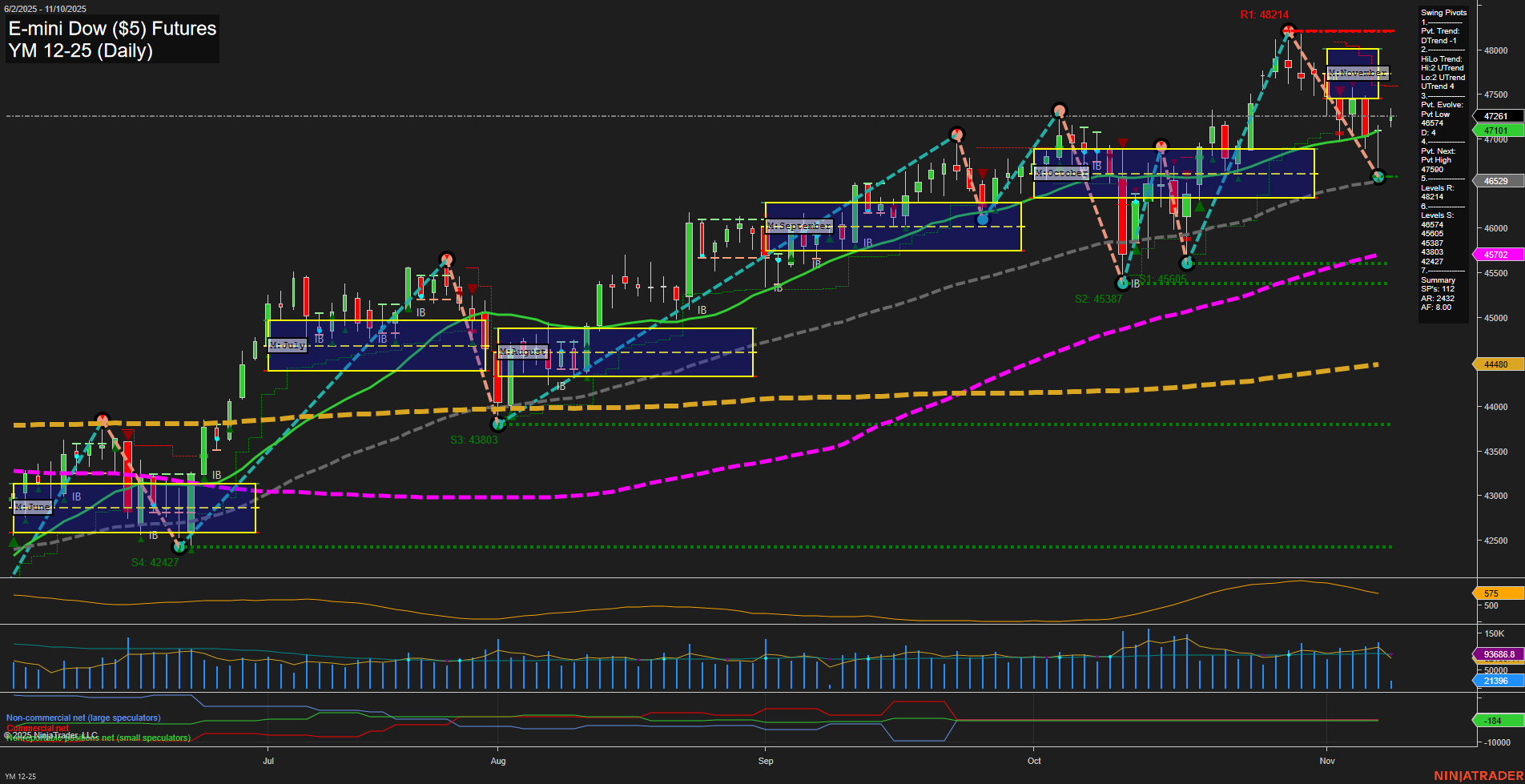

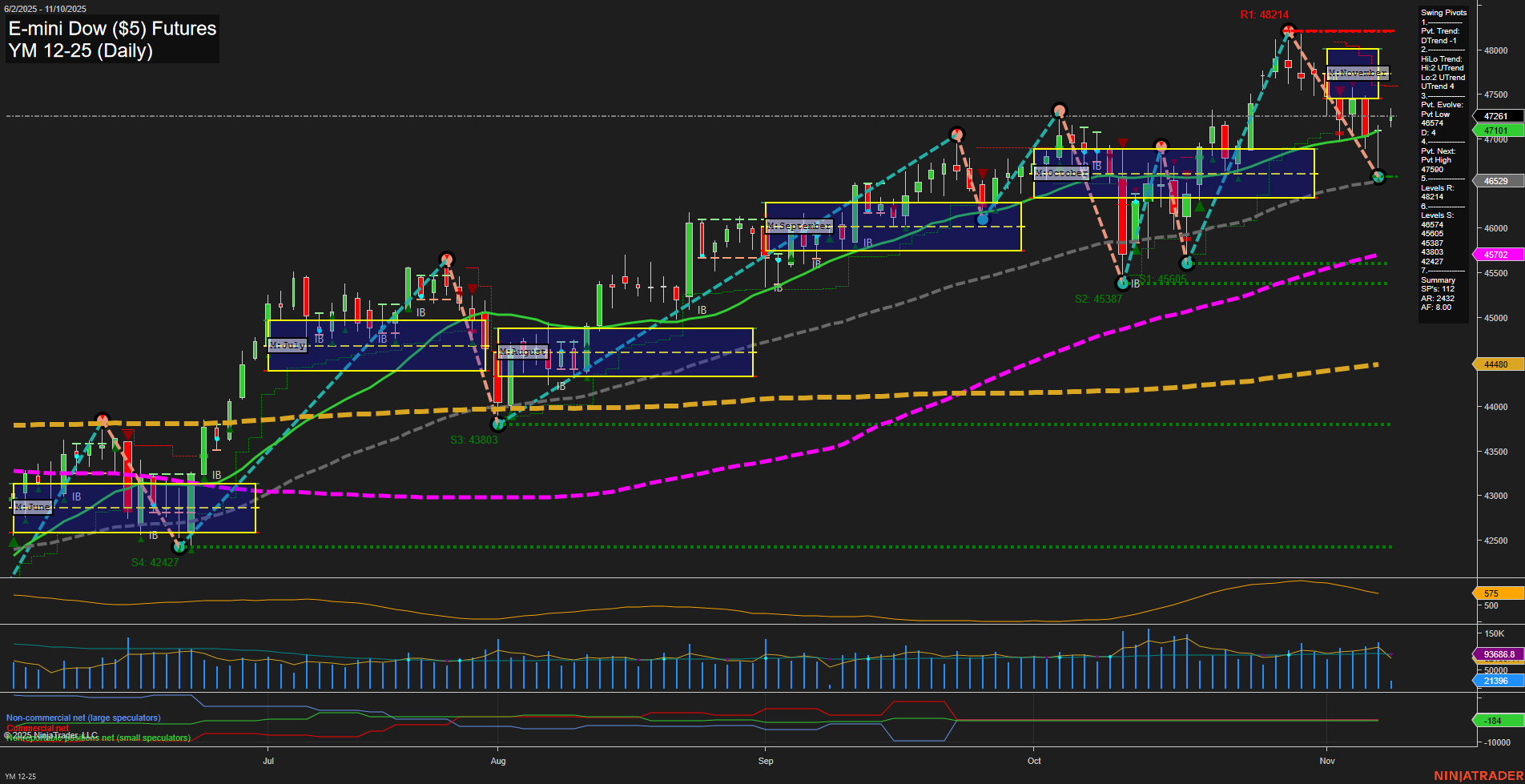

YM E-mini Dow ($5) Futures Daily Chart Analysis: 2025-Nov-10 07:21 CT

Price Action

- Last: 47261,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 11%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 42%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 47%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt Low 46704,

- 4. Pvt. Next: Pvt High 47580,

- 5. Levels R: 48214, 47580,

- 6. Levels S: 46905, 46704, 45387, 43803, 42427.

Daily Benchmarks

- (Short-Term) 5 Day: 47101 Up Trend,

- (Short-Term) 10 Day: 47014 Up Trend,

- (Intermediate-Term) 20 Day: 47261 Up Trend,

- (Intermediate-Term) 55 Day: 46529 Up Trend,

- (Long-Term) 100 Day: 45702 Up Trend,

- (Long-Term) 200 Day: 44480 Up Trend.

Additional Metrics

Recent Trade Signals

- 10 Nov 2025: Long YM 12-25 @ 47293 Signals.USAR-WSFG

- 10 Nov 2025: Long YM 12-25 @ 47282 Signals.USAR.TR120

- 06 Nov 2025: Short YM 12-25 @ 46898 Signals.USAR.TR720

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The YM E-mini Dow futures daily chart shows a market in a strong uptrend on both intermediate and long-term timeframes, with all major moving averages (5, 10, 20, 55, 100, 200 day) trending upward and price holding above key session fib grid levels. The short-term swing pivot trend has shifted to a downtrend, indicating a recent pullback or consolidation phase, but the intermediate-term pivot trend remains up, suggesting the broader trend is intact. Resistance is noted at 47580 and 48214, with support at 46905 and 46704, providing clear levels for monitoring potential reversals or continuation. Recent trade signals show a shift back to long positions after a brief short, aligning with the overall bullish structure. Volatility (ATR) and volume metrics are moderate, supporting the view of a healthy, trending market with periodic pullbacks. The chart reflects a classic swing environment: higher highs and higher lows, with the current action representing a possible retracement within a larger uptrend, as the market tests support before potentially resuming upward momentum.

Chart Analysis ATS AI Generated: 2025-11-10 07:22 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.