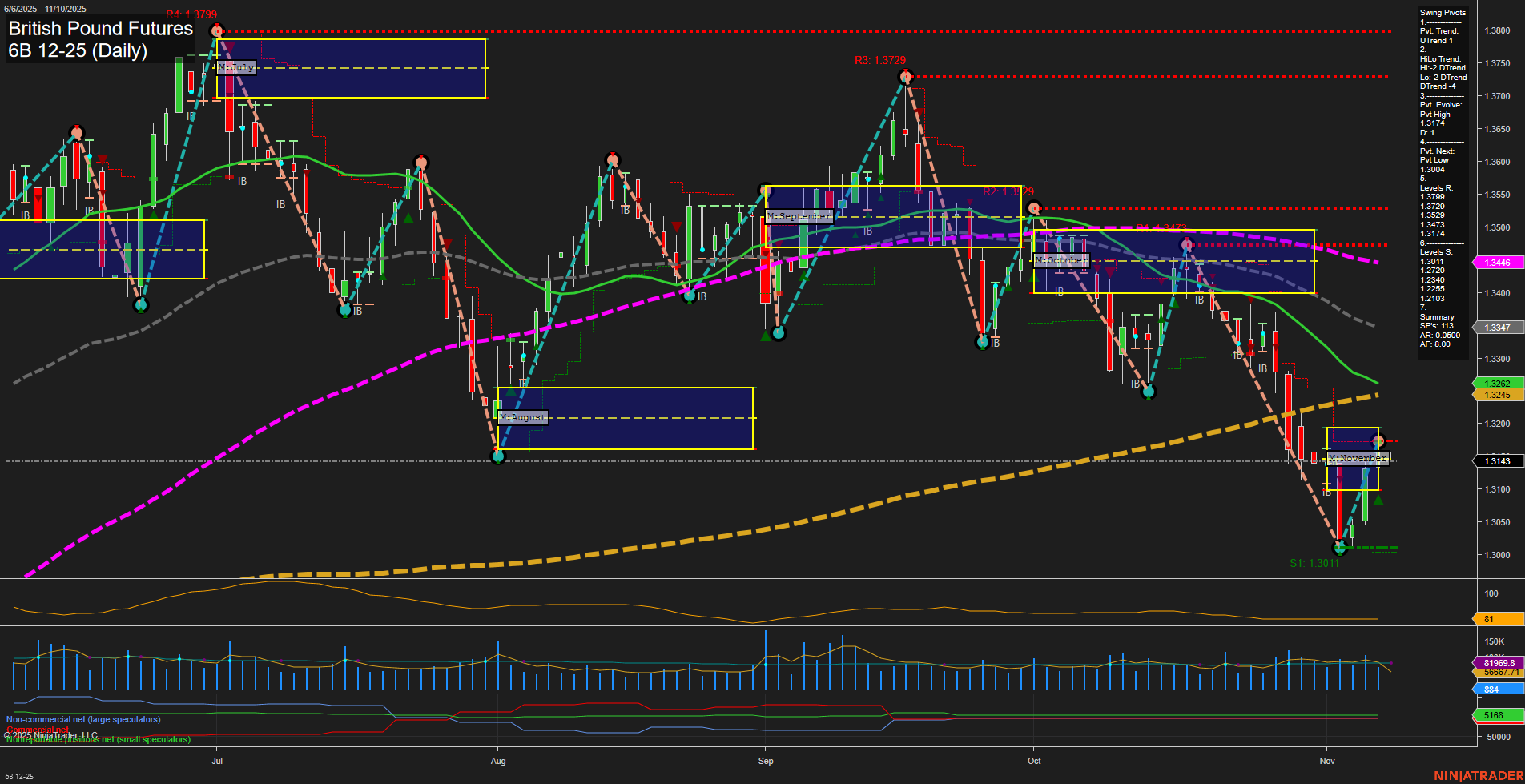

The British Pound Futures (6B) daily chart shows a market in a corrective phase after a pronounced downtrend. Price action is currently consolidating just above the recent swing low (1.3011), with momentum remaining slow and bars of medium size, indicating a pause after recent volatility. Both the weekly and monthly session fib grids (WSFG, MSFG) confirm a short- and intermediate-term bearish bias, as price remains below their respective NTZ/F0% levels and both trends are down. Swing pivot analysis also supports this, with both short-term and intermediate-term trends in a downtrend, and the next key pivot level to watch being the swing low at 1.3004. Resistance levels are stacked well above current price, suggesting any rallies may face significant overhead supply. All benchmark moving averages (from 5-day to 200-day) are trending down, reinforcing the prevailing bearish structure. The ATR and VOLMA values indicate moderate volatility and average volume, with no signs of an extreme move or exhaustion. Recent trade signals show mixed short-term activity, with a recent long signal following a short, reflecting the choppy, corrective nature of the current price action. Overall, the short- and intermediate-term outlook remains bearish, with the long-term trend neutral as price is still above the yearly fib grid and the 200-day MA is not decisively broken. The market is in a potential retracement or base-building phase after a sharp selloff, but has yet to show a clear reversal pattern. Swing traders should note the risk of further tests of support near 1.3011, while any sustained move above the nearest resistance pivots could signal a shift in momentum.