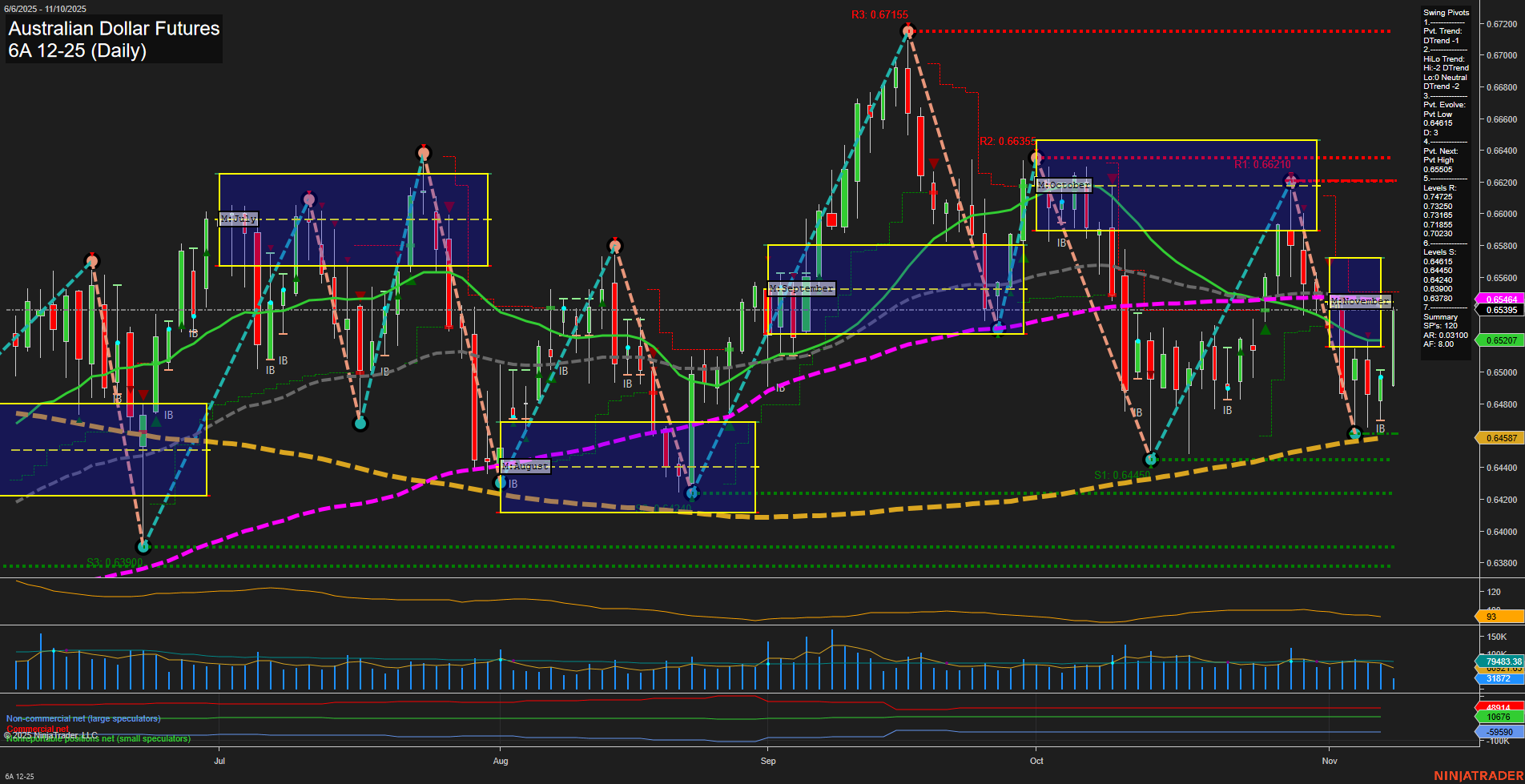

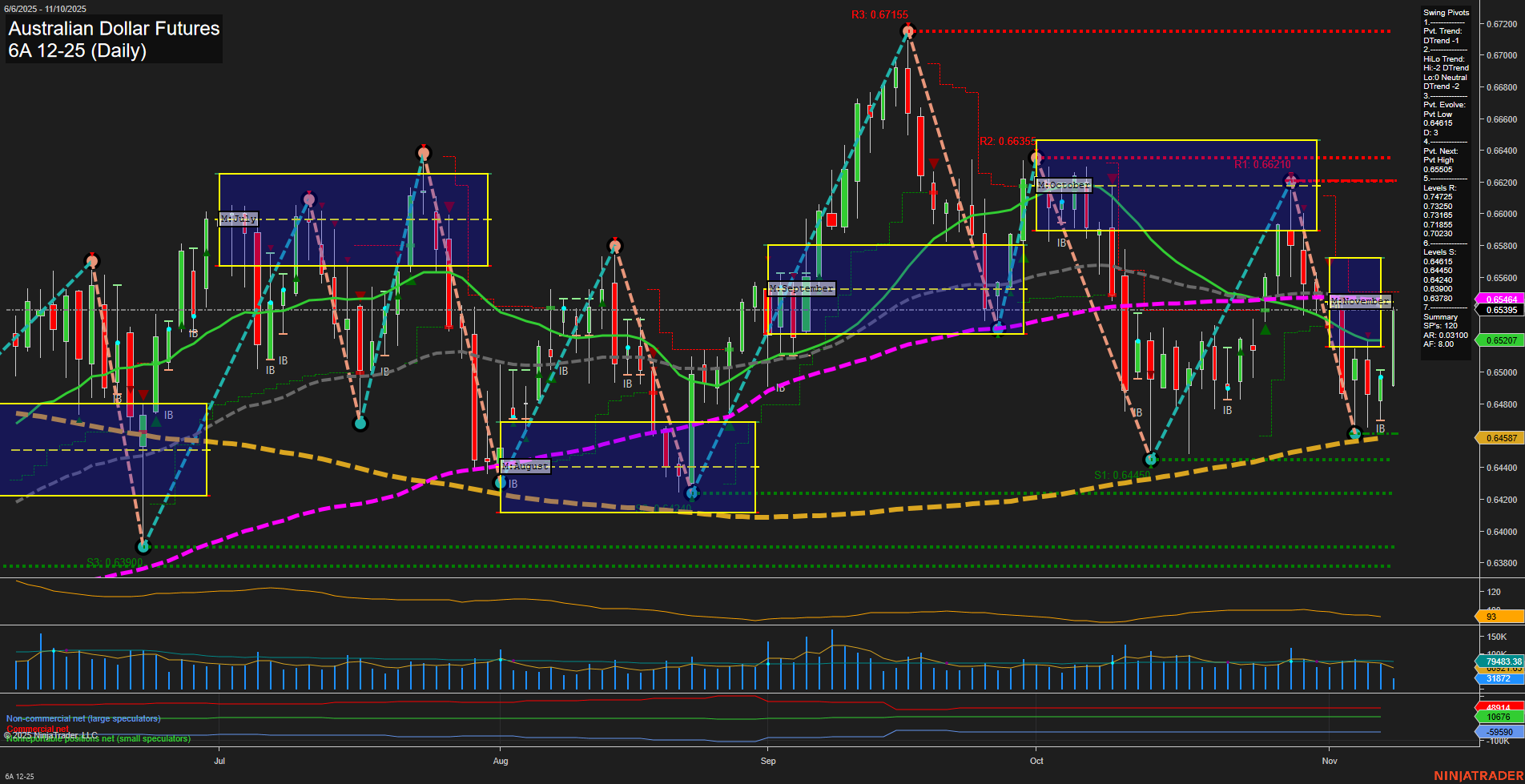

6A Australian Dollar Futures Daily Chart Analysis: 2025-Nov-10 07:00 CT

Price Action

- Last: 0.65207,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt Low 0.64915,

- 4. Pvt. Next: Pvt High 0.66125,

- 5. Levels R: 0.66125, 0.66270, 0.66355, 0.67155,

- 6. Levels S: 0.64915, 0.64450, 0.64300.

Daily Benchmarks

- (Short-Term) 5 Day: 0.65273 Down Trend,

- (Short-Term) 10 Day: 0.65395 Down Trend,

- (Intermediate-Term) 20 Day: 0.65394 Down Trend,

- (Intermediate-Term) 55 Day: 0.65484 Down Trend,

- (Long-Term) 100 Day: 0.65395 Down Trend,

- (Long-Term) 200 Day: 0.64587 Up Trend.

Additional Metrics

Recent Trade Signals

- 10 Nov 2025: Long 6A 12-25 @ 0.65215 Signals.USAR.TR120

- 10 Nov 2025: Long 6A 12-25 @ 0.65095 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

The 6A Australian Dollar Futures daily chart shows a market in a corrective phase, with both short-term and intermediate-term trends pointing down as confirmed by the swing pivot structure and all key moving averages (except the 200-day) trending lower. Price action is consolidating near recent swing lows, with momentum remaining slow and bars of medium size, indicating a lack of strong directional conviction. The market is currently trading just above a key support pivot at 0.64915, with resistance levels clustered above in the 0.66125–0.66355 range. The 200-day moving average remains upward, suggesting that the longer-term structure is still neutral, but the prevailing pressure is to the downside. Recent trade signals have triggered long entries, hinting at a possible short-term bounce or mean reversion attempt, but the overall technical backdrop remains cautious with no clear breakout or reversal pattern yet established. Volatility is moderate, and volume is steady, reflecting a market in a wait-and-see mode, potentially awaiting a catalyst for a decisive move.

Chart Analysis ATS AI Generated: 2025-11-10 07:00 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.