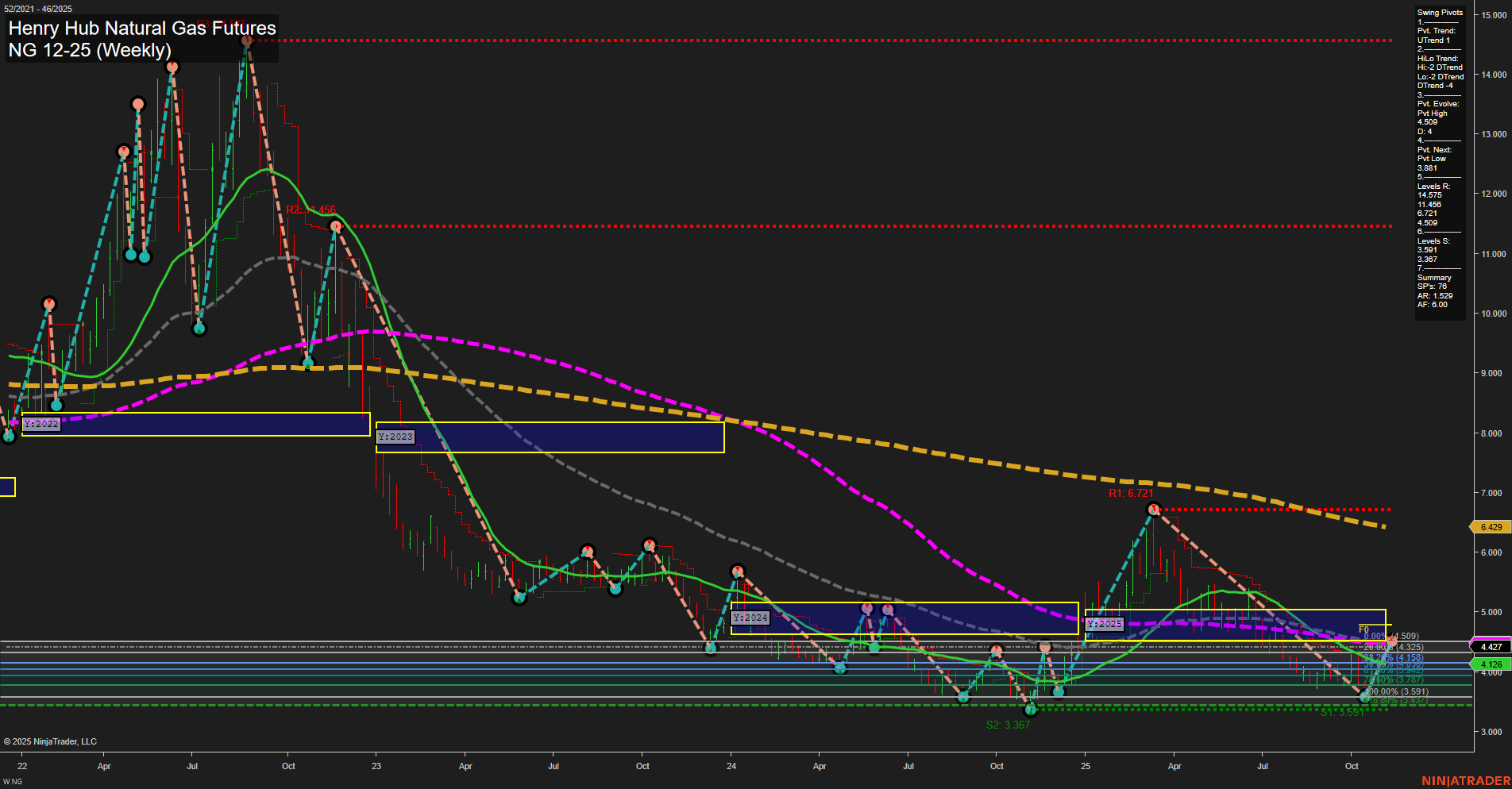

The weekly chart for NG Henry Hub Natural Gas Futures as of early November 2025 shows a notable divergence between short-term and long-term trends. Price action has stabilized with medium-sized bars and slow momentum, suggesting a pause after recent volatility. The short-term (WSFG) and intermediate-term (MSFG) session fib grids both indicate an upward trend, with price currently above their respective NTZ/F0% levels, supported by uptrending 5- and 10-week moving averages. However, the long-term (YSFG) fib grid remains in a downtrend, with price below the yearly NTZ/F0% and all major long-term moving averages (20, 55, 100, 200 week) trending down. Swing pivot analysis highlights a short-term uptrend, but the intermediate-term HiLo trend is still down, reflecting the broader bearish structure. Resistance is clustered above at 4.509 and higher, while support is established at 3.681 and below, indicating a well-defined trading range. The market appears to be in a recovery phase from recent lows, with a potential for further short-term upside, but faces significant overhead resistance and a dominant long-term bearish bias. This setup suggests a market in transition, with short-term bullish momentum contending with longer-term structural weakness, typical of a market attempting to base after a prolonged decline.