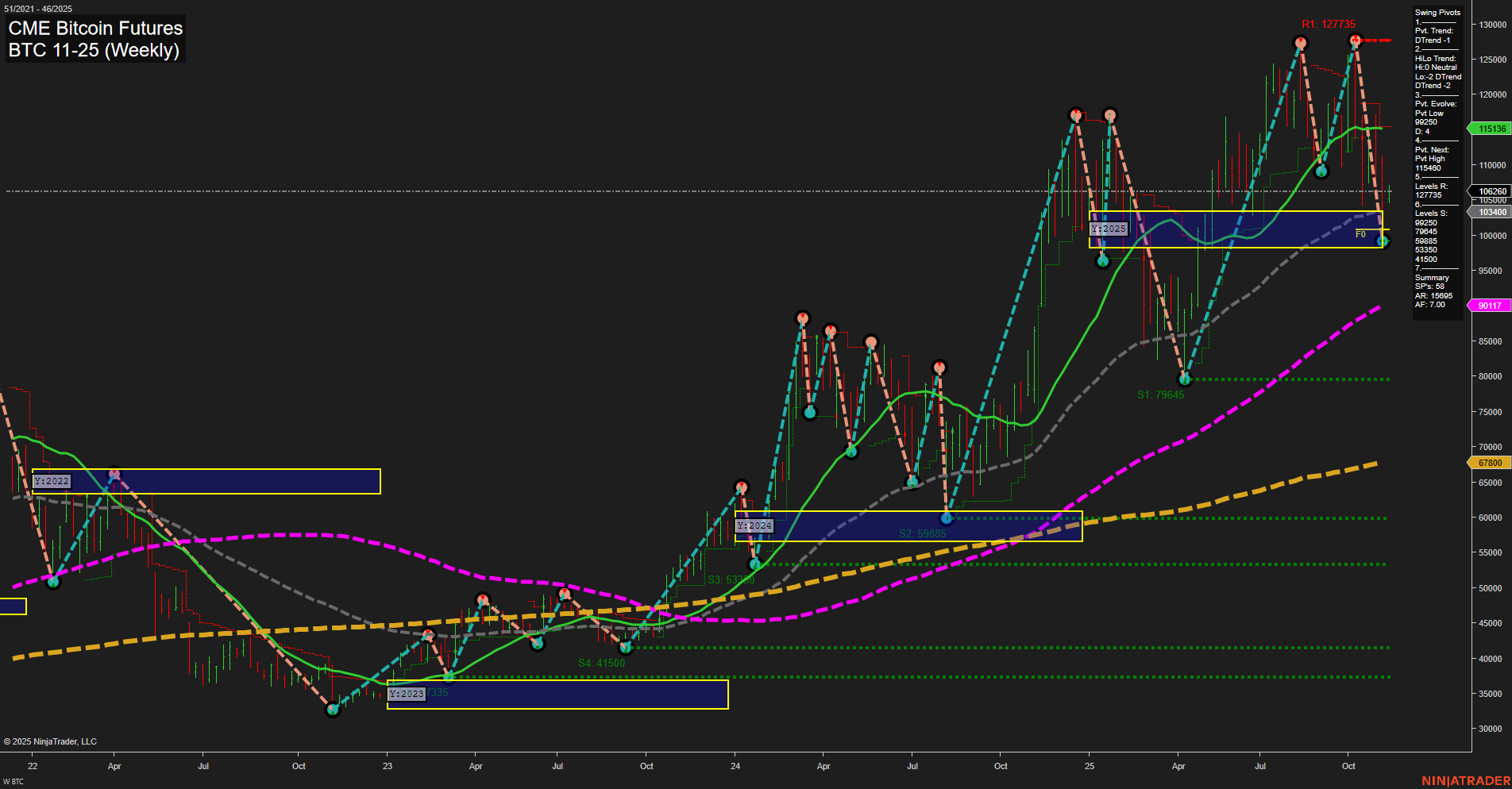

The BTC CME Bitcoin Futures weekly chart shows a market in transition. Price action is volatile with large bars and fast momentum, indicating heightened activity and possible trend inflection. Short-term (WSFG) and long-term (YSFG) session fib grid trends are both up, with price holding above their respective NTZ/F0% levels, suggesting underlying bullish structure. However, the intermediate-term (MSFG) is in a downtrend, with price below the monthly NTZ/F0% and negative MSFG reading, reflecting a recent corrective phase or pullback. Swing pivots confirm this mixed environment: both short-term and intermediate-term pivot trends are down, with the most recent pivot low at 95045 and next resistance at 115136. Multiple resistance levels cluster above, while support is layered below, indicating a broad trading range and potential for choppy price action. Benchmark moving averages show a split: short/intermediate-term MAs (5 and 10 week) are trending down, while all long-term MAs (20, 55, 100, 200 week) remain in strong uptrends, reinforcing the idea of a corrective move within a larger bullish cycle. The recent long trade signal aligns with the short-term WSFG uptrend, but faces overhead resistance and a still-bearish intermediate-term backdrop. Overall, the market is consolidating after a strong rally, with the potential for further volatility as it tests key support and resistance levels. The long-term trend remains bullish, but the intermediate-term correction is not yet resolved, and short-term direction is neutral as the market seeks a new equilibrium.