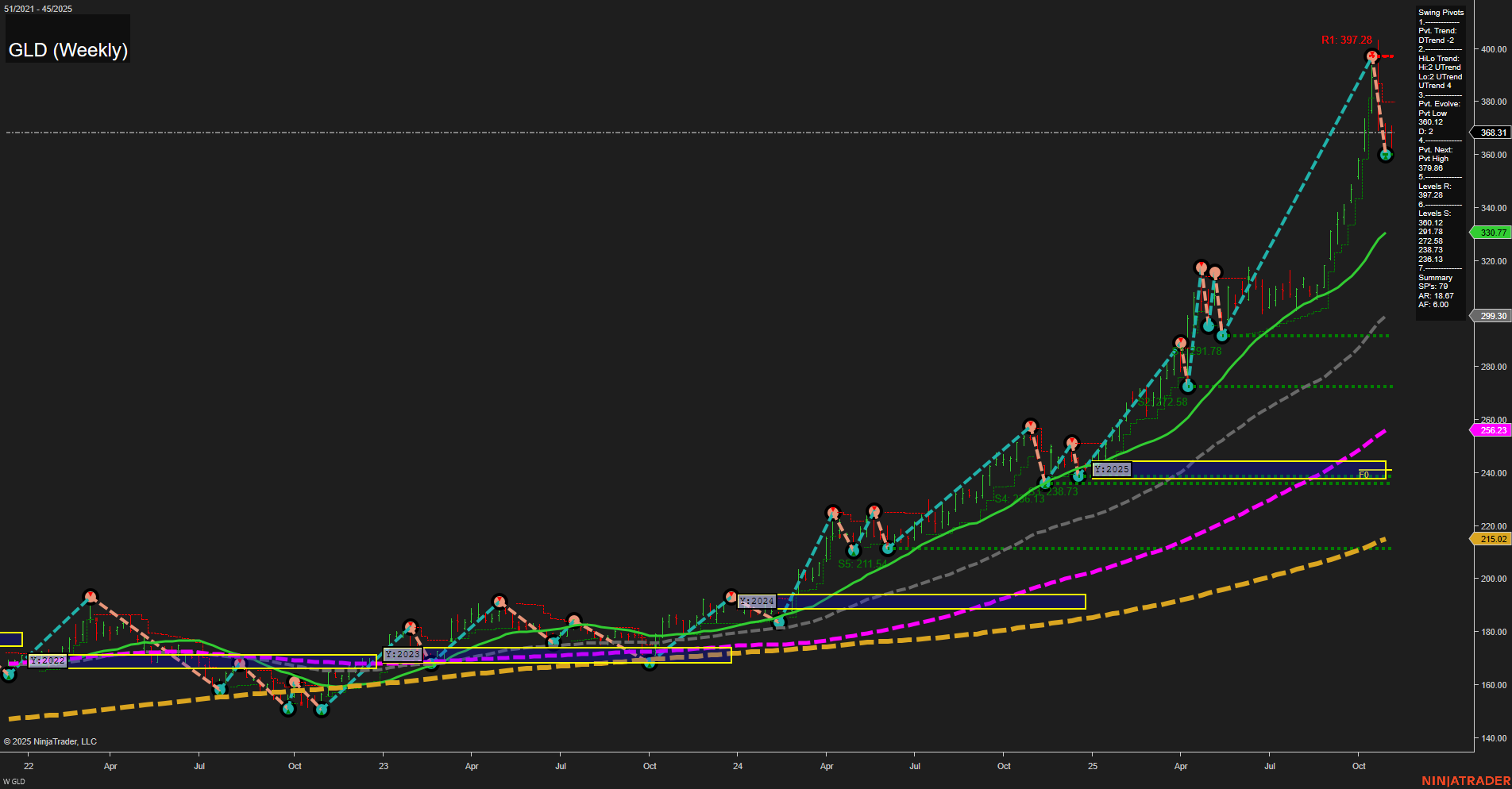

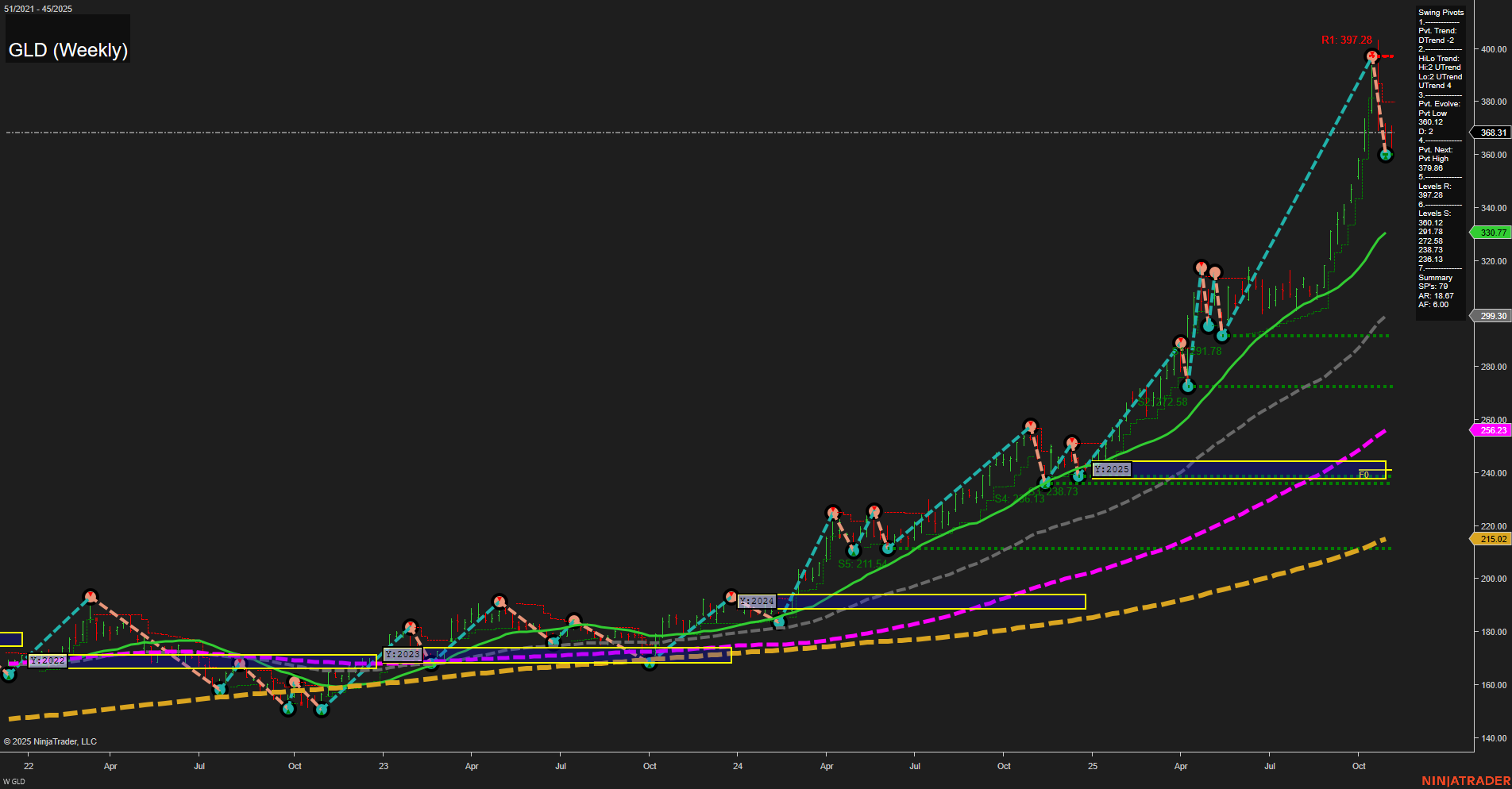

GLD SPDR Gold Shares Weekly Chart Analysis: 2025-Nov-10 07:12 CT

Price Action

- Last: 368.31,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 330.12,

- 4. Pvt. Next: Pvt high 397.28,

- 5. Levels R: 397.28,

- 6. Levels S: 330.12, 299.10, 278.78, 272.18, 256.23, 215.02, 211.54.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 368.31 Down Trend,

- (Intermediate-Term) 10 Week: 330.77 Up Trend,

- (Long-Term) 20 Week: 299.30 Up Trend,

- (Long-Term) 55 Week: 256.23 Up Trend,

- (Long-Term) 100 Week: 215.02 Up Trend,

- (Long-Term) 200 Week: 211.54 Up Trend.

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

GLD has experienced a sharp rally to new highs, followed by a significant pullback as indicated by the large, fast-momentum bars and a current short-term downtrend in swing pivots. Despite this short-term weakness, the intermediate and long-term trends remain bullish, supported by rising 10, 20, 55, 100, and 200 week moving averages. The most recent swing low at 330.12 is a key support, with resistance at the recent high of 397.28. The price is currently consolidating above major long-term support levels, suggesting a corrective phase within a broader uptrend. This setup is typical of a market that has seen a strong breakout, followed by profit-taking and a test of support, with the potential for trend continuation if support holds. The overall structure reflects a healthy long-term uptrend with a short-term retracement, common in strong bull cycles.

Chart Analysis ATS AI Generated: 2025-11-10 07:12 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.