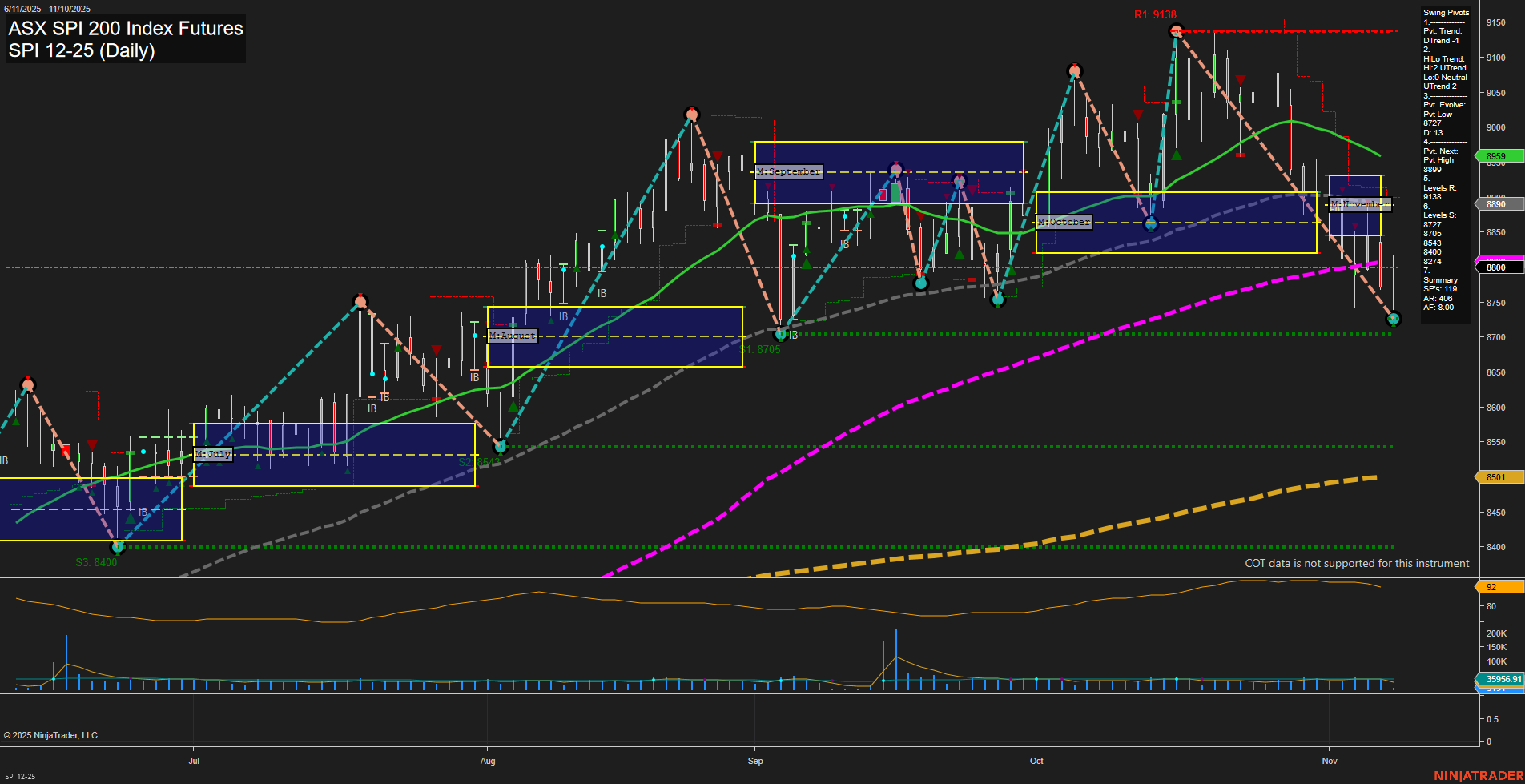

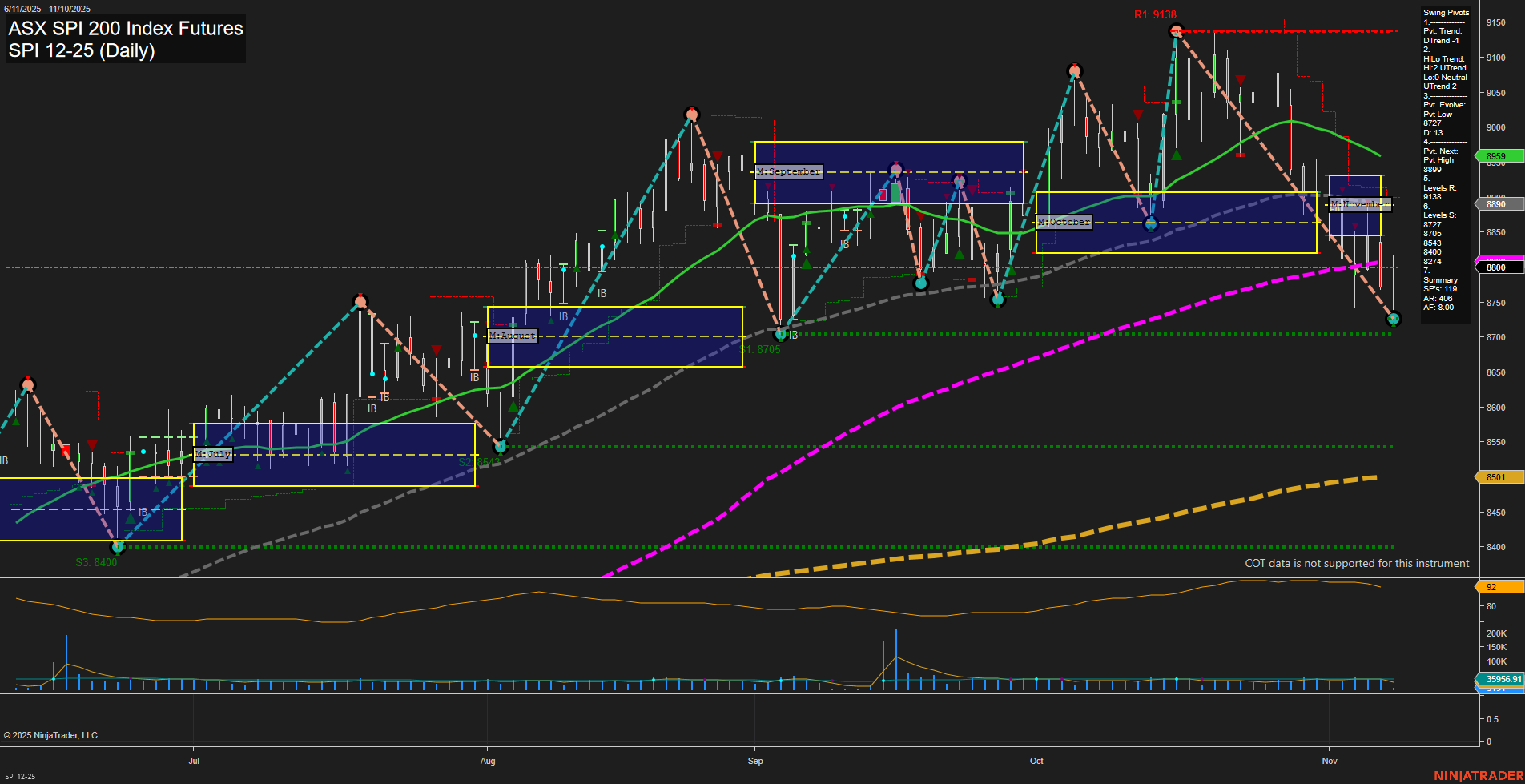

SPI ASX SPI 200 Index Futures Daily Chart Analysis: 2025-Nov-09 18:13 CT

Price Action

- Last: 8200,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 8138,

- 4. Pvt. Next: Pvt high 8705,

- 5. Levels R: 9138, 8705, 8543, 8405,

- 6. Levels S: 8138.

Daily Benchmarks

- (Short-Term) 5 Day: 8297 Down Trend,

- (Short-Term) 10 Day: 8390 Down Trend,

- (Intermediate-Term) 20 Day: 8599 Down Trend,

- (Intermediate-Term) 55 Day: 8890 Down Trend,

- (Long-Term) 100 Day: 8959 Down Trend,

- (Long-Term) 200 Day: 8501 Up Trend.

Additional Metrics

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Neutral.

Key Insights Summary

The SPI 200 futures are currently experiencing a short-term downtrend, as indicated by the most recent swing pivot trend (DTrend) and the alignment of all short and intermediate-term moving averages in a downward trajectory. Price has recently set a new swing low at 8138, with the next potential reversal level at 8705, suggesting the market is in a corrective phase after a prior uptrend. Resistance levels are stacked above, with the most significant at 9138, while support is now defined at the recent low. The ATR remains moderate, and volume is steady, indicating no extreme volatility or panic. Both the weekly and monthly session fib grids are neutral, reflecting a lack of strong directional conviction in the broader context. The long-term trend remains neutral, with the 200-day MA still in an uptrend but price currently below it, hinting at a possible test of longer-term support. Overall, the market is consolidating after a sell-off, with short-term momentum favoring the bears, while intermediate and long-term participants may be waiting for clearer signals or a potential base to form.

Chart Analysis ATS AI Generated: 2025-11-09 18:13 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.