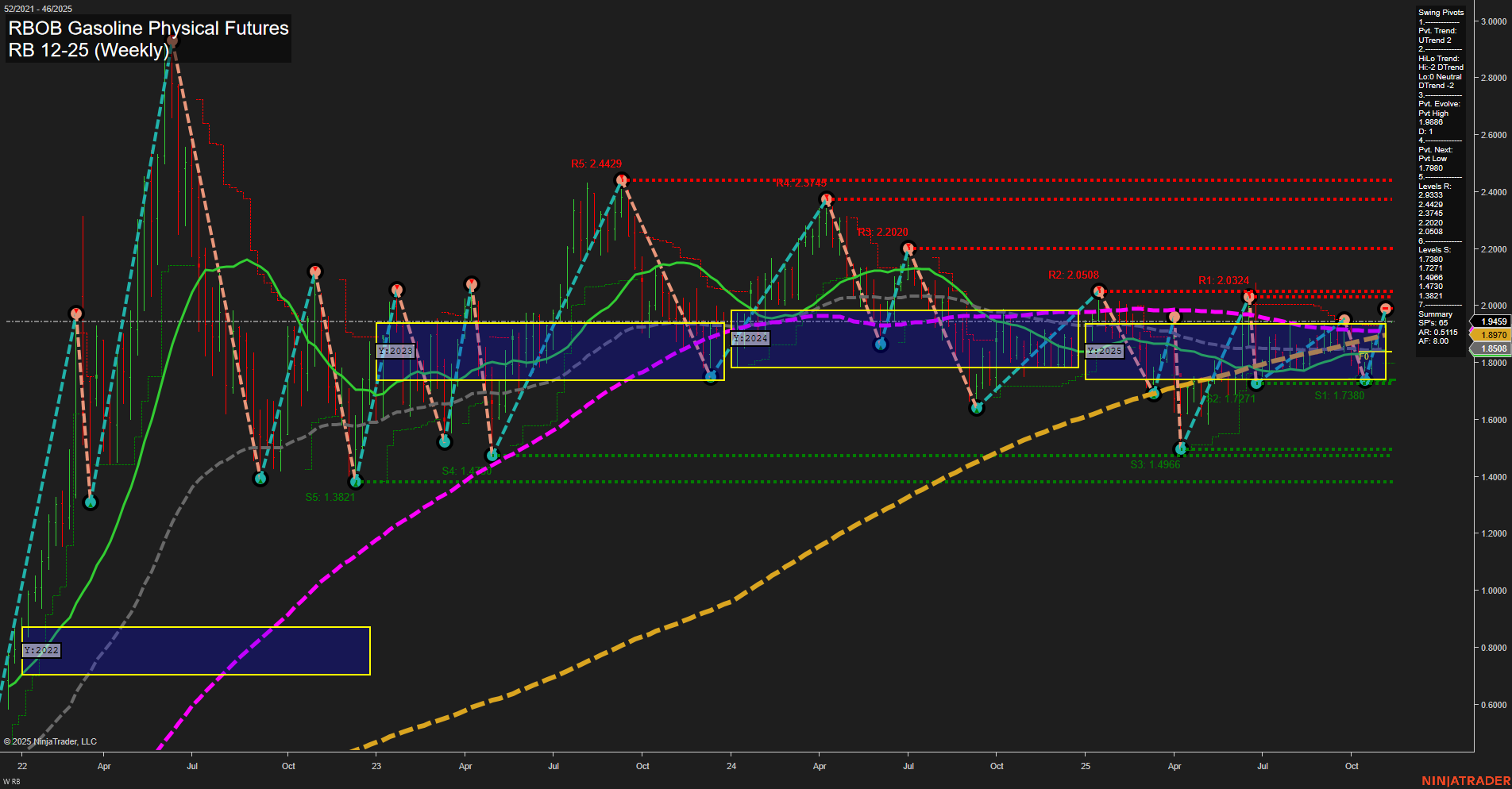

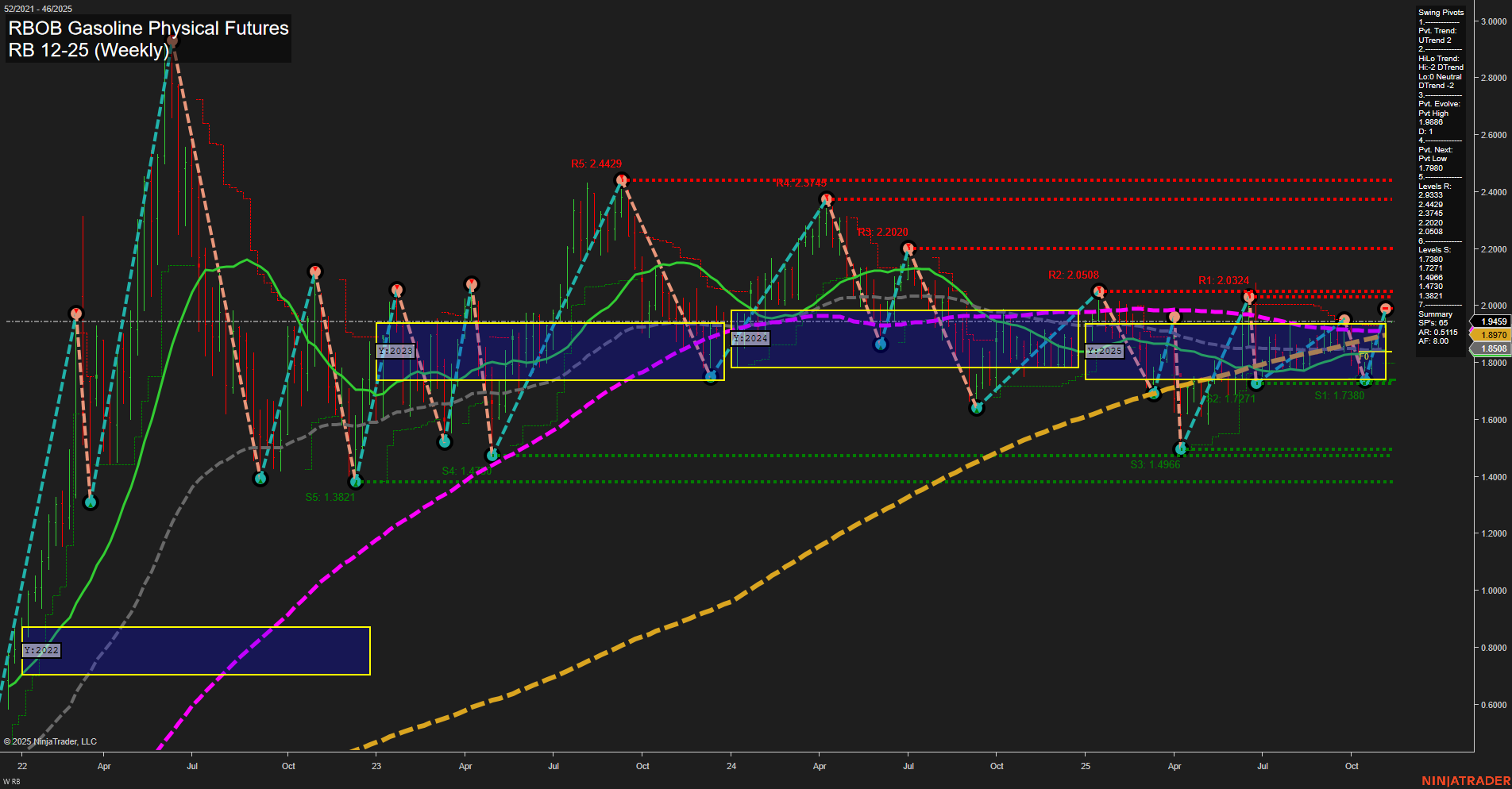

RB RBOB Gasoline Physical Futures Weekly Chart Analysis: 2025-Nov-09 18:11 CT

Price Action

- Last: 1.9459,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 4%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 62%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 11%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 1.9881,

- 4. Pvt. Next: Pvt low 1.8780,

- 5. Levels R: 2.4429, 2.3749, 2.2020, 2.0508, 2.0324,

- 6. Levels S: 1.7380, 1.4966, 1.3821.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.8970 Up Trend,

- (Intermediate-Term) 10 Week: 1.8879 Up Trend,

- (Long-Term) 20 Week: 1.8506 Up Trend,

- (Long-Term) 55 Week: 1.8797 Up Trend,

- (Long-Term) 100 Week: 1.7381 Up Trend,

- (Long-Term) 200 Week: 1.3821 Up Trend.

Recent Trade Signals

- 07 Nov 2025: Short RB 12-25 @ 1.9428 Signals.USAR.TR120

- 05 Nov 2025: Long RB 12-25 @ 1.9127 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The RBOB Gasoline futures market is showing a constructive technical structure with price currently above all major moving averages and the NTZ center line across weekly, monthly, and yearly session fib grids, indicating a persistent upward bias. Short-term momentum is average, with medium-sized bars suggesting moderate volatility. The short-term swing pivot trend is up, but the intermediate-term HiLo trend is down, reflecting some recent consolidation or corrective action within a broader uptrend. Resistance levels are clustered above 2.03, while support is well below at 1.73 and lower, highlighting a wide trading range. Recent trade signals show both long and short entries, suggesting active two-way trade and possible range-bound conditions in the near term. Overall, the long-term structure remains bullish, with all benchmarks trending higher, but the intermediate-term trend is less decisive, hinting at potential consolidation or a pause before the next directional move.

Chart Analysis ATS AI Generated: 2025-11-09 18:12 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.