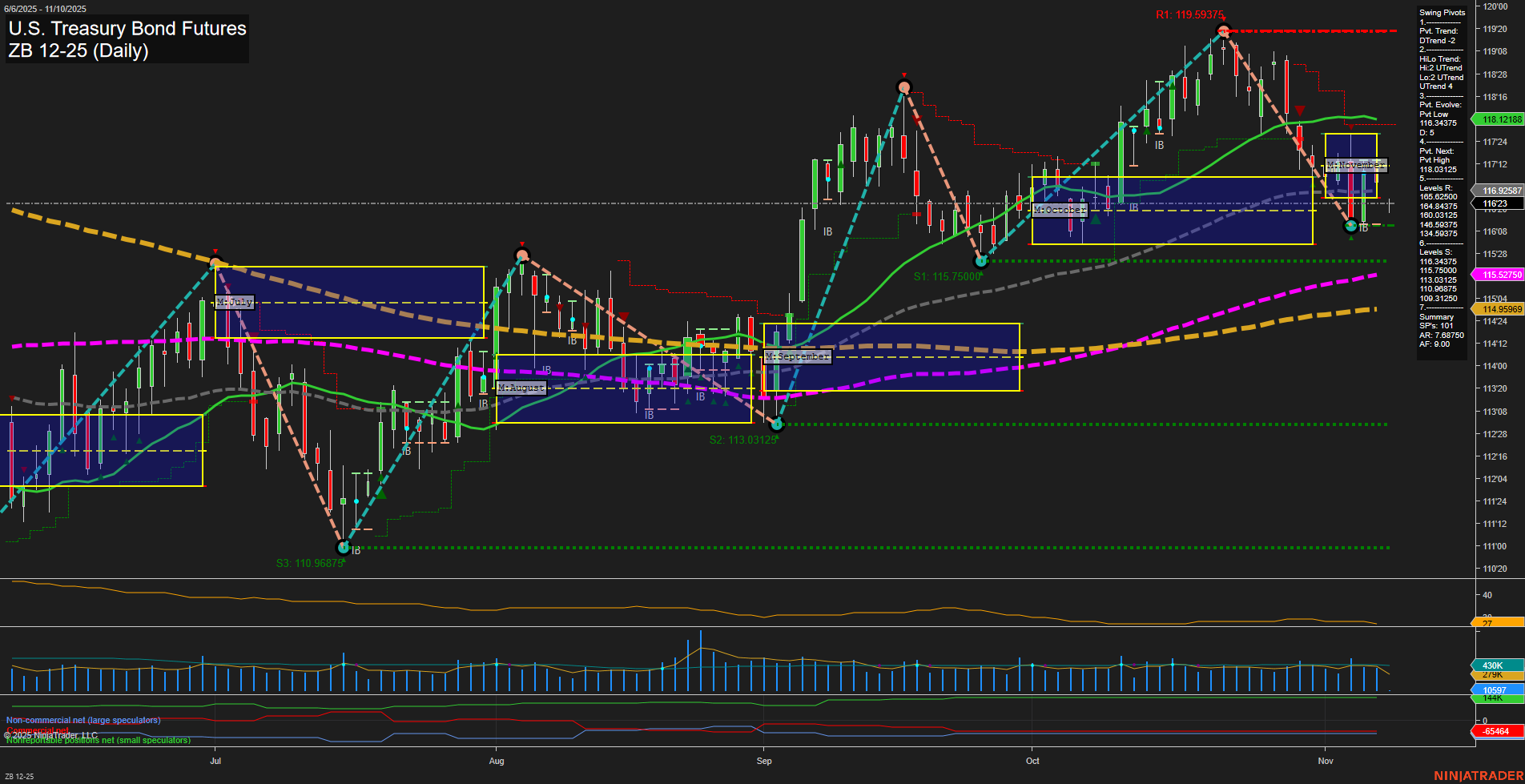

The ZB U.S. Treasury Bond Futures daily chart currently reflects a market in transition. Price action shows a recent swing low at 116'18, with medium-sized bars and slow momentum, indicating a lack of strong directional conviction. The short-term trend is bearish, as confirmed by the downward direction of the 5, 10, 20, and 55-day moving averages, and the most recent swing pivot is a low. However, intermediate and long-term trends remain neutral, with the 100 and 200-day moving averages still in uptrends, suggesting underlying support at lower levels. Swing pivot analysis highlights a short-term downtrend but an intermediate-term uptrend, with resistance levels at 119'59 and 118'12, and support at 115'75 and 113'03. The market is consolidating within the monthly and weekly session fib grids, with no clear bias, and volatility remains moderate as indicated by the ATR and volume metrics. Overall, the chart suggests a market in a corrective phase after a prior rally, with potential for further downside in the short term but underlying support and possible stabilization in the intermediate to long term. The current environment is characterized by consolidation and indecision, with traders watching for a break of key support or resistance levels to signal the next directional move.