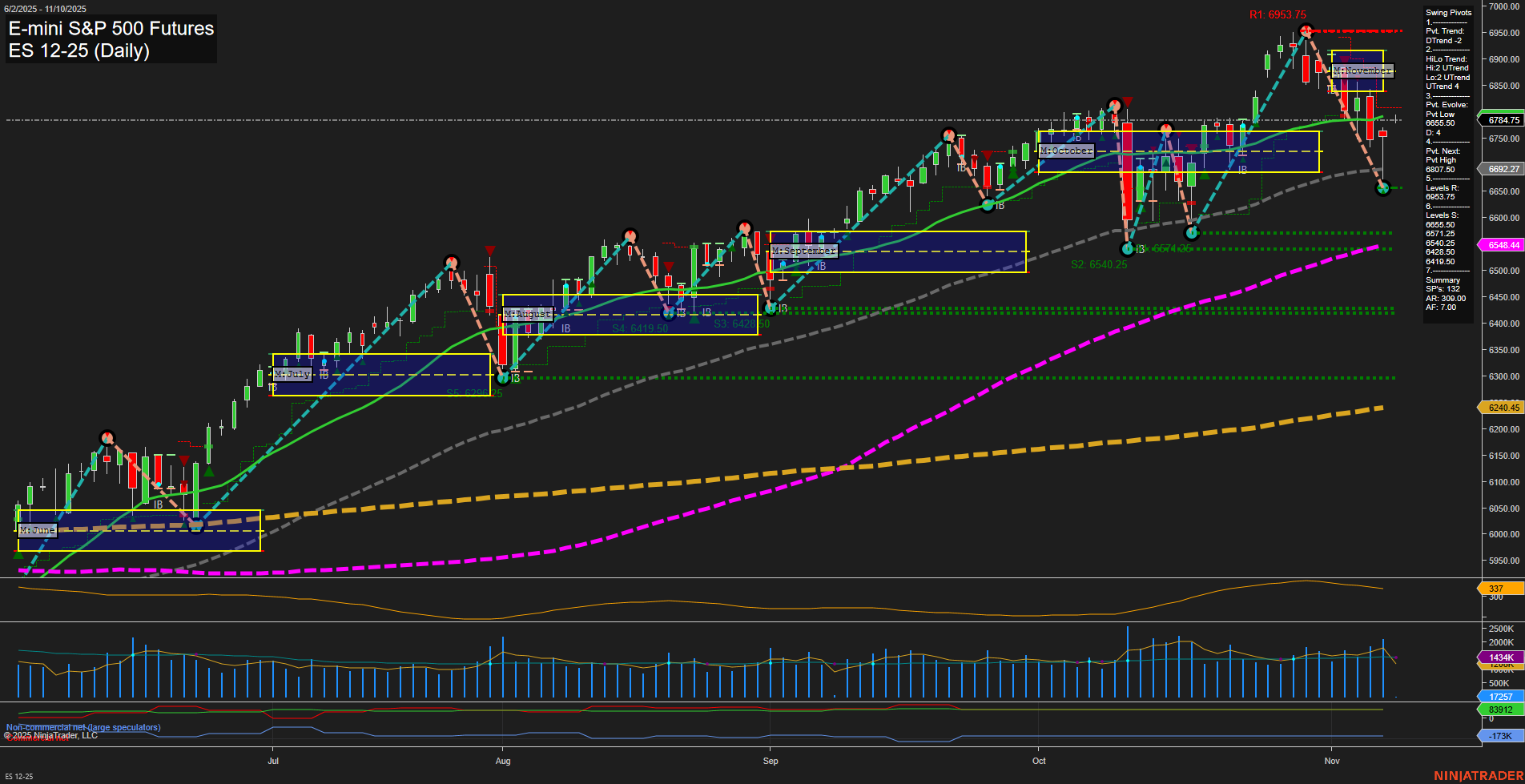

The ES E-mini S&P 500 Futures daily chart shows a market in transition. Price action has recently pulled back from the highs, with medium-sized bars and average momentum, indicating a pause or retracement within a broader uptrend. The short-term trend has shifted to the downside (DTrend) as confirmed by the swing pivot and both the 5-day and 10-day moving averages trending down. However, the intermediate and long-term trends remain bullish, supported by the 55, 100, and 200-day moving averages all pointing higher and price holding above key long-term support levels. Recent trade signals have been to the short side, reflecting the short-term weakness and the current corrective phase. The ATR remains elevated, suggesting ongoing volatility, while volume is steady, indicating active participation during this pullback. The market is currently above the key F0%/NTZ levels on all session fib grids (weekly, monthly, yearly), which supports the underlying bullish structure despite the short-term correction. Overall, the chart reflects a classic swing trading environment: a strong uptrend on higher timeframes with a short-term pullback or consolidation phase. This could be interpreted as a potential setup for trend continuation if support holds and momentum shifts back to the upside, or further correction if key support levels are breached. The interplay between short-term bearish signals and longer-term bullish structure is a key theme, with traders likely watching for signs of reversal or continuation at the current support and resistance levels.