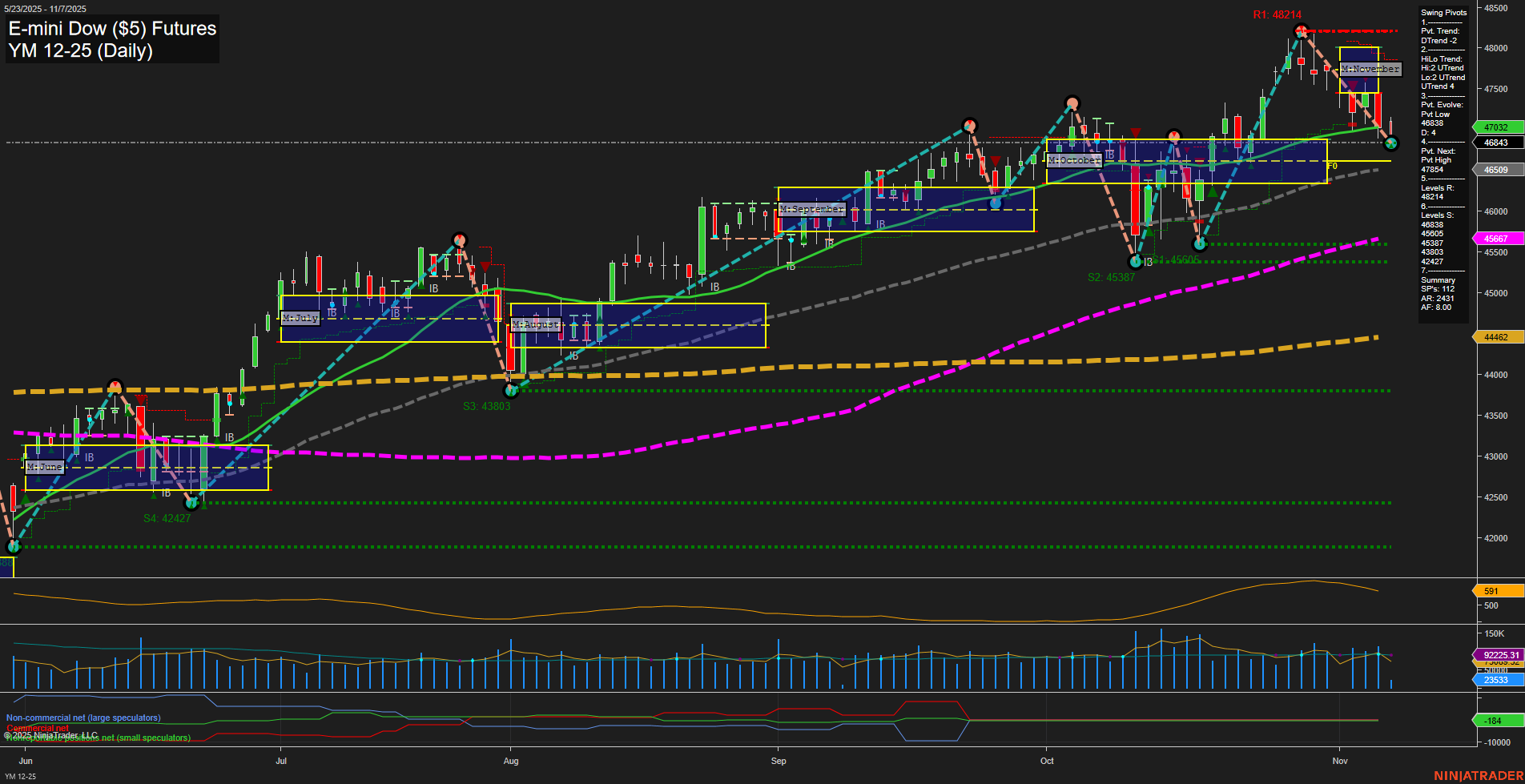

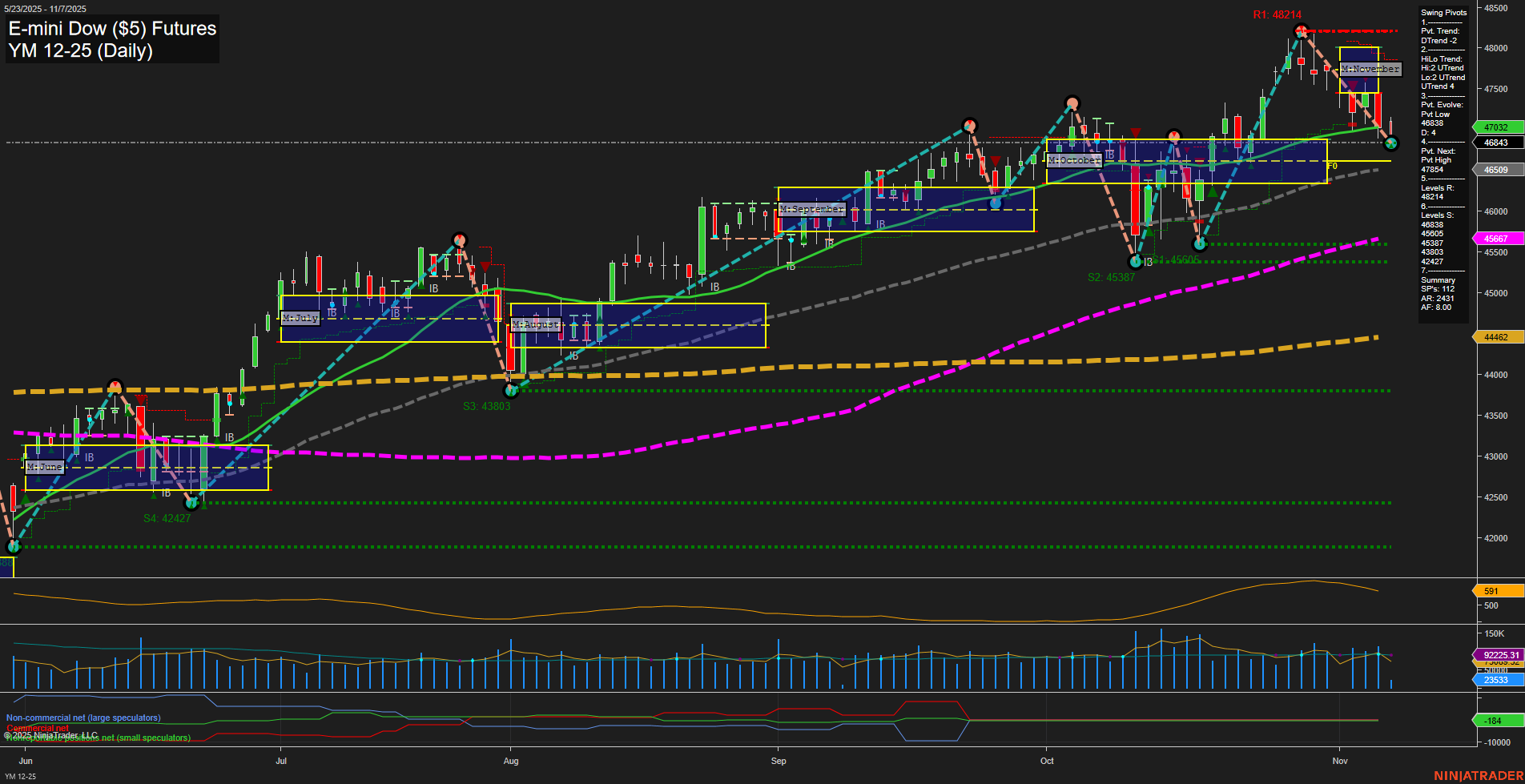

YM E-mini Dow ($5) Futures Daily Chart Analysis: 2025-Nov-07 07:20 CT

Price Action

- Last: 46843,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -70%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Nov

- Intermediate-Term

- MSFG Current: 20%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 41%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt Low 46838,

- 4. Pvt. Next: Pvt High 47854,

- 5. Levels R: 48214, 47854,

- 6. Levels S: 46838, 45387, 44803, 44227.

Daily Benchmarks

- (Short-Term) 5 Day: 47032 Down Trend,

- (Short-Term) 10 Day: 47032 Down Trend,

- (Intermediate-Term) 20 Day: 47032 Down Trend,

- (Intermediate-Term) 55 Day: 46509 Up Trend,

- (Long-Term) 100 Day: 45567 Up Trend,

- (Long-Term) 200 Day: 44462 Up Trend.

Additional Metrics

Recent Trade Signals

- 06 Nov 2025: Short YM 12-25 @ 46898 Signals.USAR.TR720

- 03 Nov 2025: Short YM 12-25 @ 47522 Signals.USAR-WSFG

- 30 Oct 2025: Short YM 12-25 @ 47646 Signals.USAR.TR120

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The YM E-mini Dow is currently experiencing a short-term pullback, with price action showing slow momentum and medium-sized bars. The short-term trend is bearish, as confirmed by the downward direction of the 5, 10, and 20-day moving averages, and the WSFG weekly grid indicating price below the NTZ and a downtrend. However, the intermediate and long-term outlooks remain bullish, with the MSFG and YSFG both showing price above their respective NTZs and uptrends, supported by the 55, 100, and 200-day moving averages trending higher. Swing pivots highlight a recent pivot low at 46838, with resistance at 47854 and 48214, and support levels below at 46838, 45387, 44803, and 44227. Recent trade signals have favored the short side, aligning with the current short-term weakness. Volatility is moderate, and volume remains healthy. Overall, the market is in a corrective phase within a broader uptrend, with the potential for further downside in the short term before a possible resumption of the longer-term bullish trend.

Chart Analysis ATS AI Generated: 2025-11-07 07:21 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.