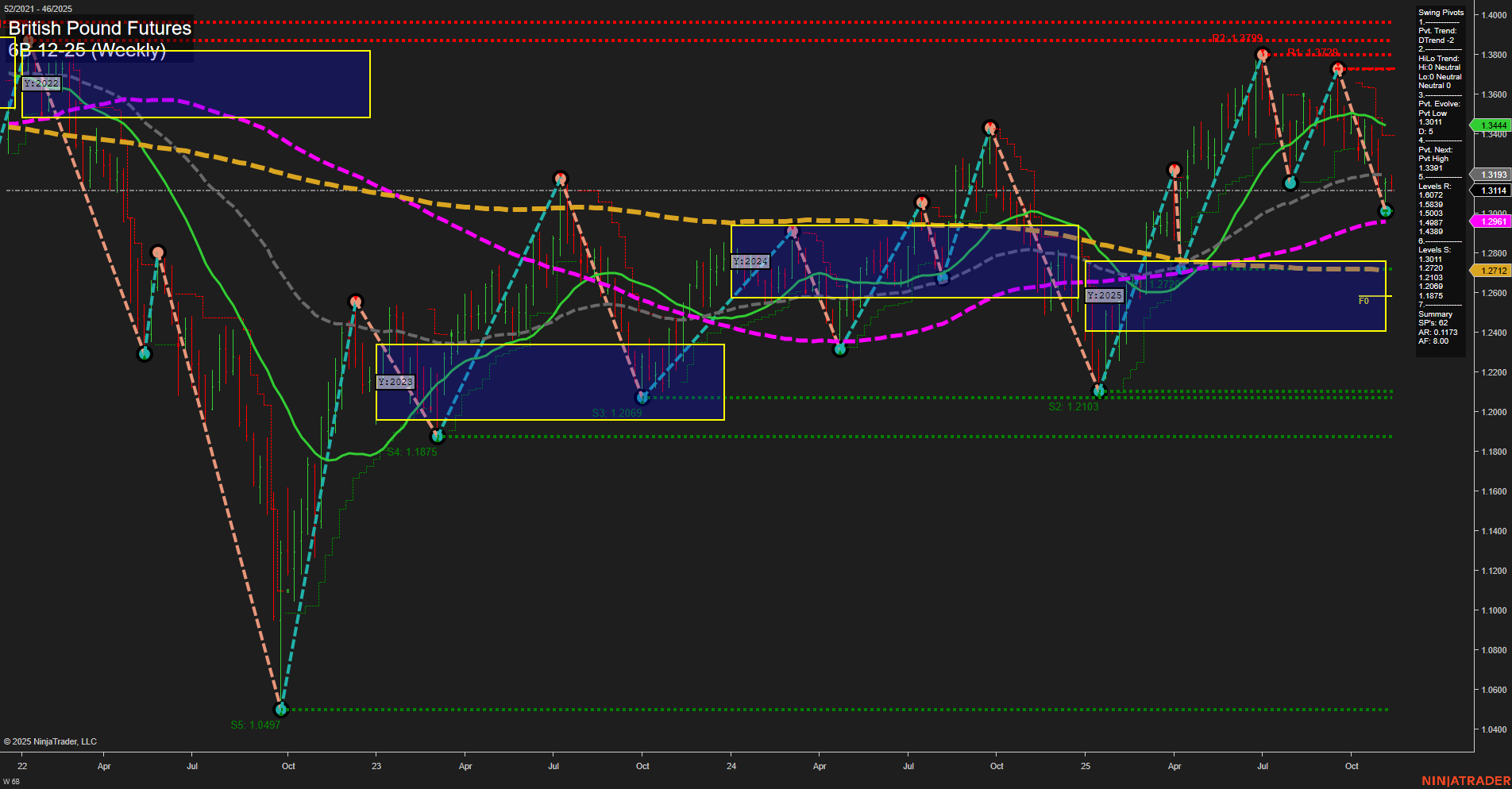

6B British Pound Futures Weekly Chart Analysis: 2025-Nov-12 07:01 CT

Price Action

- Last: 1.3444,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -23%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: -78%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 30%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt low 1.3444,

- 4. Pvt. Next: Pvt high 1.3193,

- 5. Levels R: 1.3799, 1.3728, 1.3444, 1.3193,

- 6. Levels S: 1.3114, 1.2961, 1.2712, 1.2069, 1.1875, 1.2103, 1.0497.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.3444 Down Trend,

- (Intermediate-Term) 10 Week: 1.3193 Down Trend,

- (Long-Term) 20 Week: 1.3444 Up Trend,

- (Long-Term) 55 Week: 1.2961 Up Trend,

- (Long-Term) 100 Week: 1.2712 Up Trend,

- (Long-Term) 200 Week: 1.2103 Up Trend.

Recent Trade Signals

- 12 Nov 2025: Short 6B 12-25 @ 1.3116 Signals.USAR-WSFG

- 12 Nov 2025: Short 6B 12-25 @ 1.3116 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The British Pound Futures (6B) weekly chart shows a market in transition. Short-term and intermediate-term trends are both bearish, as indicated by the WSFG and MSFG readings, with price action below the NTZ and negative session grid percentages. The most recent swing pivot trend is down, and both the 5- and 10-week moving averages are trending lower, confirming short-term weakness. Recent trade signals also align with a bearish short-term outlook.

However, the long-term picture remains constructive. The YSFG is positive, with price above the yearly NTZ and all long-term moving averages (20, 55, 100, 200 week) trending up, suggesting that the broader uptrend is still intact. The intermediate-term HiLo trend is neutral, indicating a possible pause or consolidation phase within the larger trend.

Resistance is layered above at 1.3444, 1.3728, and 1.3799, while support is found at 1.3114, 1.2961, and further below. The market appears to be in a corrective phase within a longer-term uptrend, with the potential for further downside in the short term before any resumption of the broader bullish trend. Volatility is moderate, and price is currently testing key support and resistance levels, with the potential for choppy or range-bound action in the near term.

Chart Analysis ATS AI Generated: 2025-11-12 07:02 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.