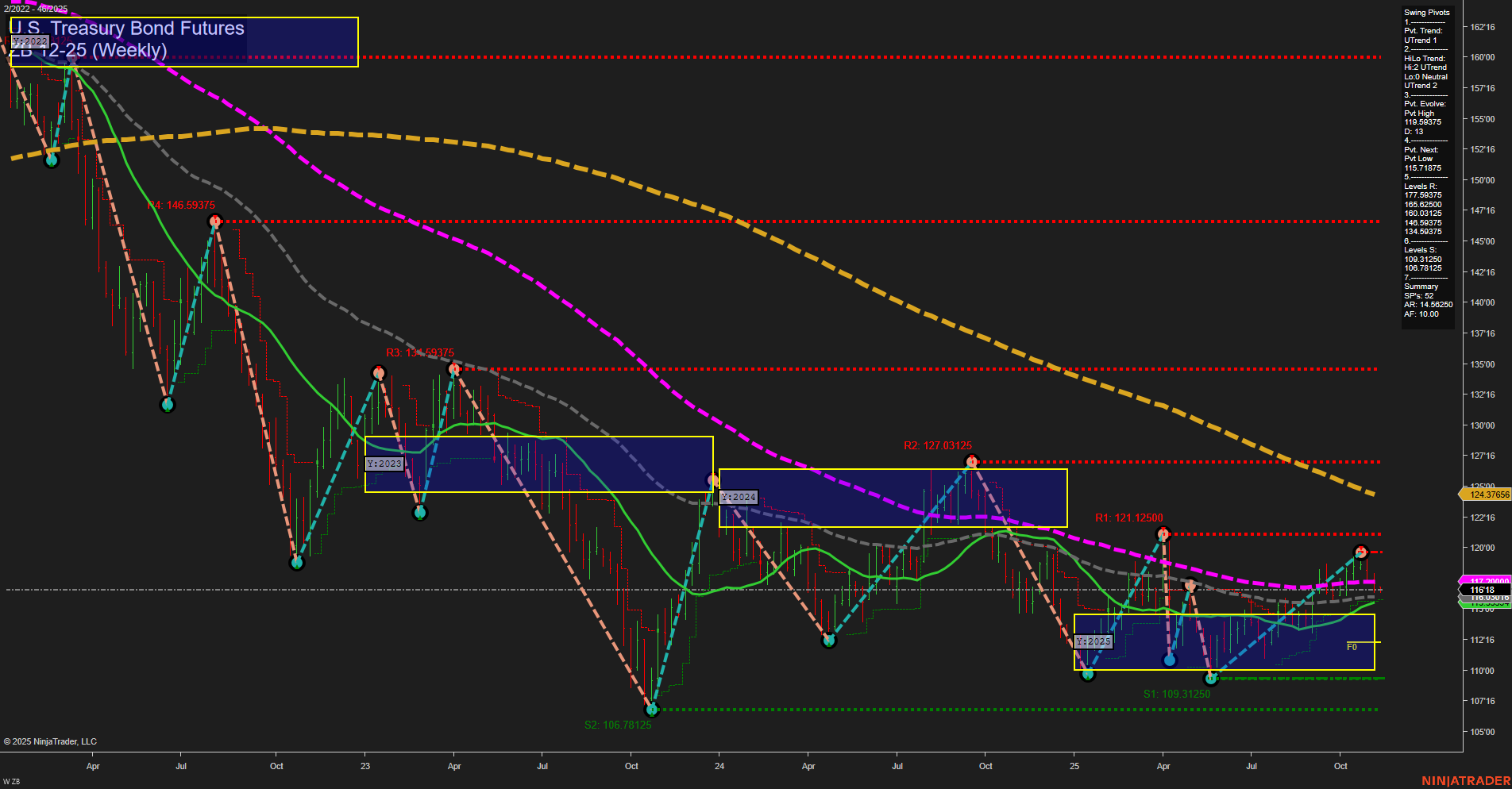

The ZB U.S. Treasury Bond Futures weekly chart shows a market in transition. Price action has shifted to an average momentum phase with medium-sized bars, indicating a balanced but active environment. Both short-term and intermediate-term swing pivot trends are upward, supported by a series of higher lows and a recent pivot high at 119.59375. The price is currently above key intermediate and long-term moving averages (5, 10, 20, and 55 week), all trending upward, which reinforces the bullish tone in the short and intermediate timeframes. However, the 100 and 200 week moving averages remain in a downtrend, highlighting persistent long-term bearishness. The price is trading within a neutral NTZ (No Trade Zone) on the yearly session fib grid, suggesting consolidation and indecision at higher timeframes. Resistance levels are stacked above, with 127.59375 as a major cap, while support is well-defined at 109.3125 and 106.78125. The overall structure suggests a market in a corrective rally within a broader bearish cycle, with potential for further upside in the short to intermediate term, but significant overhead resistance and long-term bearish context remain. The environment is characterized by consolidation, possible range expansion, and a watchful eye on whether the current rally can break through long-term resistance or revert to the prevailing downtrend.