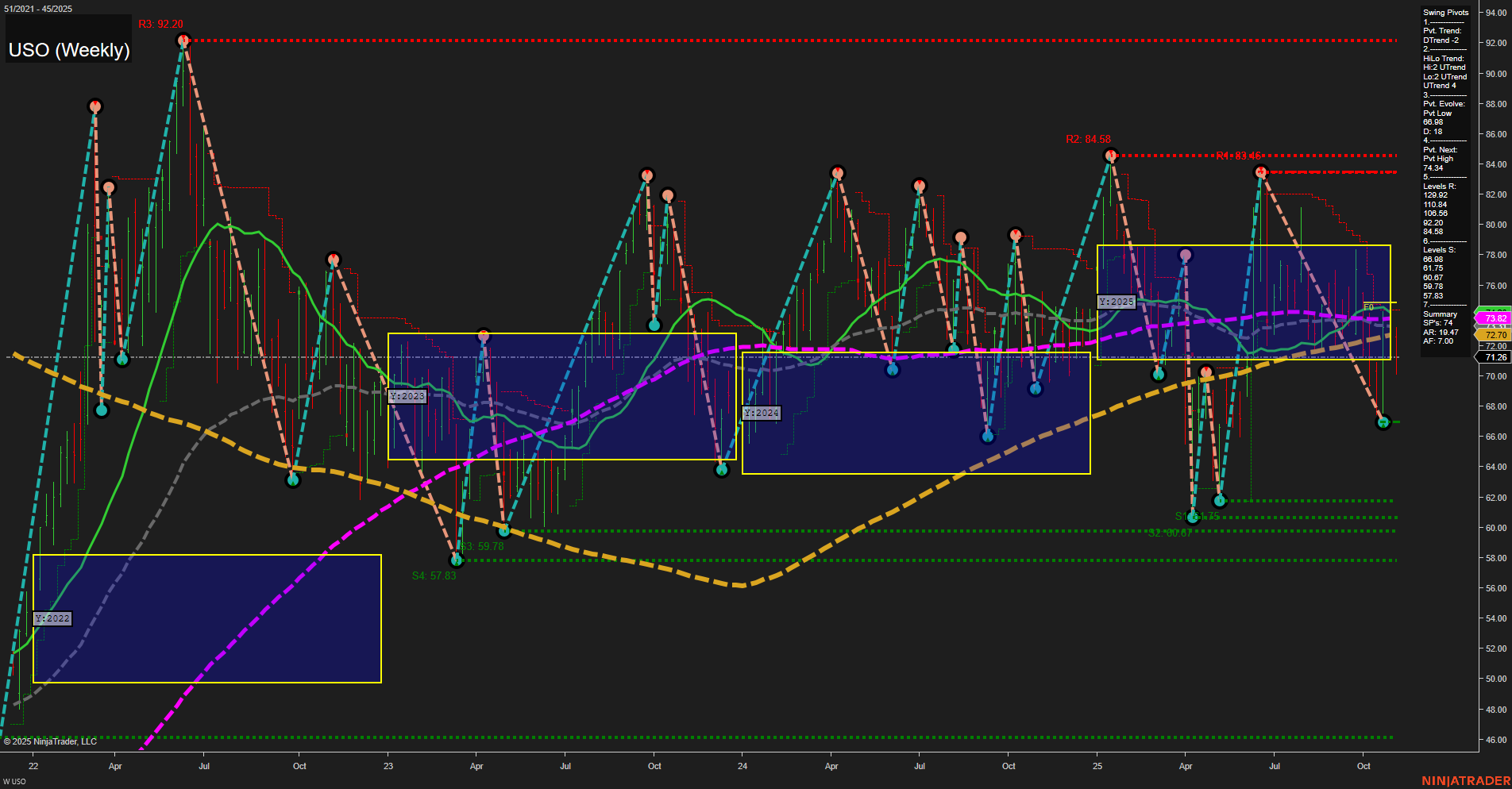

USO is currently trading in a broad consolidation range, with price action showing medium-sized bars and slow momentum, indicating a lack of strong directional conviction. The short-term swing pivot trend is down, with the most recent pivot low at 67.75 and the next resistance at 83.46, suggesting the market is in a corrective phase after a recent decline. Intermediate-term HiLo trend remains up, but the majority of weekly benchmarks (5, 10, 20, 55, and 100 week MAs) are in a downtrend, reinforcing a cautious stance. The 200-week MA is the only benchmark still in an uptrend, providing some long-term support. The price is currently near the center of the yearly NTZ, reflecting a neutral bias across all session fib grids. Multiple resistance levels overhead (83.46, 84.58, 92.20) and support levels below (67.75, 59.78, 57.83) define the trading range. The overall environment is characterized by choppy, range-bound action with no clear breakout or breakdown, and the market appears to be waiting for a catalyst to resolve the current consolidation. Futures swing traders may note the lack of strong momentum and the prevalence of mean-reverting price action, with the potential for volatility spikes should price test key support or resistance levels.