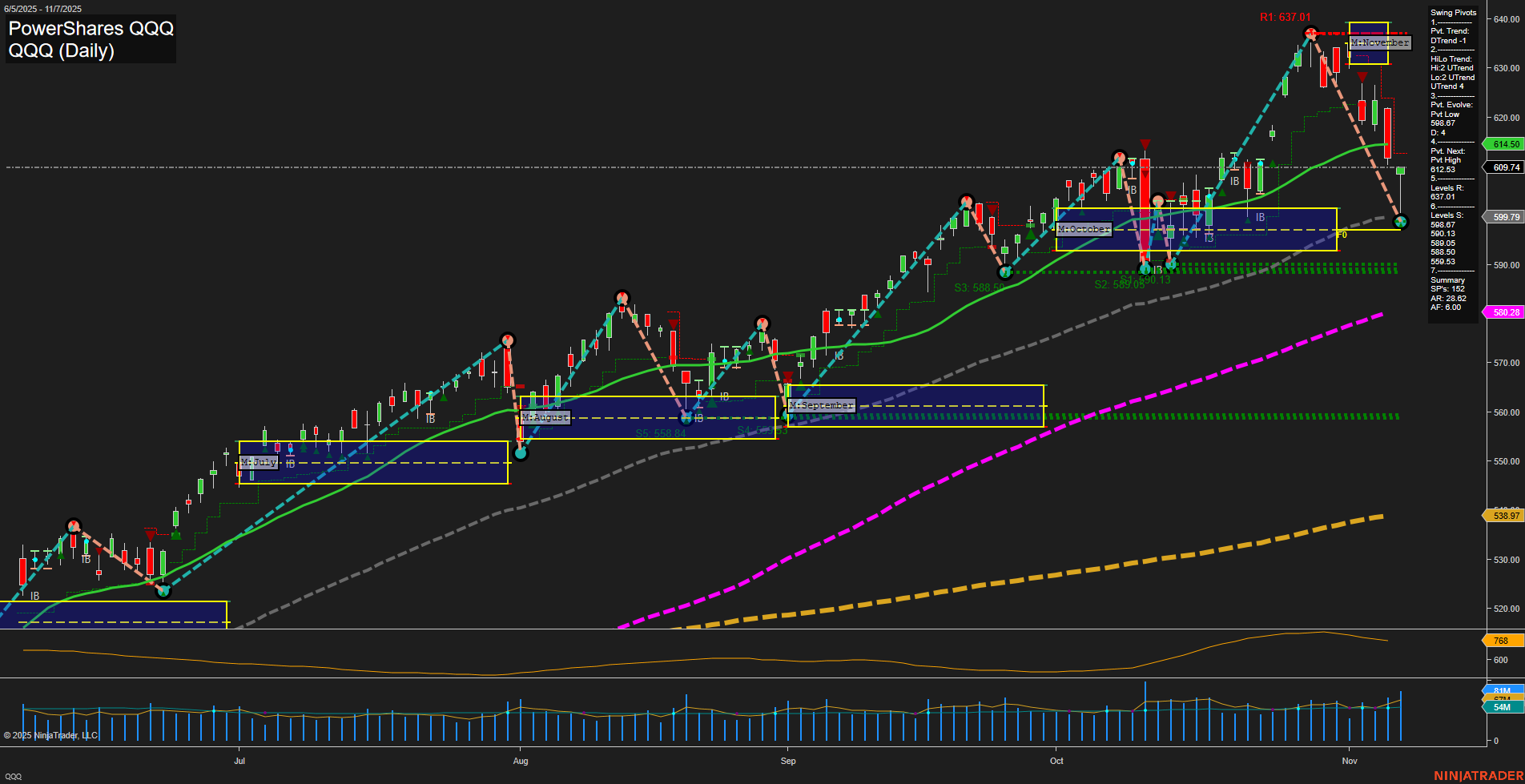

The QQQ daily chart shows a recent sharp pullback from the swing high at 637.01, with price currently at 614.50 and large, fast-moving bars indicating heightened volatility. The short-term trend has shifted to the downside (DTrend), confirmed by both the 5-day and 10-day moving averages turning down. However, the intermediate and long-term trends remain bullish, as the 20, 55, 100, and 200-day moving averages are all trending upward and well below current price, suggesting underlying strength in the broader trend. Swing pivot analysis highlights a recent pivot high at 637.01, with the next key support at 609.74, followed by deeper levels at 588.01 and 580.13. Resistance is clearly defined at the recent high. The ATR is elevated, reflecting increased volatility, and volume is robust, supporting the significance of the recent move. Overall, the chart reflects a classic swing trader’s environment: a strong uptrend experiencing a corrective phase. The short-term bias is bearish due to the recent breakdown, but the intermediate and long-term structure remains intact, with higher lows and strong support levels below. This setup often precedes either a deeper retracement or a potential resumption of the primary uptrend, depending on how price reacts at the next support levels. The market is currently in a corrective phase within a larger bullish context, with volatility and volume signaling active participation and potential for further swings.