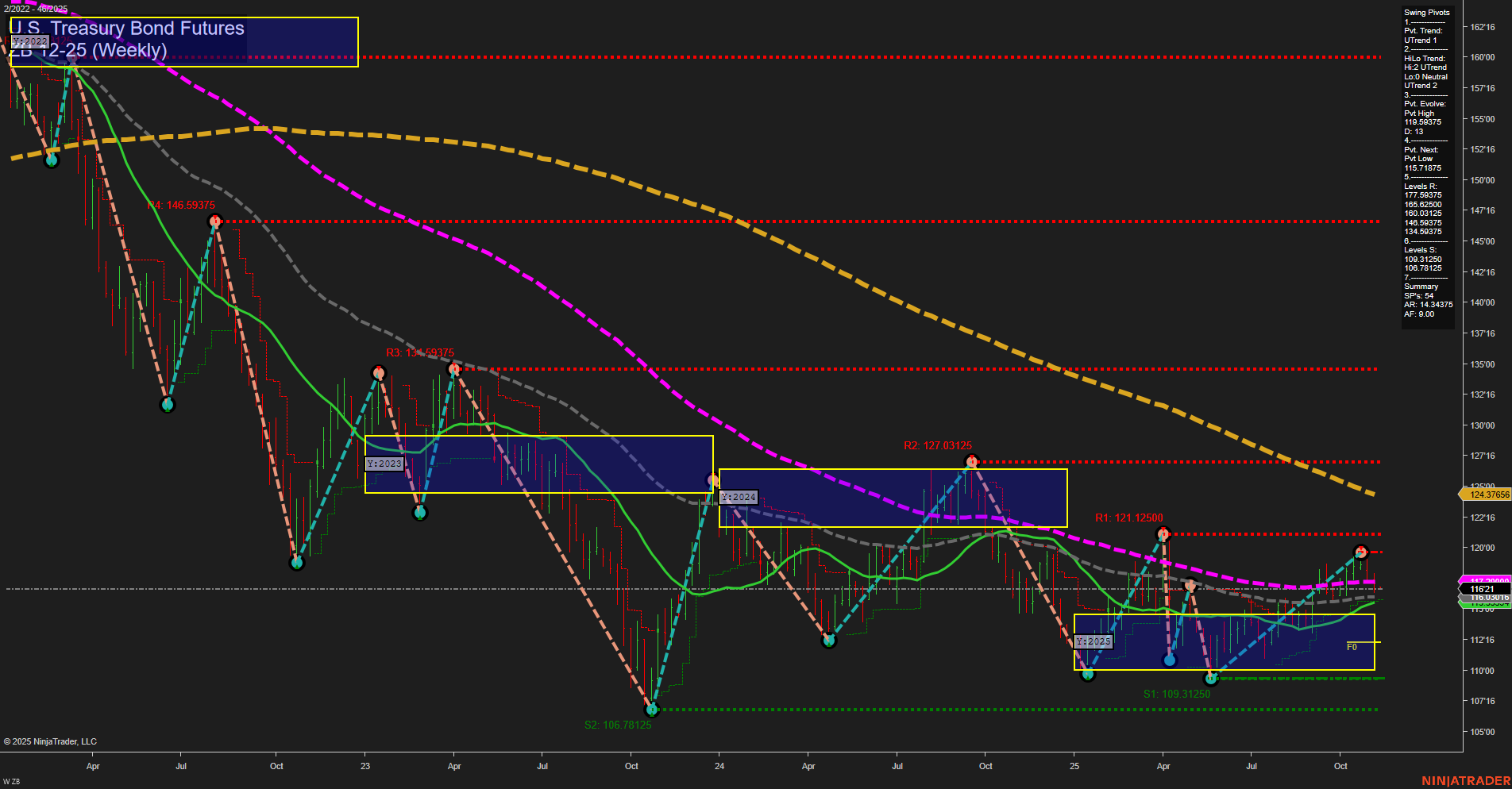

The ZB U.S. Treasury Bond Futures weekly chart shows a market in transition. Price action has shifted to an average momentum phase, with medium-sized bars reflecting a balanced tug-of-war between buyers and sellers. The short- and intermediate-term swing pivot trends are both up, supported by a cluster of moving averages (5, 10, and 20 week) all trending higher, indicating recent bullishness. However, the long-term picture remains bearish, as the 55, 100, and 200 week moving averages are still in downtrends, and price remains well below these benchmarks. The chart is currently trading within a broad neutral zone (NTZ) as defined by the yearly session fib grid, with no clear directional bias from the fib grids across all timeframes. Resistance levels are stacked above at 121.125, 127.031, and 134.593, while support is found at 109.312 and 106.781. The most recent swing high and low pivots suggest the market is testing the upper end of its recent range, but has not yet broken out of the longer-term consolidation. Overall, the market is showing signs of a potential recovery or counter-trend rally in the short- to intermediate-term, but the dominant long-term trend remains down. This reflects a classic swing trading environment where rallies may be met with resistance at higher levels, and the market could remain choppy until a decisive breakout or breakdown occurs. The technicals suggest a cautious optimism for bulls in the near term, but the broader bearish structure should not be ignored.