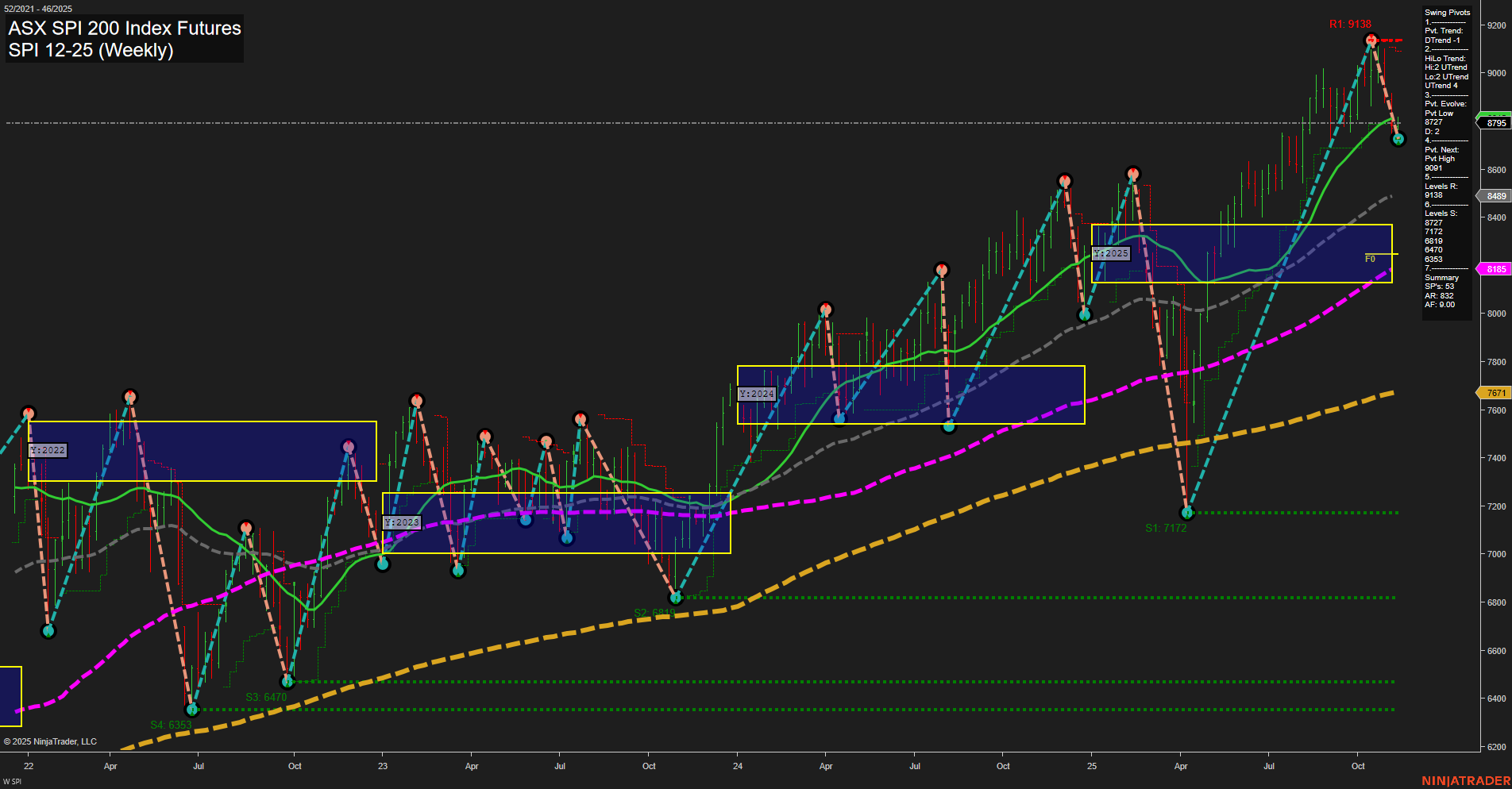

The SPI 200 Index Futures weekly chart shows a recent sharp pullback from the swing high at 9138, with price currently at 8795 and large, fast-moving bars indicating heightened volatility. The short-term swing pivot trend has shifted to down (DTrend), confirmed by both the 5- and 10-week moving averages turning down, suggesting a short-term correction or retracement phase. However, the intermediate-term HiLo trend remains up (UTrend), and the longer-term 55-, 100-, and 200-week moving averages are all in uptrends, reflecting underlying bullish momentum. Key support levels to watch are 8727 (current swing low), 8185, and 7671, while resistance is at the recent high of 9138. The neutral bias across the session fib grids (WSFG, MSFG, YSFG) suggests the market is consolidating after a strong rally, possibly digesting gains. The overall structure points to a short-term bearish correction within a broader bullish trend, with the potential for further downside testing of support before any resumption of the uptrend. This phase may reflect profit-taking, macro news digestion, or seasonal volatility, but the long-term trend remains intact unless key support levels are broken.