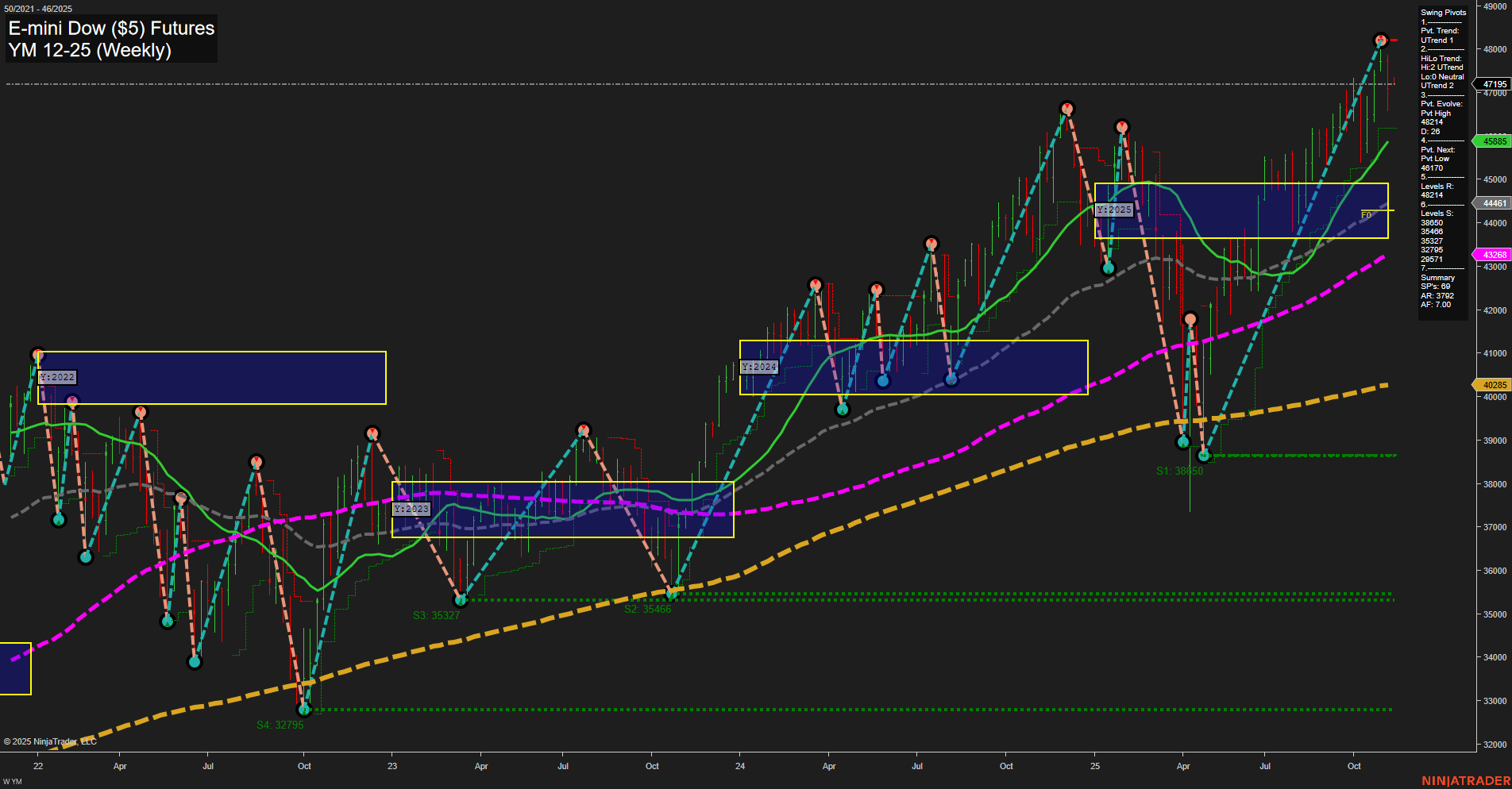

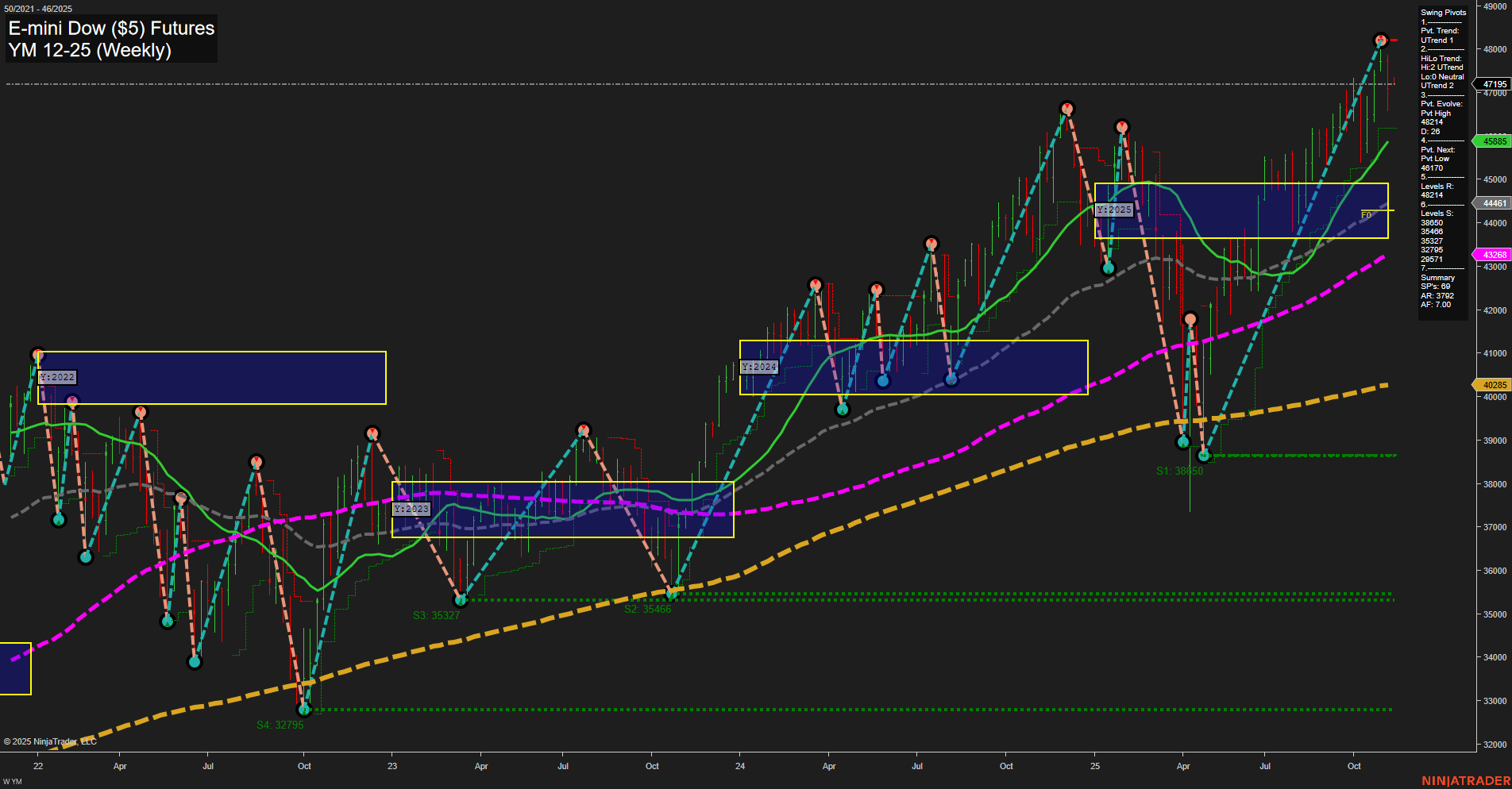

YM E-mini Dow ($5) Futures Weekly Chart Analysis: 2025-Nov-09 18:16 CT

Price Action

- Last: 45885,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 6%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 40%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 46%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 47195,

- 4. Pvt. Next: Pvt low 44110,

- 5. Levels R: 47195, 46241,

- 6. Levels S: 44110, 43267, 39367, 35327, 32795.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 45885 Up Trend,

- (Intermediate-Term) 10 Week: 44461 Up Trend,

- (Long-Term) 20 Week: 43268 Up Trend,

- (Long-Term) 55 Week: 40285 Up Trend,

- (Long-Term) 100 Week: 43268 Up Trend,

- (Long-Term) 200 Week: 40285 Up Trend.

Recent Trade Signals

- 06 Nov 2025: Short YM 12-25 @ 46898 Signals.USAR.TR720

- 03 Nov 2025: Short YM 12-25 @ 47522 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The YM E-mini Dow futures weekly chart shows a market that has been in a sustained uptrend across all major timeframes, with price action currently above all key moving averages and session fib grid levels. The most recent swing pivot is a high at 47195, with the next significant support at 44110, indicating a potential retracement zone if the current pullback deepens. Despite the recent short trade signals, the intermediate and long-term trends remain bullish, supported by rising moving averages and higher swing lows. The short-term outlook is neutral as price consolidates below recent highs, reflecting a pause or minor correction within the broader uptrend. The market has shown resilience with higher lows and strong support levels, suggesting that any pullbacks may be met with buying interest unless key support levels are breached. Overall, the technical structure favors the bulls on a swing trading horizon, but short-term volatility and corrective moves are present as the market digests recent gains.

Chart Analysis ATS AI Generated: 2025-11-09 18:16 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.