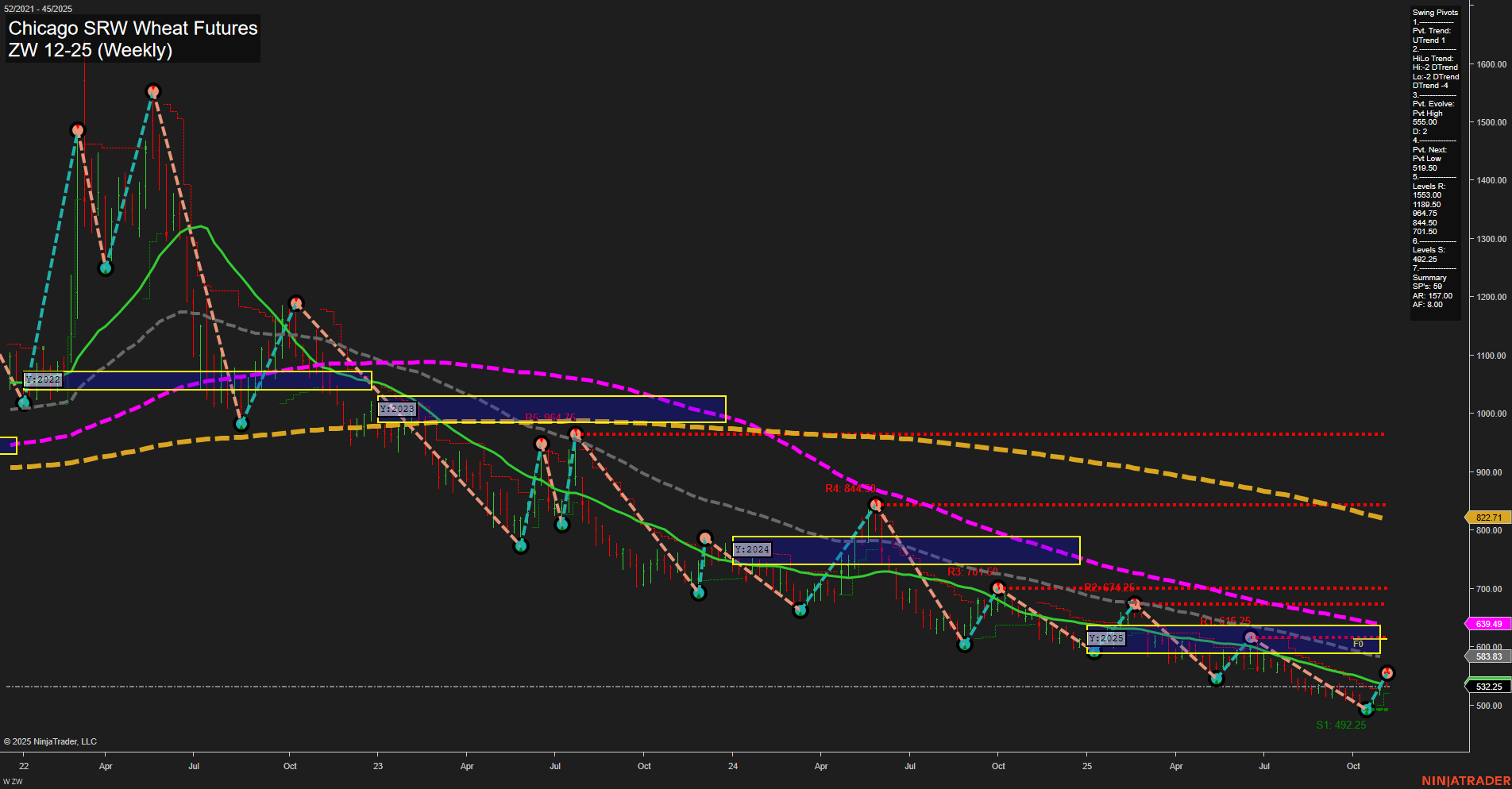

The ZW Chicago SRW Wheat Futures weekly chart continues to reflect a dominant bearish structure across all timeframes. Price action remains subdued, with medium-sized bars and slow momentum, indicating a lack of strong buying interest. The short-term Weekly Session Fib Grid (WSFG) and long-term Yearly Session Fib Grid (YSFG) both show price trading below their respective NTZ/F0% levels, confirming persistent downward pressure. The intermediate-term Monthly Session Fib Grid (MSFG) is the only outlier, showing an uptrend, but this appears to be a countertrend move within a broader downtrend. Swing pivot analysis reinforces the bearish outlook, with both short-term and intermediate-term trends pointing down. The most recent swing high at 545.00 acts as immediate resistance, while the next pivot low at 510.50 and support at 492.25 are key levels to watch for potential downside continuation. Major resistance levels remain well above current price, highlighting the depth of the decline over the past year. Long-term moving averages (20, 55, and 200 week) are all trending down and positioned above current price, further confirming the prevailing bearish sentiment. The recent short trade signal aligns with this overall trend. In summary, the market is entrenched in a downtrend, with only minor countertrend rallies observed. The technical landscape suggests continued pressure, with any rallies likely to face strong resistance from overhead levels and moving averages.