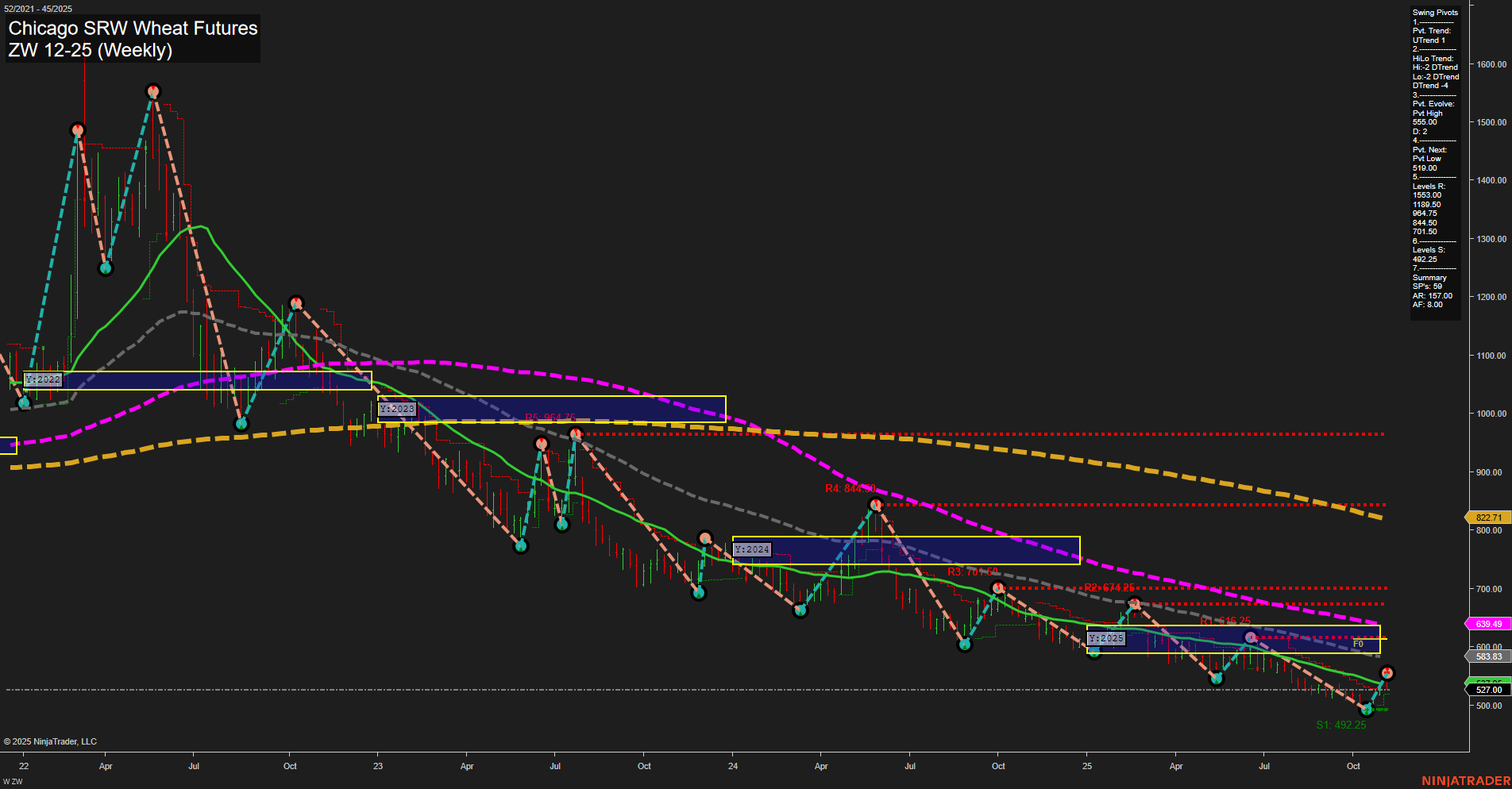

The ZW Chicago SRW Wheat Futures weekly chart shows a persistent downtrend across all timeframes. Price action remains weak, with the last close at 527.00 and slow momentum, as indicated by medium-sized bars and a series of lower highs and lower lows. The Weekly Session Fib Grid (WSFG) and Yearly Session Fib Grid (YSFG) both show price below their respective NTZ/F0% levels, confirming a dominant bearish bias. The Monthly Session Fib Grid (MSFG) is the only outlier, showing an intermediate-term uptrend, but this appears to be a countertrend move within a broader downtrend. Swing pivot analysis highlights a prevailing downtrend in both short- and intermediate-term trends, with the next key support at 492.25 and multiple resistance levels overhead, the nearest being 605.00. All benchmark moving averages (5, 10, 20, 55 week) are trending down, reinforcing the overall bearish structure. The market is in a prolonged corrective phase, with no clear signs of reversal, and any rallies have been met with selling pressure at resistance levels. The technical landscape suggests continued weakness, with the potential for further tests of support unless a significant change in momentum or structure occurs.