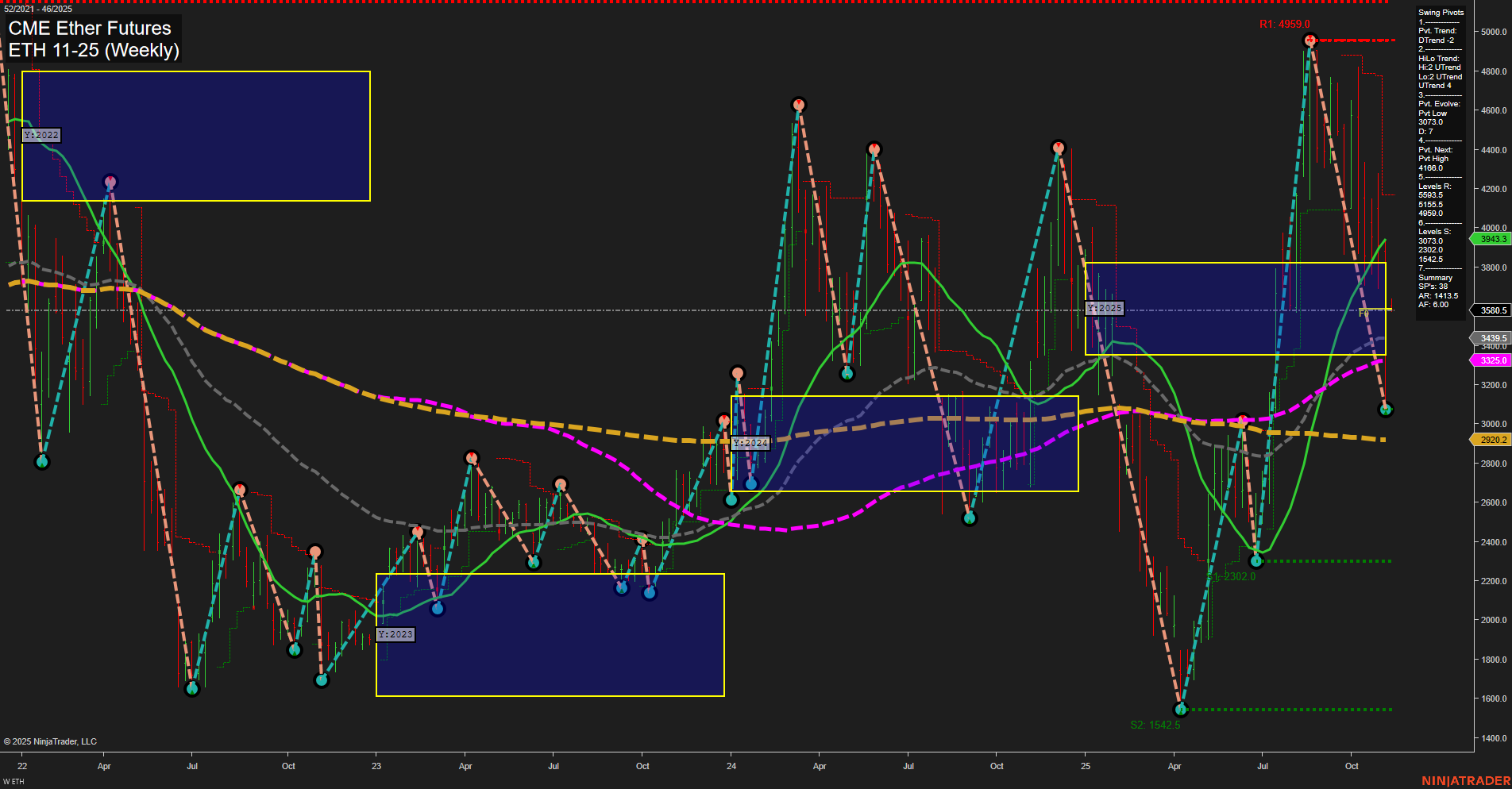

The current weekly chart for ETH CME Ether Futures shows a market in transition. Price action is characterized by large bars and fast momentum, indicating heightened volatility and strong participation. The short-term WSFG trend is up, with price holding above the NTZ center, but the swing pivot trend is down, suggesting a recent pullback or correction within a broader uptrend. Intermediate-term signals are mixed: the monthly session fib grid is trending down, but the HiLo swing trend is up, and all key moving averages (except the 200-week) are in uptrends, supporting a bullish bias. The long-term yearly fib grid is neutral, but the structure of higher lows and the recent strong bounce from support levels (notably 3073.0 and 2920.2) reinforce the underlying strength. Resistance is overhead at 3535.0, 4207.5, and the major swing high at 4959.0, while support is well-defined below. The recent long signal aligns with the prevailing intermediate and long-term bullish structure, though short-term consolidation or choppiness may persist as the market digests recent gains. Overall, the chart reflects a market that has recovered from a significant sell-off, is building a base, and is positioned for potential continuation higher, with volatility and possible retests of support along the way.