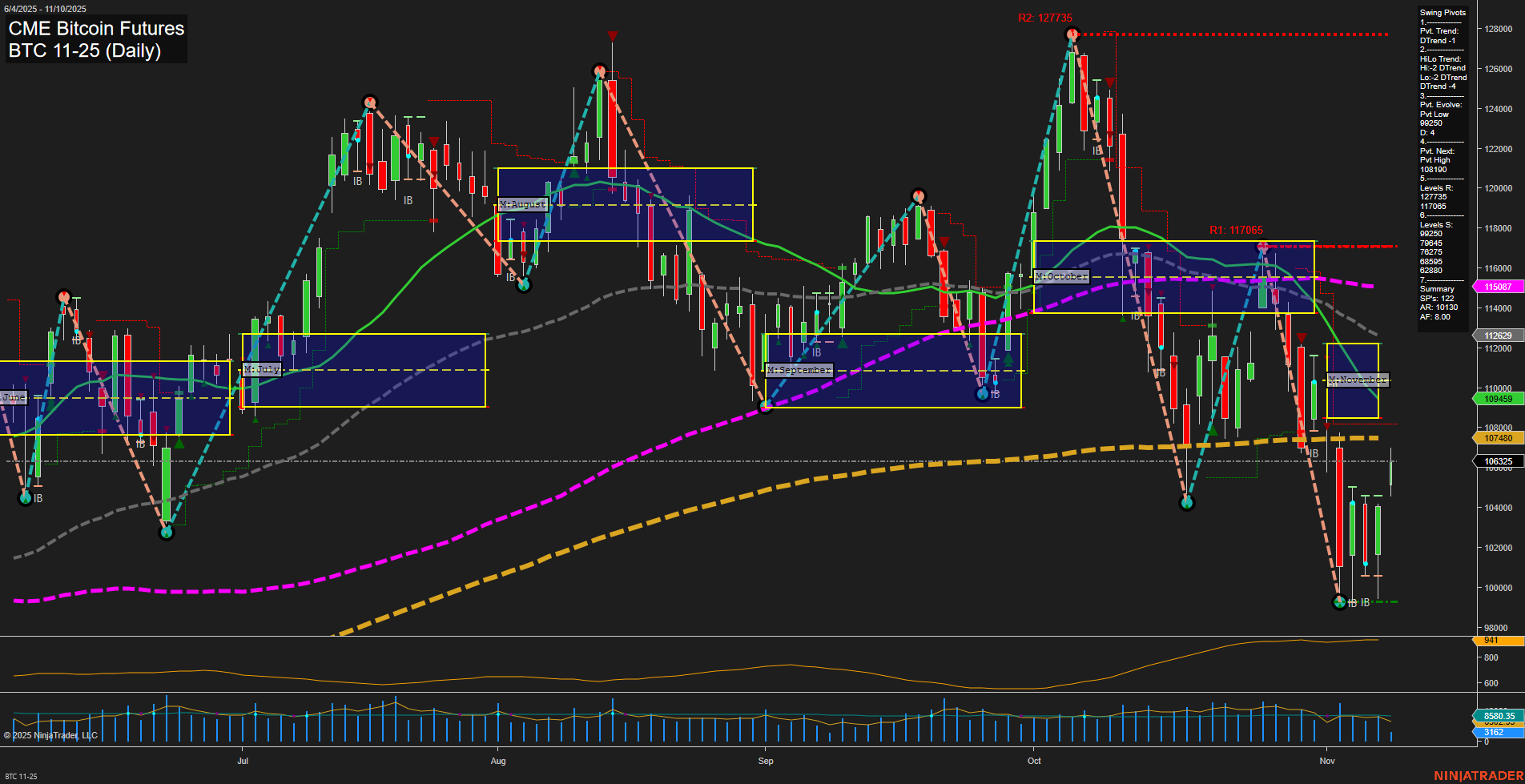

The current BTC CME futures chart shows a market in transition. Price action is volatile with large bars and fast momentum, indicating heightened activity and possible short-term exhaustion after a sharp move down. The short-term WSFG trend is up, but the monthly MSFG trend is decisively down, reflecting a strong intermediate-term bearish bias as price remains below the monthly NTZ. The swing pivot structure confirms this, with both short-term and intermediate-term trends in a downtrend, and the most recent pivot low at 105325 acting as a key support. Resistance levels are stacked above, with significant hurdles at 109545 and 115087. All benchmark moving averages are trending down, reinforcing the intermediate-term bearish environment, though the yearly SFG trend remains up, suggesting the broader bull cycle is intact. The recent long signal at 106585 may reflect a potential short-term bounce or mean reversion attempt, but the overall structure points to a market in a corrective phase within a larger uptrend. Volatility remains elevated (ATR 1025), and volume is robust, supporting the view of active participation and possible further swings. The market is likely to remain choppy with potential for sharp countertrend rallies, but sustained upside will require reclaiming key resistance and a shift in the intermediate-term trend.