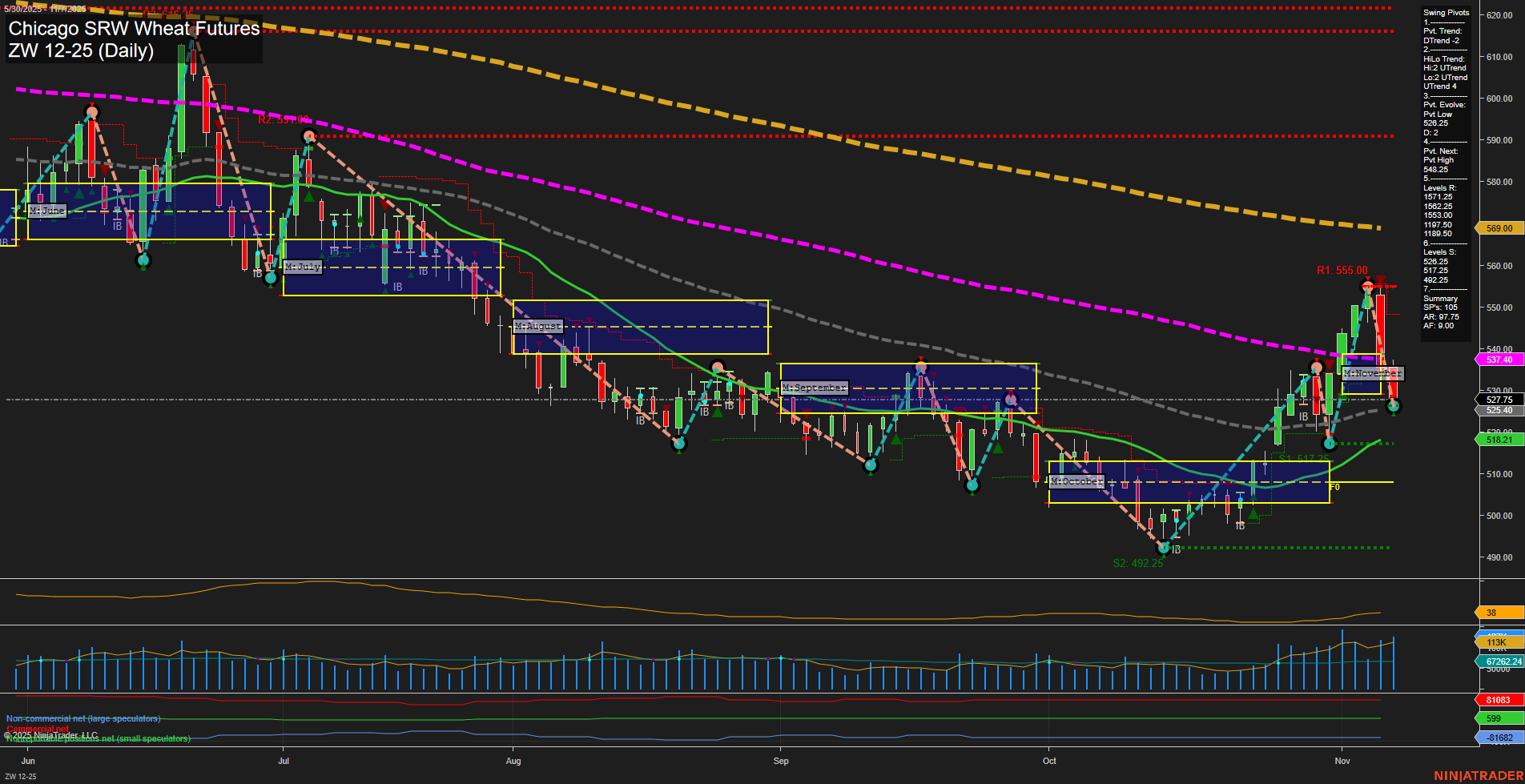

The ZW Chicago SRW Wheat Futures daily chart shows a recent surge in price momentum, with large bars and fast movement, indicating heightened volatility. Short-term price action has shifted to a downtrend following a sharp rally, as seen in the latest swing pivot reversal from a high at 555.00 to a new pivot low at 502.25. Despite this, the intermediate-term trend remains up, supported by the MSFG and all short/intermediate moving averages (5, 10, 20, 55-day) trending higher. However, the long-term outlook is still bearish, with both the 100-day and 200-day moving averages sloping downward and price trading below the yearly session fib grid. Resistance is clustered near recent highs (555.00–548.25), while support is established at 527.25, 525.25, and further down at 502.25 and 492.25. The ATR and volume metrics confirm increased activity, suggesting a possible transition phase. Overall, the market is in a consolidation or pullback phase after a strong rally, with mixed signals across timeframes: short-term neutral, intermediate-term bullish, and long-term bearish. This reflects a market at a technical crossroads, with traders watching for confirmation of either a sustained reversal or a resumption of the prior downtrend.