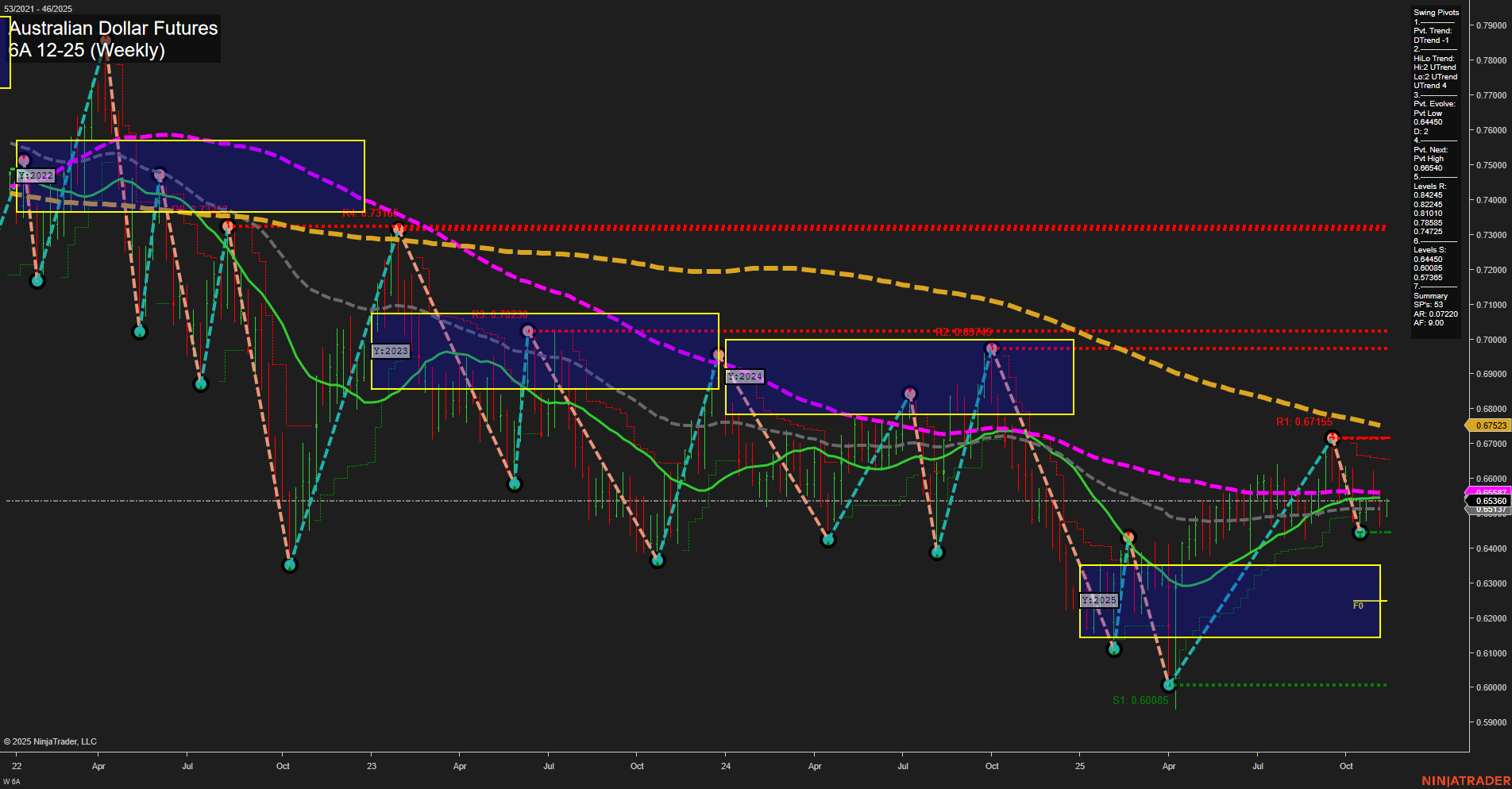

The Australian Dollar Futures (6A) weekly chart shows a market in consolidation after a significant recovery from the 0.60085 swing low. Price action is currently neutral, with medium-sized bars and slow momentum, indicating a lack of strong directional conviction. The short-term swing pivot trend has turned down, but the intermediate-term HiLo trend remains up, reflecting a market caught between a recent pullback and a broader recovery attempt. All major session fib grid trends (weekly, monthly, yearly) are neutral, with price hovering near the center of the NTZ (neutral zone) and no clear bias. The moving averages paint a mixed picture: short and intermediate-term benchmarks are in a mild downtrend, while the 20-week MA is up, but all longer-term averages (55, 100, 200 week) remain in a pronounced downtrend, capping rallies and reinforcing a bearish long-term structure. Resistance is layered above at 0.64865 through 0.67155, with major support at the 0.60085 swing low. Recent trade signals have triggered long entries, suggesting some short-term bullish attempts, but the overall environment remains choppy and range-bound, with no decisive breakout. The market is in a transition phase, with swing traders watching for either a sustained move above resistance to confirm a trend reversal, or a failure and retest of support to resume the broader downtrend.