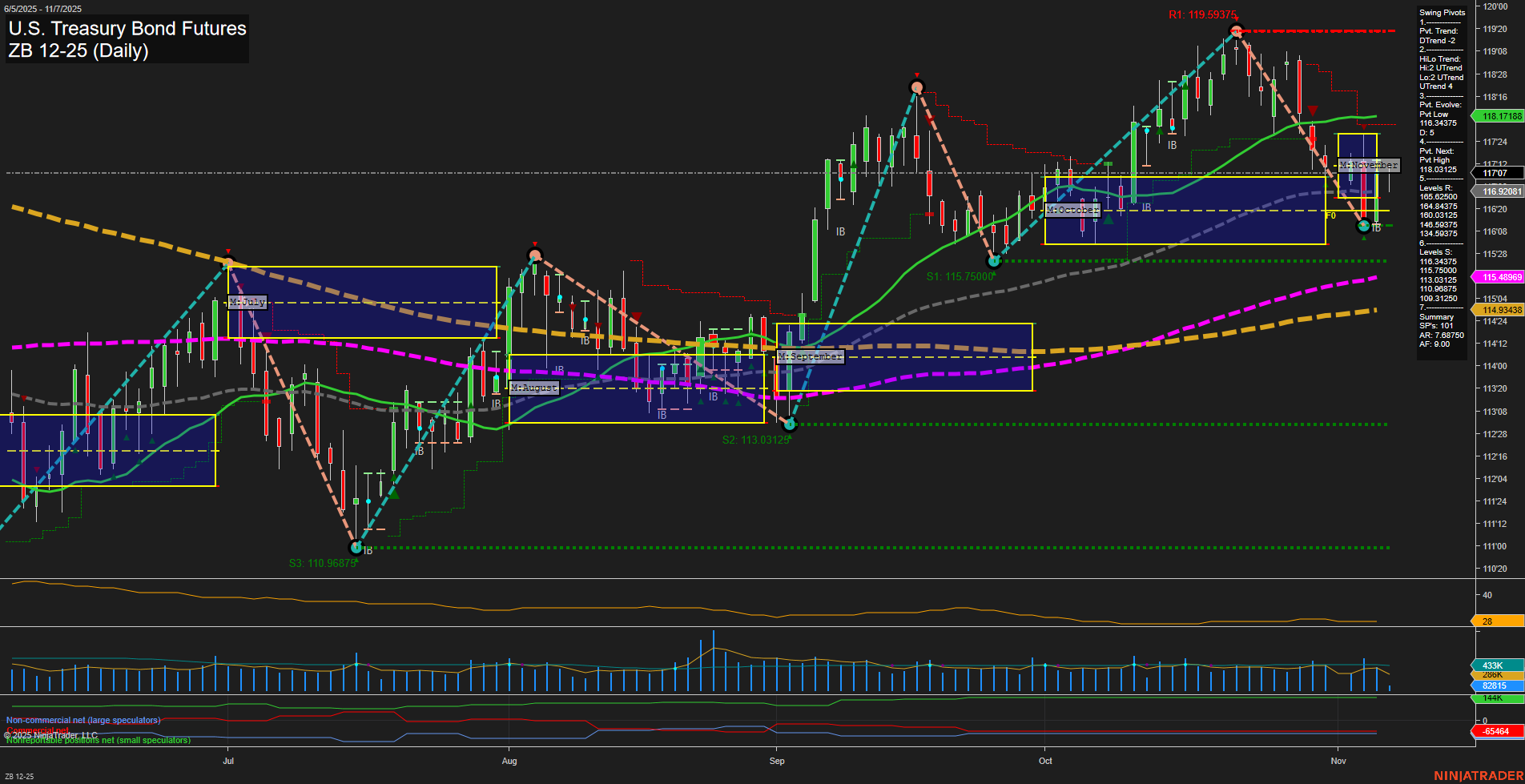

The ZB U.S. Treasury Bond Futures daily chart currently reflects a market in a corrective phase after a recent swing high. Price action is characterized by medium-sized bars and slow momentum, indicating a lack of strong directional conviction. Both the short-term and intermediate-term swing pivot trends are down (DTrend), with the most recent pivot low at 116.92081 acting as immediate support, and resistance levels above at 118.17188 and 119.59375. The 5-day, 10-day, and 20-day moving averages are all trending down, reinforcing the short-term and intermediate-term bearish bias, while the longer-term 55, 100, and 200-day moving averages remain in uptrends, suggesting underlying support on a broader time frame. The ATR value of 35 points to moderate volatility, and volume remains steady at 450,837. The market is consolidating near support after a pullback, with no clear breakout or reversal signal yet. Overall, the technical structure suggests a bearish bias in the short and intermediate term, while the long-term outlook remains neutral as price holds above major moving averages. The market appears to be in a wait-and-see mode, with traders watching for either a continuation lower or a potential reversal from current support levels.