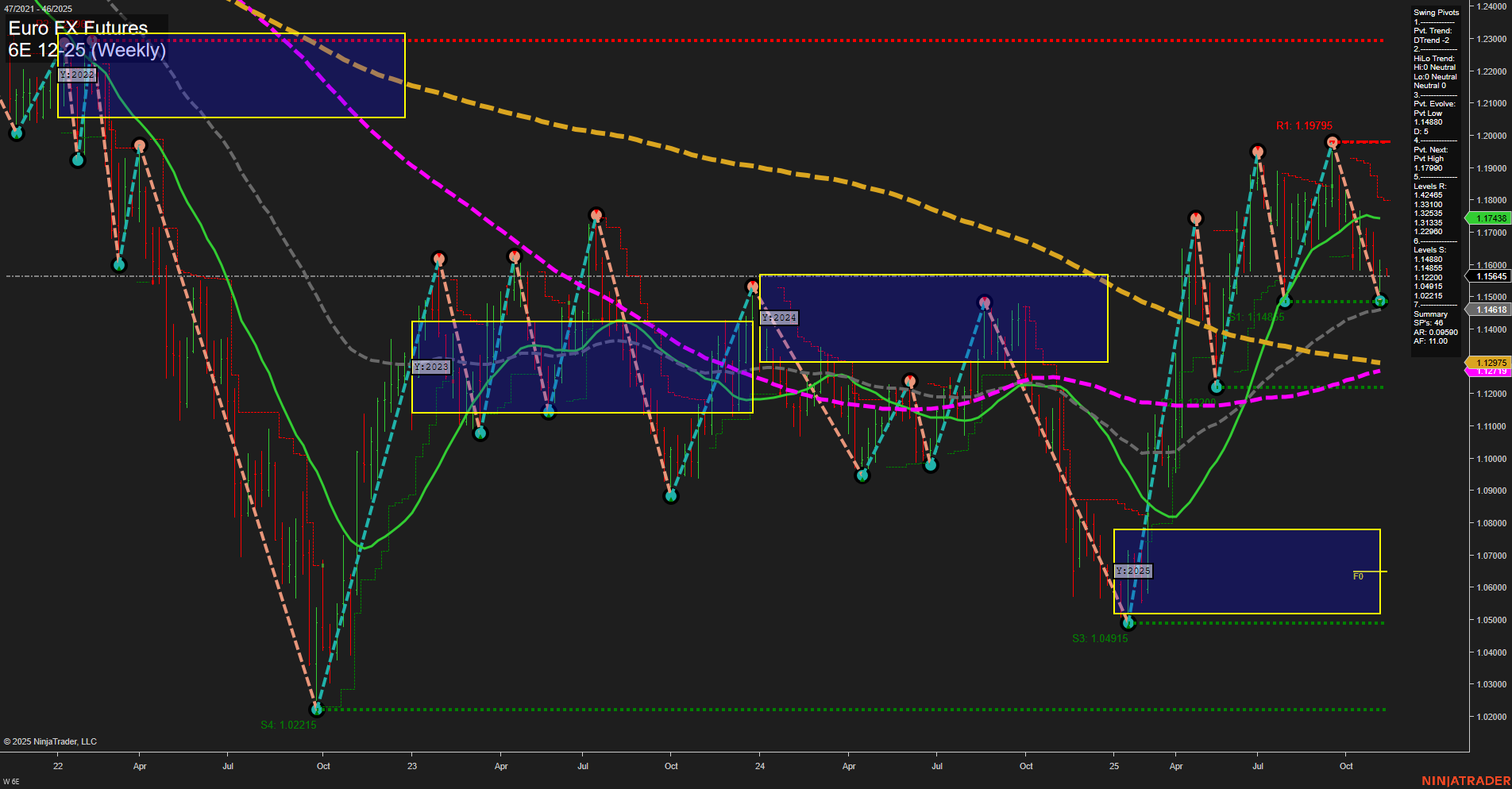

The 6E Euro FX Futures weekly chart shows a market in transition. Short- and intermediate-term trends are clearly bearish, with both the WSFG and MSFG indicating price action below their respective NTZ/F0% levels and downward momentum, albeit slow. Swing pivots confirm this with a dominant downtrend in both short- and intermediate-term metrics, and the most recent pivot evolution is a new swing low at 1.14618. Resistance levels cluster above, with the next significant swing high at 1.19795, while support is found at 1.14618 and lower at 1.12975 and 1.12410. Weekly benchmarks reinforce the bearish short- and intermediate-term outlook, as the 5- and 10-week moving averages are trending down and price is below these levels. However, the long-term picture is more mixed: the 20- and 55-week MAs are trending up, but the 100- and 200-week MAs remain in a downtrend, suggesting a broader consolidation or a potential inflection point. Recent trade signals reflect this choppy environment, with a short signal following a brief long, highlighting indecision and possible volatility. The yearly session fib grid (YSFG) remains bullish, with price above the yearly NTZ/F0% and a strong uptrend, but this is not yet reflected in the shorter timeframes. Overall, the market is experiencing a corrective pullback within a longer-term uptrend, with the potential for further downside in the short- to intermediate-term before any sustained recovery. The environment is characterized by lower highs and lower lows, with volatility and possible whipsaws as the market tests key support and resistance levels.