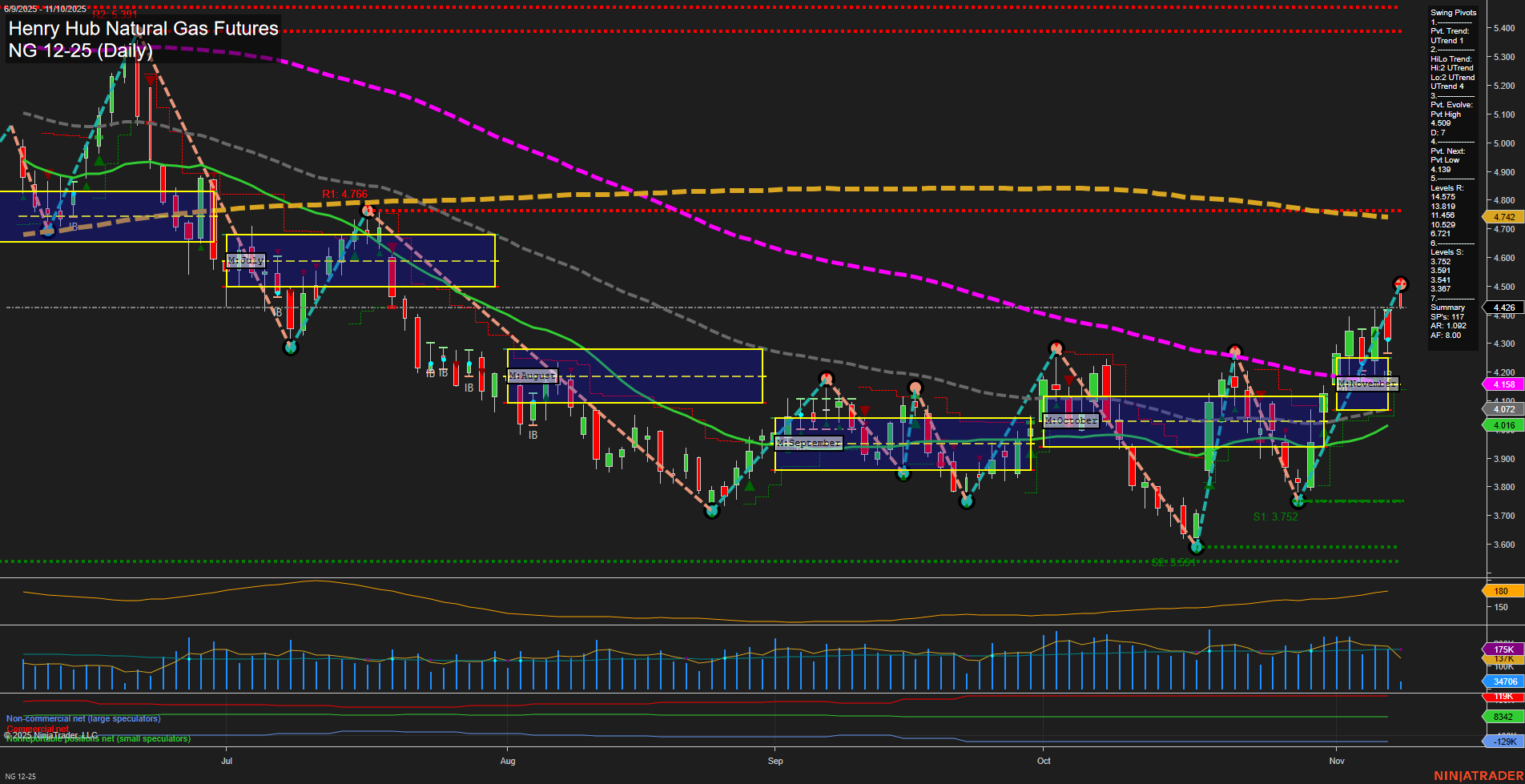

Natural gas futures have staged a strong rally, with price action showing large, fast momentum bars breaking above key short- and intermediate-term resistance levels. Both the weekly and monthly session fib grids indicate price is above their respective NTZ centers, confirming an upward bias and trend in the short and intermediate term. Swing pivot analysis shows an established uptrend, with the most recent pivot high at 4.67 and the next potential reversal at 4.07, while resistance levels cluster just above the current price. All short- and intermediate-term moving averages are trending up, supporting the bullish structure, though the 100- and 200-day long-term averages remain in a downtrend, highlighting a longer-term bearish overhang. Volatility is elevated (ATR 285), and volume remains robust. The overall structure suggests a strong short- and intermediate-term uptrend, but the longer-term trend is still negative, indicating this move could be a countertrend rally within a broader bearish cycle. The market is currently testing higher resistance zones, and the recent price action reflects a possible breakout from consolidation, with volatility and volume supporting the move.