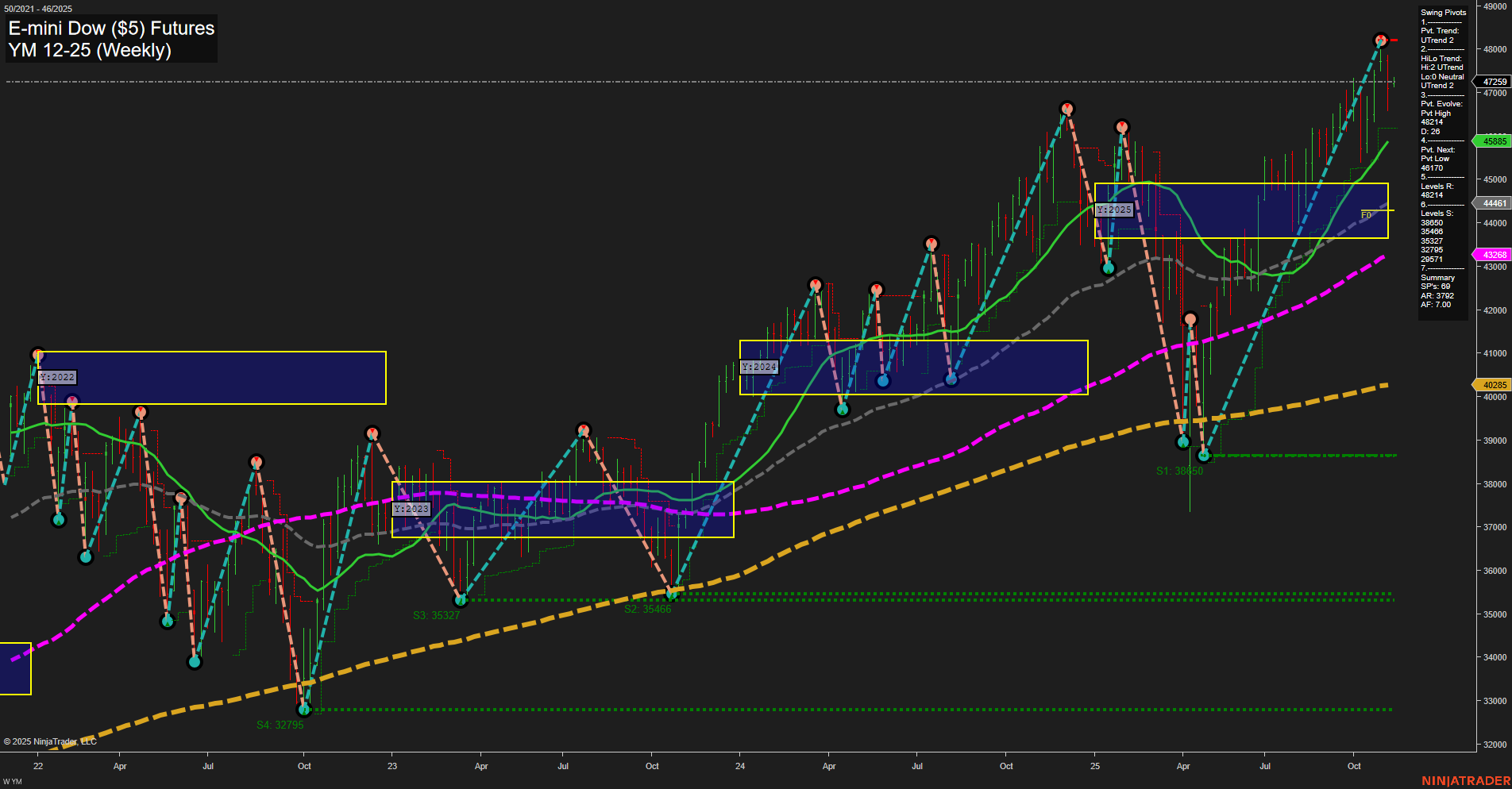

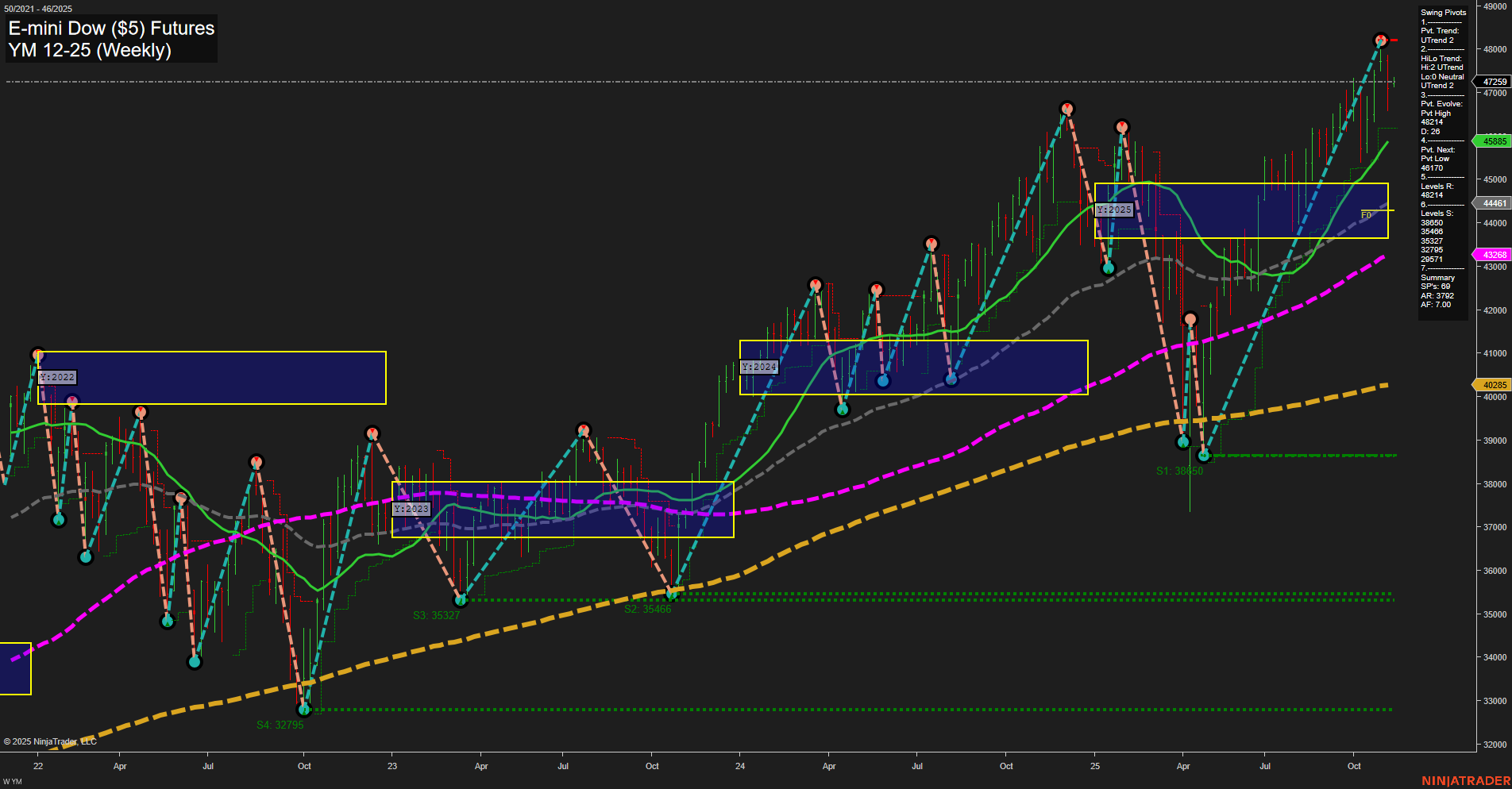

YM E-mini Dow ($5) Futures Weekly Chart Analysis: 2025-Nov-10 07:22 CT

Price Action

- Last: 47,259,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 11%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 42%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 47%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 48,418,

- 4. Pvt. Next: Pvt low 46,170,

- 5. Levels R: 48,418, 47,967, 47,367,

- 6. Levels S: 44,461, 44,000, 43,267, 39,367, 38,450, 35,466, 35,327, 32,796.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 45,885 Up Trend,

- (Intermediate-Term) 10 Week: 44,461 Up Trend,

- (Long-Term) 20 Week: 45,885 Up Trend,

- (Long-Term) 55 Week: 43,268 Up Trend,

- (Long-Term) 100 Week: 43,268 Up Trend,

- (Long-Term) 200 Week: 40,285 Up Trend.

Recent Trade Signals

- 10 Nov 2025: Long YM 12-25 @ 47,293 Signals.USAR-WSFG

- 10 Nov 2025: Long YM 12-25 @ 47,282 Signals.USAR.TR120

- 06 Nov 2025: Short YM 12-25 @ 46,898 Signals.USAR.TR720

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The YM E-mini Dow futures weekly chart shows a strong bullish structure across all timeframes. Price is trading above all major moving averages, with the 5, 10, 20, 55, 100, and 200-week benchmarks all trending upward, confirming sustained momentum. The swing pivot structure highlights a recent pivot high at 48,418, with the next key support at 46,170, and multiple support levels well below, indicating a healthy buffer for pullbacks. The WSFG, MSFG, and YSFG all show price above their respective NTZ/F0% levels, reinforcing the uptrend bias. Recent trade signals are predominantly long, aligning with the prevailing trend. The market has demonstrated resilience after previous corrections, forming higher lows and breaking out of consolidation zones, suggesting trend continuation. Volatility remains moderate, and the overall technical landscape favors the bulls, with no immediate signs of reversal or exhaustion.

Chart Analysis ATS AI Generated: 2025-11-10 07:22 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.