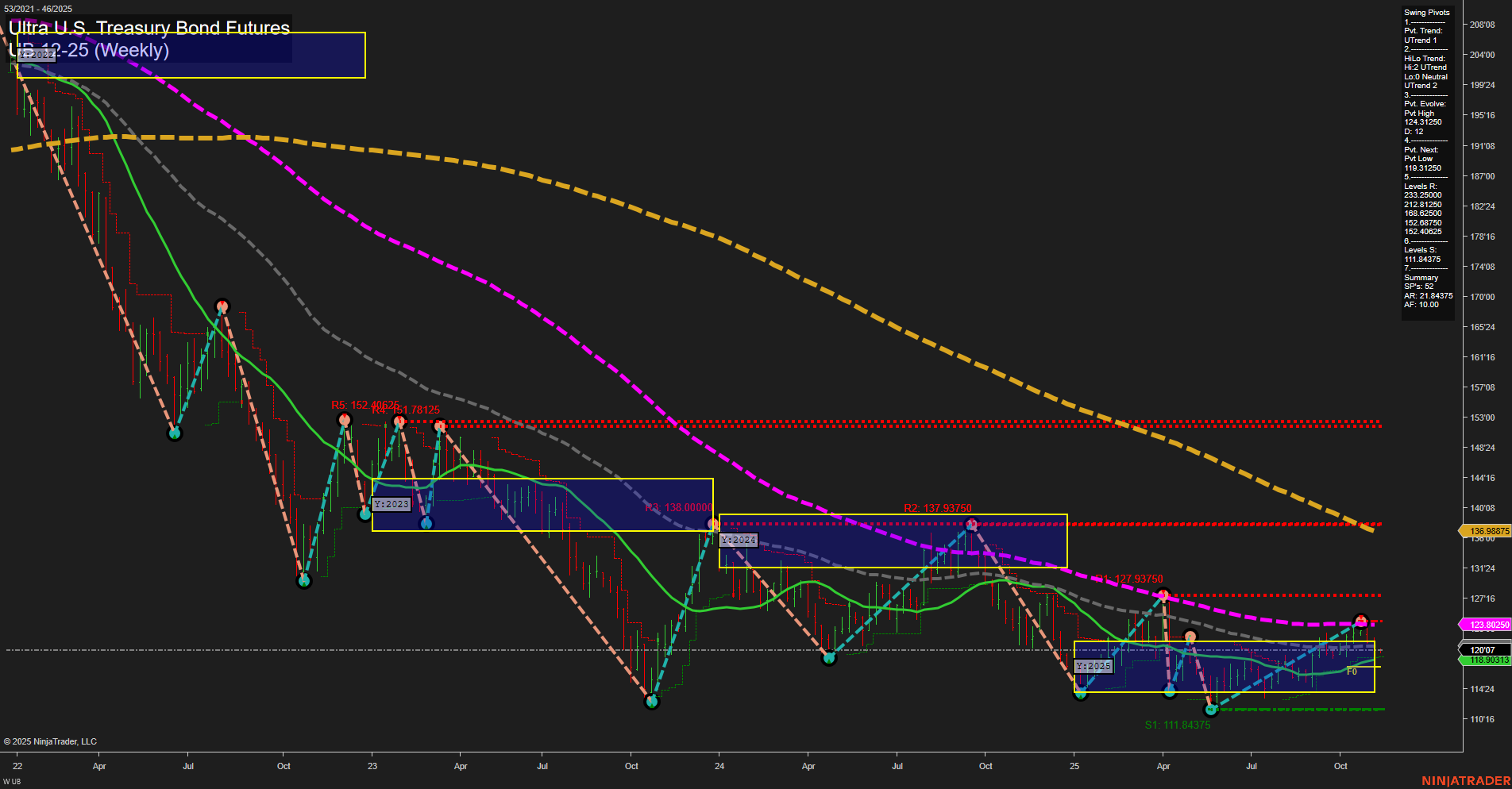

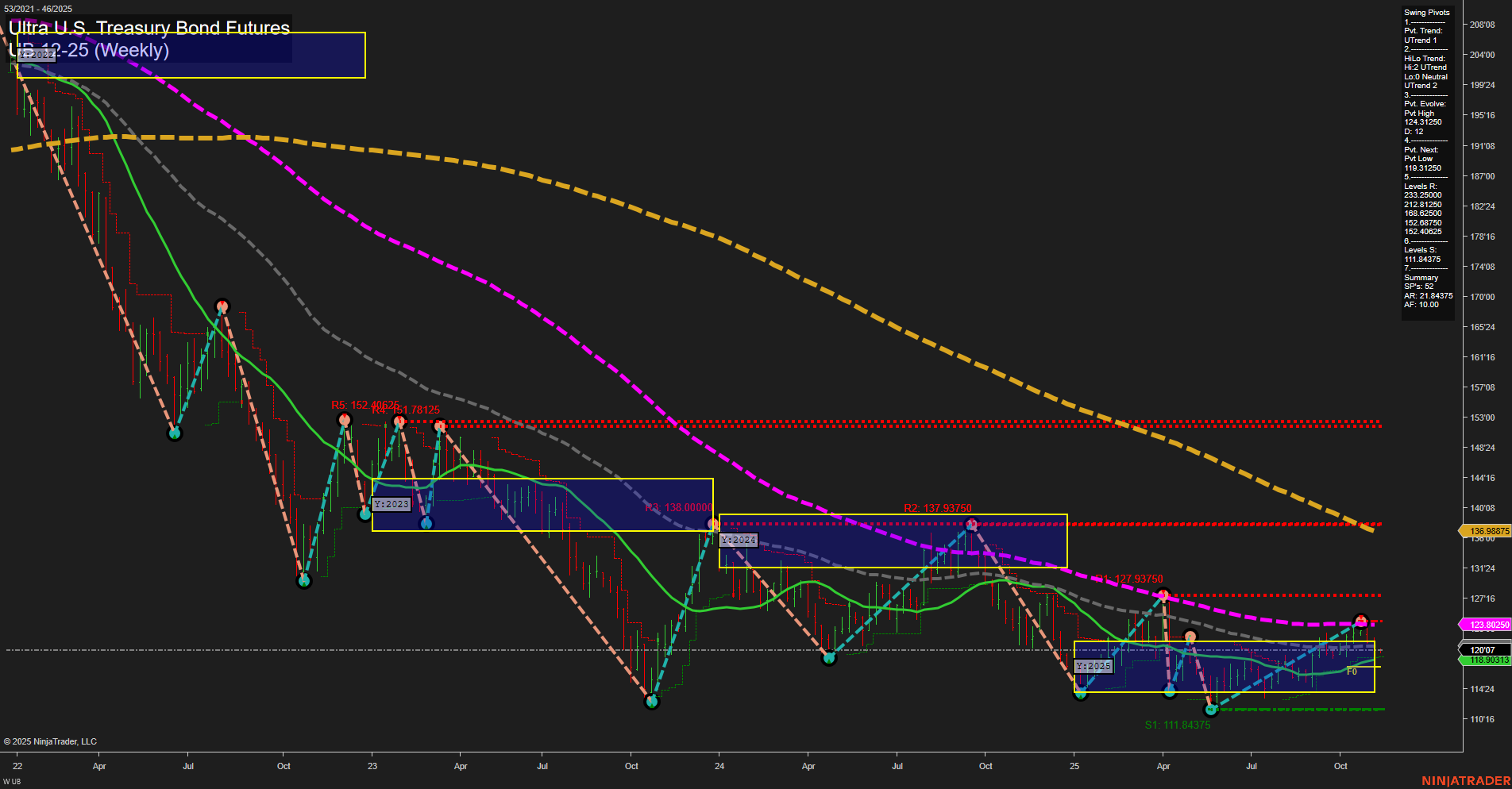

UB Ultra U.S. Treasury Bond Futures Weekly Chart Analysis: 2025-Nov-10 07:20 CT

Price Action

- Last: 120'07,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -30%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 2%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 6%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 124'13.25,

- 4. Pvt. Next: Pvt low 119'31.25,

- 5. Levels R: 152'14.00, 151'78.125, 138'00.00, 137'93.750, 127'93.750, 123'29.500, 121'28.125,

- 6. Levels S: 118'90.312, 111'84.375.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 118'90.312 Up Trend,

- (Intermediate-Term) 10 Week: 119'43.75 Up Trend,

- (Long-Term) 20 Week: 123'80.52 Up Trend,

- (Long-Term) 55 Week: 136'98.875 Down Trend,

- (Long-Term) 100 Week: 123'80.52 Down Trend,

- (Long-Term) 200 Week: 136'98.875 Down Trend.

Recent Trade Signals

- 10 Nov 2025: Short UB 12-25 @ 120.1875 Signals.USAR.TR120

- 07 Nov 2025: Long UB 12-25 @ 120.96875 Signals.USAR-MSFG

- 04 Nov 2025: Short UB 12-25 @ 121.125 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The UB Ultra U.S. Treasury Bond Futures weekly chart shows a market in transition. Short-term price action is mixed, with the WSFG indicating a downward trend and price below the NTZ, but swing pivots and recent signals show both up and down moves, reflecting choppy, range-bound conditions. Intermediate-term signals are more constructive, with the MSFG and swing pivot trends both up, and moving averages confirming upward momentum. Long-term trends remain neutral, as price is still below major resistance levels and long-term moving averages are in downtrends, suggesting that the market has not yet broken out of its broader consolidation phase. Key resistance levels are clustered well above current price, while support is established just below. The recent trade signals highlight the ongoing battle between bulls and bears, with alternating long and short entries. Overall, the market is showing signs of a potential intermediate-term recovery, but remains constrained by long-term resistance and a lack of decisive breakout, making it a market to watch for further confirmation of trend direction.

Chart Analysis ATS AI Generated: 2025-11-10 07:20 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.