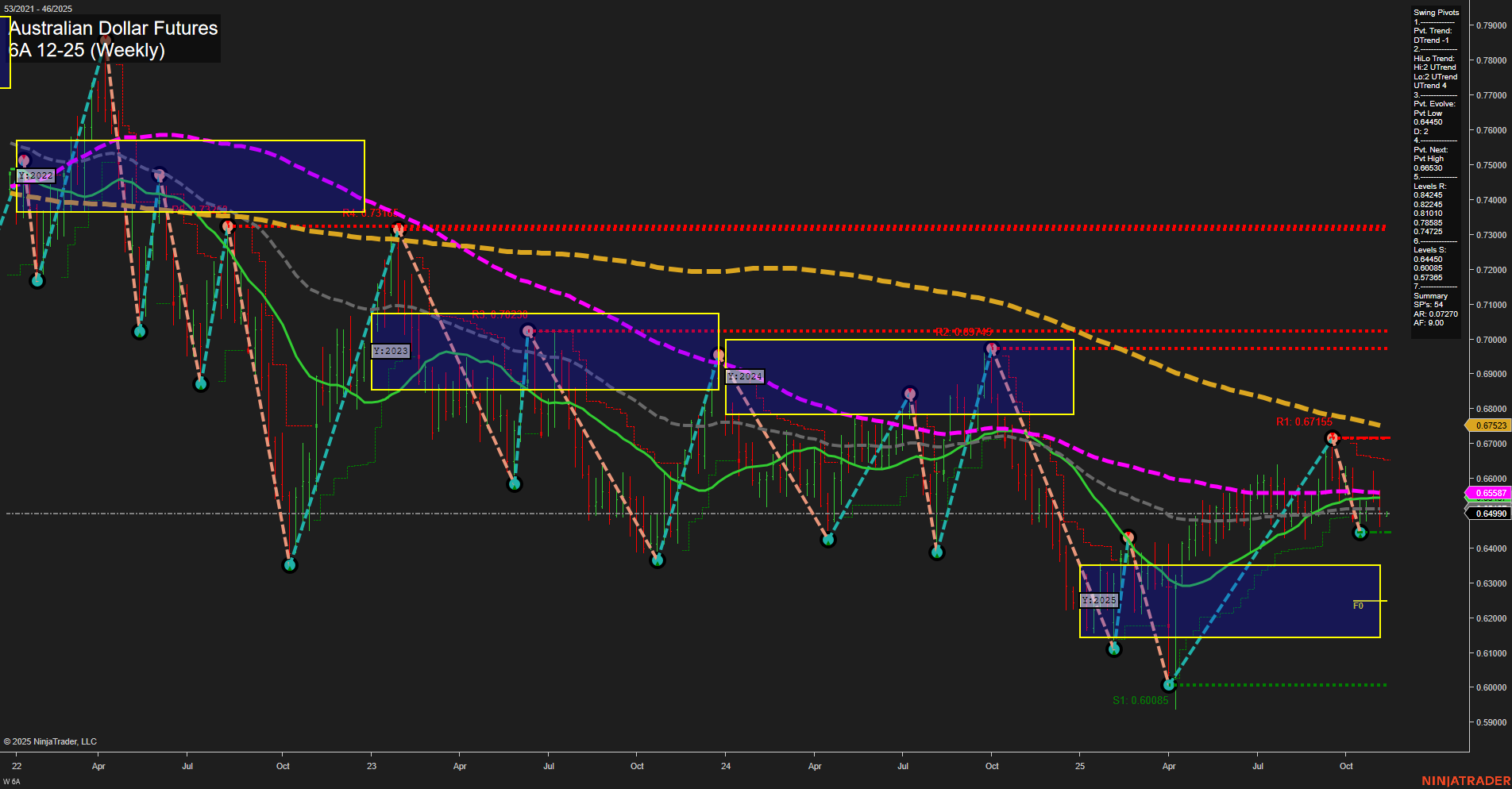

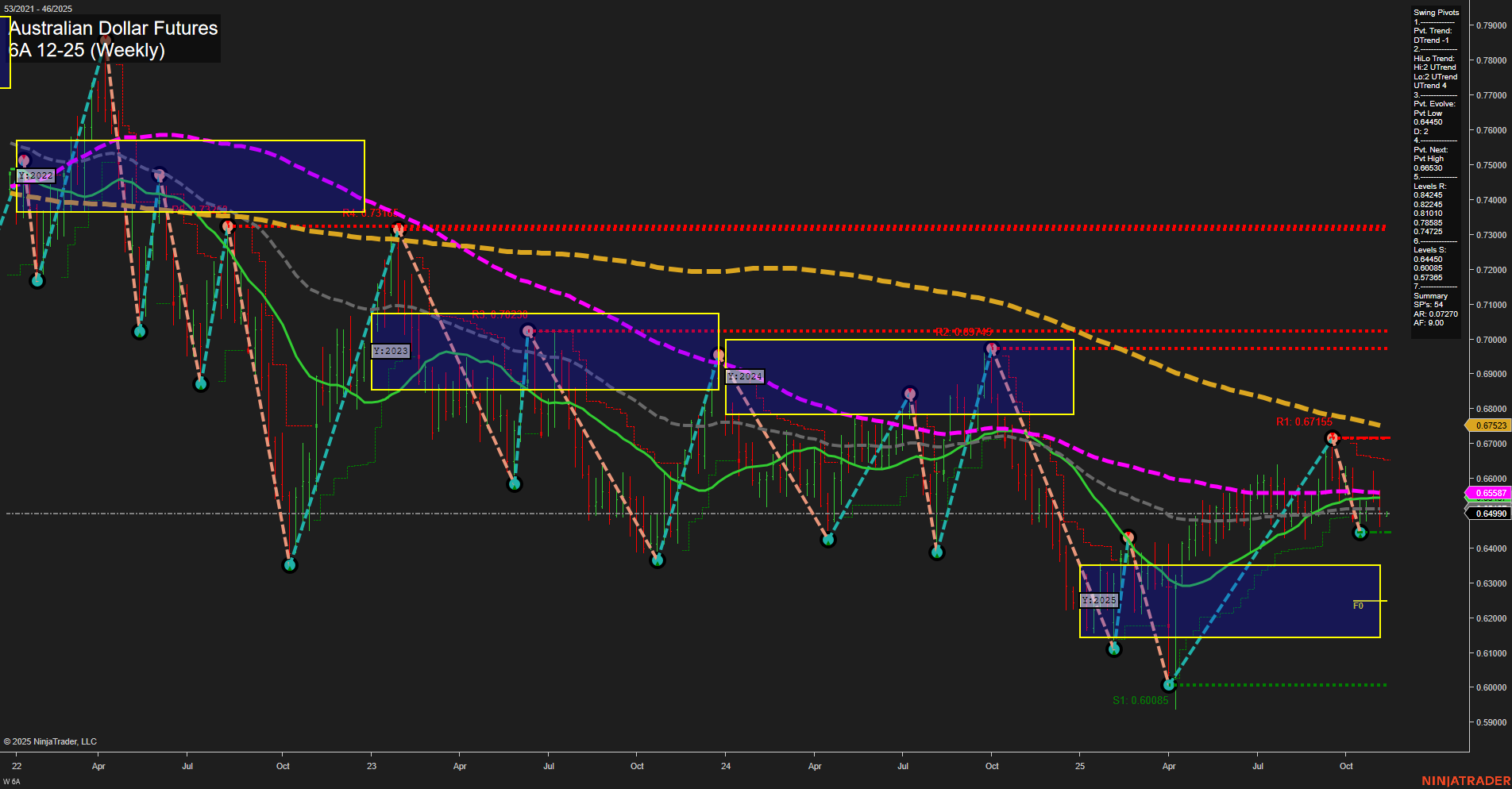

6A Australian Dollar Futures Weekly Chart Analysis: 2025-Nov-09 18:00 CT

Price Action

- Last: 0.65557,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 0.64990,

- 4. Pvt. Next: Pvt high 0.67115,

- 5. Levels R: 0.67115, 0.67485, 0.68749, 0.69749,

- 6. Levels S: 0.64990, 0.60085.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.65557 Down Trend,

- (Intermediate-Term) 10 Week: 0.65557 Down Trend,

- (Long-Term) 20 Week: 0.64990 Up Trend,

- (Long-Term) 55 Week: 0.65557 Down Trend,

- (Long-Term) 100 Week: 0.67485 Down Trend,

- (Long-Term) 200 Week: 0.68749 Down Trend.

Recent Trade Signals

- 06 Nov 2025: Short 6A 12-25 @ 0.647 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The Australian Dollar Futures (6A) weekly chart shows a market in transition, with recent price action reflecting a medium-sized bar and average momentum. The short-term trend has shifted to bearish, as indicated by the latest swing pivot downtrend and a recent short signal. Intermediate-term trends remain neutral, with the HiLo trend still up but losing momentum as price consolidates near key support at 0.64990. Long-term moving averages (55, 100, 200 week) are all trending down, reinforcing a bearish bias for the broader trend, while the 20-week MA is the only one showing an uptrend, suggesting some underlying support. Resistance levels are clustered above at 0.67115 and higher, while support is firm at 0.64990 and 0.60085. The market is currently trading within a neutral zone on the session fib grids, indicating indecision and a lack of clear directional conviction. Overall, the chart reflects a market that is consolidating after a recent rally, with downside risks prevailing in the short and long term, while the intermediate-term outlook remains balanced as the market tests key support and resistance levels.

Chart Analysis ATS AI Generated: 2025-11-09 18:00 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.