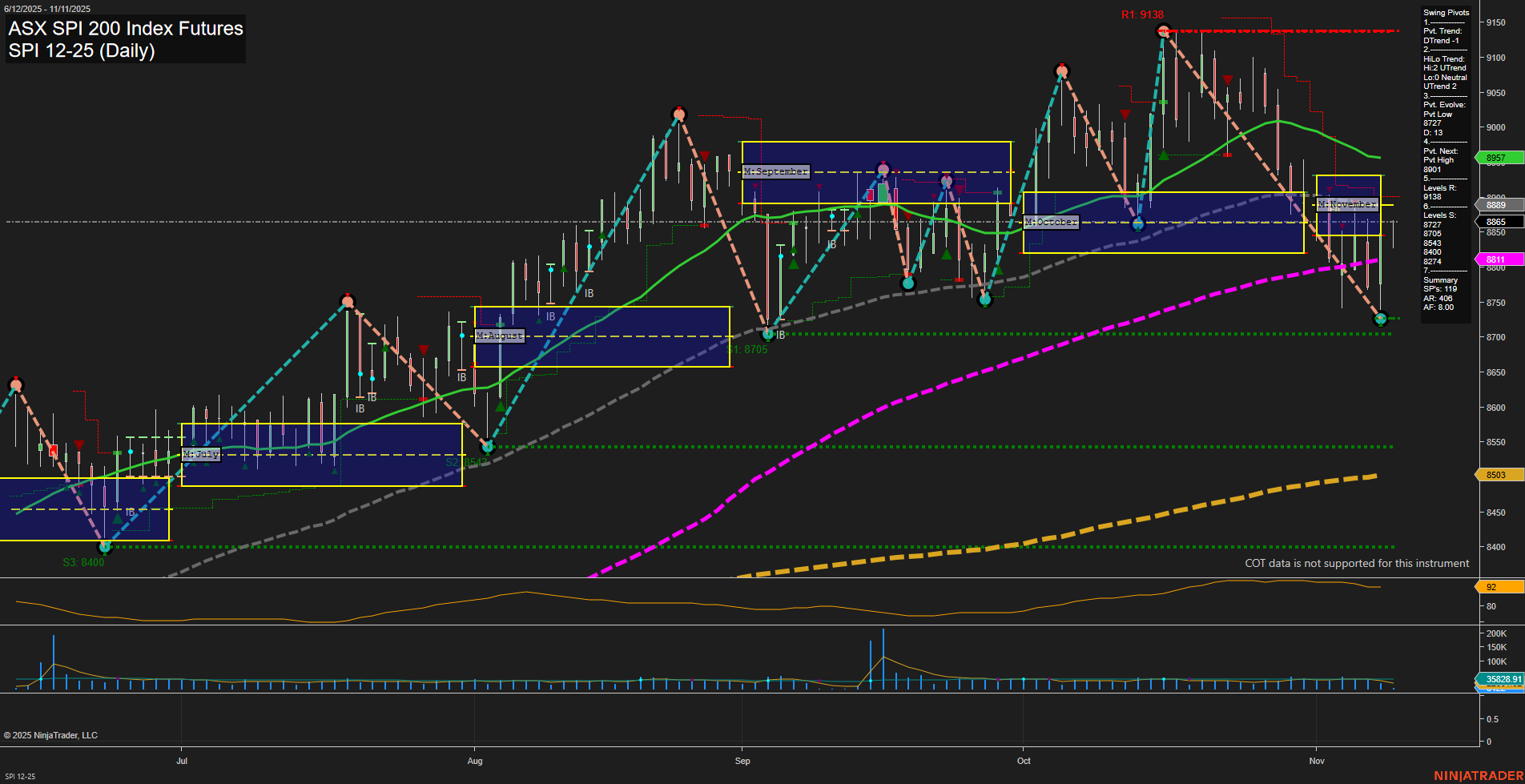

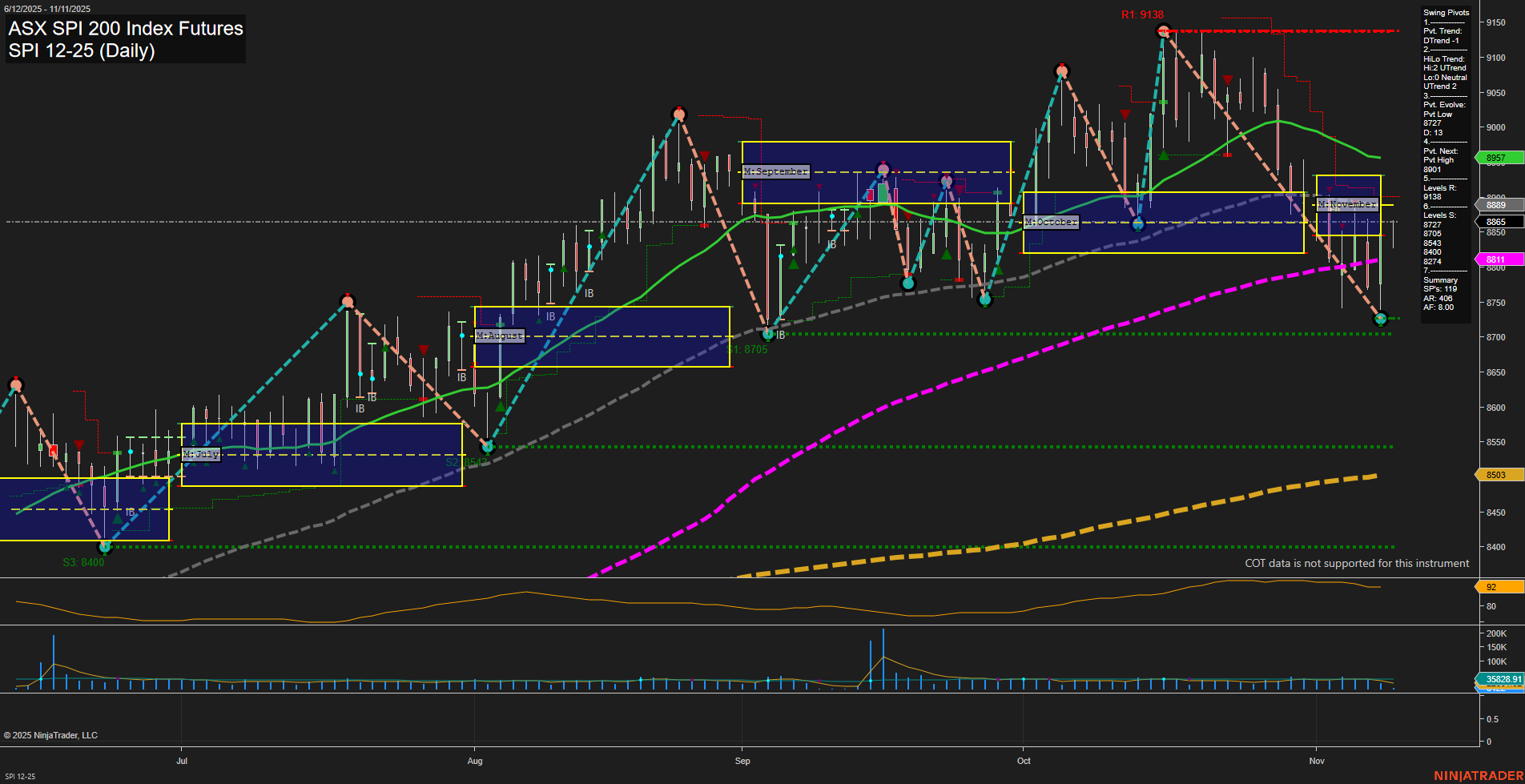

SPI ASX SPI 200 Index Futures Daily Chart Analysis: 2025-Nov-10 07:18 CT

Price Action

- Last: 8811,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 8705,

- 4. Pvt. Next: Pvt high 8901,

- 5. Levels R: 9138, 8901, 8875, 8843,

- 6. Levels S: 8705, 8400.

Daily Benchmarks

- (Short-Term) 5 Day: 8889 Down Trend,

- (Short-Term) 10 Day: 8888 Down Trend,

- (Intermediate-Term) 20 Day: 8957 Down Trend,

- (Intermediate-Term) 55 Day: 8811 Neutral,

- (Long-Term) 100 Day: 8811 Neutral,

- (Long-Term) 200 Day: 8503 Up Trend.

Additional Metrics

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Neutral.

Key Insights Summary

The SPI 200 futures are currently experiencing a short-term downtrend, as indicated by the latest swing pivot (DTrend) and both the 5-day and 10-day moving averages trending lower. Price has recently bounced off a swing low at 8705, with the next key resistance at 8901 and major resistance at 9138. Intermediate and long-term trends remain neutral, with the 20-day moving average also pointing down, but the 55-day and 100-day benchmarks are flat, suggesting a pause in directional conviction. The 200-day moving average is still in an uptrend, providing a longer-term supportive backdrop. Volatility (ATR) is moderate, and volume is steady. The market appears to be in a corrective phase within a broader consolidation, with price action testing support and resistance levels but lacking strong momentum in either direction. This environment reflects indecision, with neither bulls nor bears in clear control, and the market is likely to remain choppy until a decisive breakout or breakdown occurs.

Chart Analysis ATS AI Generated: 2025-11-10 07:18 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.