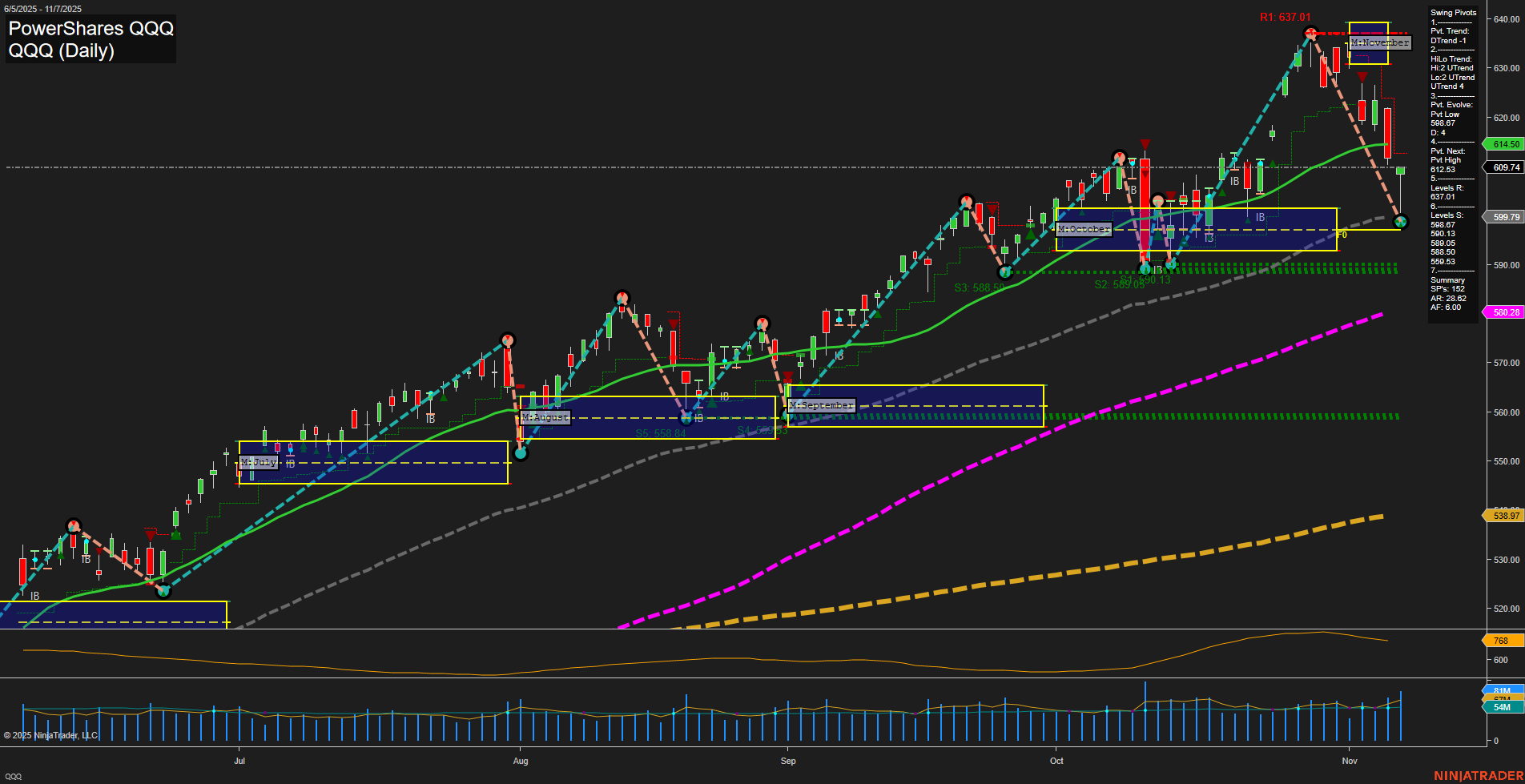

The QQQ daily chart shows a notable shift in short-term momentum, with a recent large, fast-moving bearish swing that has flipped the short-term pivot trend (DTrend) to the downside. The last price is just above the most recent swing low support at 609.67, with the next resistance at the prior swing high of 637.01. Both the 5-day and 10-day moving averages are trending down, confirming short-term weakness, while all intermediate and long-term benchmarks (20, 55, 100, 200-day) remain in solid uptrends, reflecting underlying bullish structure. The intermediate-term HiLo trend remains up, suggesting the broader swing structure is still intact despite the recent pullback. Volatility is elevated (ATR 733), and volume is robust, indicating active participation during this correction. The market is currently in a corrective phase within a larger uptrend, with price action testing key support levels. This environment is typical of a pullback or retracement within a bullish cycle, and the next sessions will be critical to see if support holds or if further downside develops. The overall structure remains constructive for bulls on higher timeframes, but short-term traders are facing a counter-trend move.