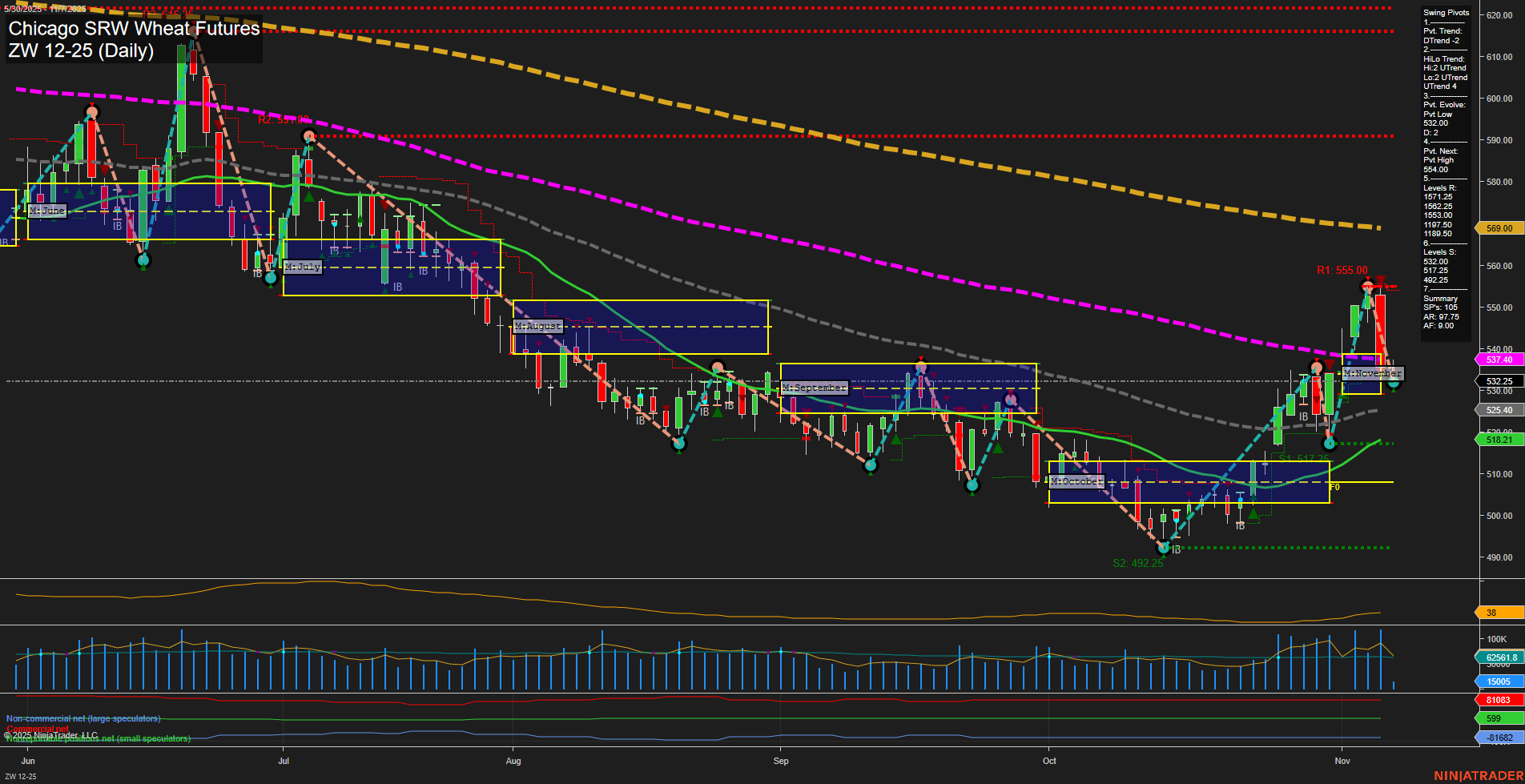

The ZW Chicago SRW Wheat Futures daily chart shows a market in transition. Short-term momentum is fast and the most recent bars are large, reflecting heightened volatility and a sharp move lower after a failed rally to the 555.00 resistance pivot. The short-term trend (WSFG) is down, with price below the weekly NTZ, and both the 5-day and 10-day moving averages trending down. However, the intermediate-term (MSFG) is up, with price above the monthly NTZ and the 20-day and 55-day moving averages both in uptrends, suggesting a recent bullish impulse that has now met resistance. Long-term structure remains bearish, with the yearly grid and major moving averages (100/200-day) still trending down. Swing pivots highlight a recent pivot high at 555.00 and a key support at 492.25, with the next short-term pivot likely to be a high if price reverses. Volume and volatility are elevated, indicating active participation and potential for further swings. The recent short signal aligns with the short-term bearish bias, but the mixed trends across timeframes suggest a choppy environment where countertrend rallies and sharp pullbacks are likely. The market is currently testing support levels after a strong rejection from resistance, and traders should be aware of the potential for both continued downside and sharp corrective bounces within this broader consolidation phase.