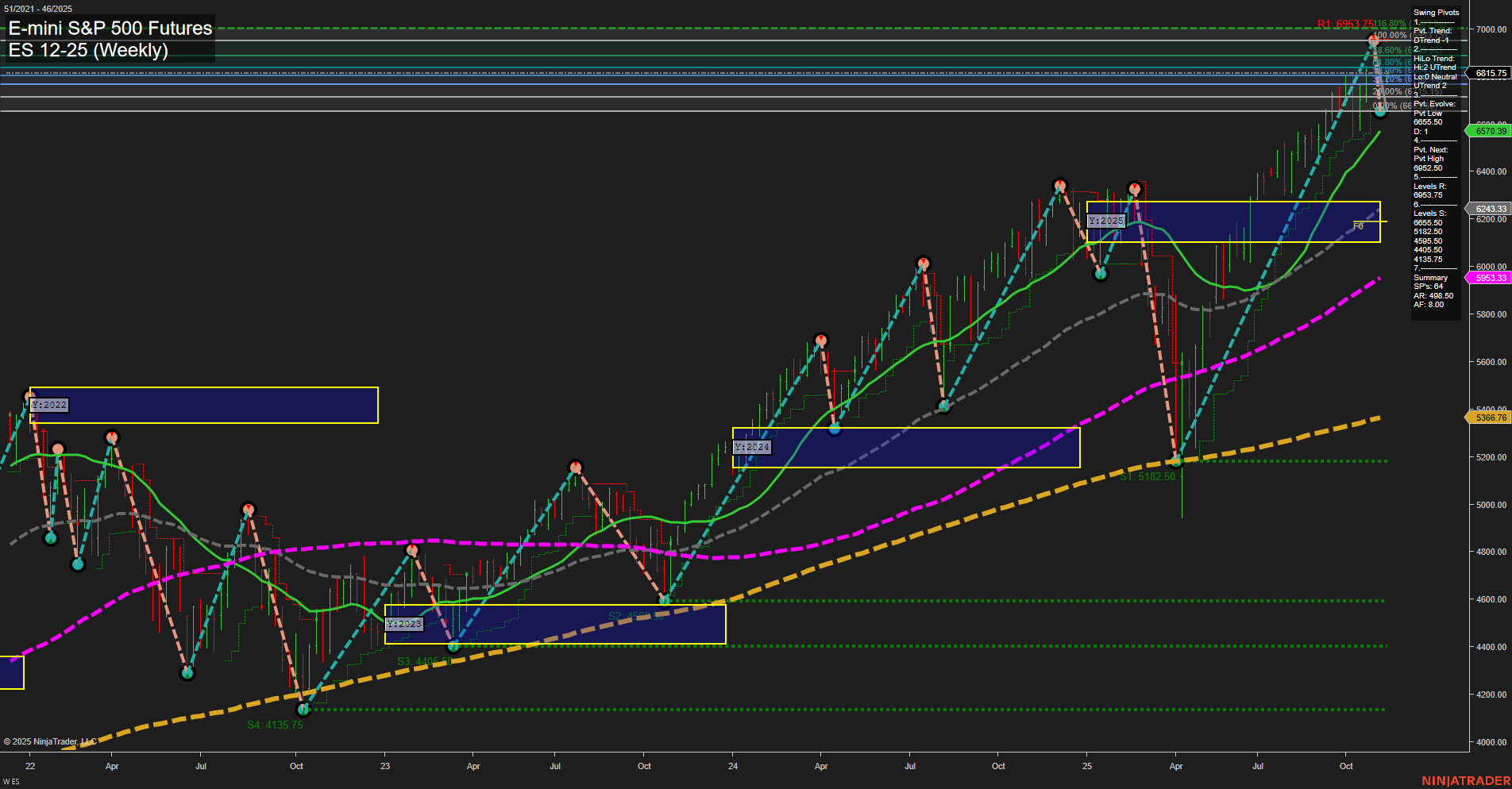

ES E-mini S&P 500 Futures Weekly Chart Analysis: 2025-Nov-10 07:08 CT

Price Action

- Last: 6815.75,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 27%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 38%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 72%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 6963.75,

- 4. Pvt. Next: Pvt low 6505.00,

- 5. Levels R: 6963.75, 6815.75, 6623.25,

- 6. Levels S: 6505.00, 6243.33, 5182.50, 4135.75.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 6570.39 Up Trend,

- (Intermediate-Term) 10 Week: 6095.33 Up Trend,

- (Long-Term) 20 Week: 5903.33 Up Trend,

- (Long-Term) 55 Week: 5366.76 Up Trend,

- (Long-Term) 100 Week: 5093.33 Up Trend,

- (Long-Term) 200 Week: 4980.46 Up Trend.

Recent Trade Signals

- 10 Nov 2025: Long ES 12-25 @ 6803.5 Signals.USAR-WSFG

- 10 Nov 2025: Long ES 12-25 @ 6796.5 Signals.USAR.TR120

- 07 Nov 2025: Short ES 12-25 @ 6663.25 Signals.USAR-MSFG

- 06 Nov 2025: Short ES 12-25 @ 6738.75 Signals.USAR.TR720

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The ES E-mini S&P 500 Futures weekly chart shows a strong bullish structure across all timeframes. Price action is robust, with large bars and fast momentum, indicating aggressive buying and a potential breakout environment. All major session Fib grid trends (weekly, monthly, yearly) are up, with price holding above their respective NTZ/F0% levels, confirming sustained upward pressure. Swing pivots highlight a recent pivot high at 6963.75, with the next significant support at 6505.00, suggesting the market is in a higher-high, higher-low sequence. All benchmark moving averages from short to long-term are trending upward, reinforcing the prevailing uptrend. Recent trade signals are mixed but skewed bullish, with the latest entries on the long side. The market is in a strong uptrend, with momentum and breadth supporting further upside, though the presence of large bars may also signal increased volatility and potential for sharp pullbacks or profit-taking phases. Overall, the technical landscape favors trend continuation, with key support levels well below current price, and resistance defined by recent highs.

Chart Analysis ATS AI Generated: 2025-11-10 07:08 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.